In May of each year, it is always delightful to see signs popping up in the yards of various neighborhood kids and grandkids, announcing their graduations.

It’s an exhilarating and frenzied time, where over 13 years of school culminates in caps and gowns and pomp and circumstance and, for many, the thrill of a college acceptance. Hopefully, those parents or grandparents sending their students off for four years (or more) of higher education have properly planned and are financially ready to do so.

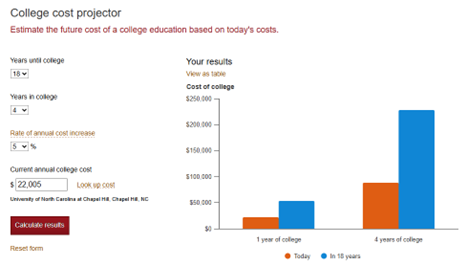

Given the ever-increasing costs of education, saving to support loved ones’ future educational needs is critical. And starting the savings early is just as important. Ideally, parents should start saving for future educational needs as soon as their child is born. To illustrate, consider that for a child born in 2025 and attending school in state at UNC Chapel Hill starting in 2043, the total estimated four-year cost of tuition, room and board for that child will be over $228,000[1].

How much you need to save depends on a variety of assumptions, such as the current cost of education of a particular college or university, the inflation rate of these costs and the rate of return on your education savings. The key to success is to start saving early and regularly.

Here are a few ways to save for education expenses, to help ensure you, or your loved one in this position, are as financially ready as can be.

529 Education Savings Plans

A 529 college savings plan is a state-sponsored investment plan that enables you to save money for a beneficiary to pay for education expenses. You can withdraw funds tax-free to cover nearly any type of college expense. There are many advantages to using a 529 plan:

- Tax advantages: Money grows tax-free, and withdrawals are tax-free if used for qualified education expenses.

- No income or annual contribution limits.

- Covers: College costs (tuition, room/board, books, computers) + up to $10K/year for K–12 tuition (in many states). This money can also be used for graduate school, community college, trade schools and professional programs.

- State tax benefits: Some states offer tax deductions/credits for contributions (usually only if you use your home state’s plan).

- Ownership flexibility: You can use any state’s plan; not restricted by your location. Shop around for the best investment options, as they may be limited.

- Minimal impact on qualifying for need-based financial aid (if owned by parents).

- No deadline to use funds; total contribution limits apply (varies by state).

- If your child receives a scholarship, you can withdraw up to the scholarship amount penalty-free, but will owe taxes on any gains withdrawn.

There are a few disadvantages to 529 plans worth mentioning. Contributions to 529 plans count as gifts and are subject to gift tax at the $19,000 annual limit for you or $38,000 for you and your spouse (for 2025). You can “front-load” 5 years of gifts, but you should consult your financial advisor to make certain that fits in your overall financial plan. Also, withdrawals from 529 plans must be used for qualified educational expenses. If not, they are subject to taxes and a 10% penalty.

So, what if your child decides not to go to college? The beneficiary of the account can be changed to another family member, to be used as the plan is intended. As a result of SECURE Act 2.0, under certain circumstances, there is also an option to roll 529 funds into a Roth IRA. There are certain considerations to doing this which are best to discuss with a tax professional and your financial advisor.

UTMA and UGMA Custodial Accounts

Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA) accounts are custodial accounts that allow you to save and transfer assets to a minor child without having to open a trust. This type of account is managed by you until your child is of age (18, 19 or 21 depending on the state where the minor resides) at which point all assets in the account must be transferred to them.

The major benefit to these accounts is that the assets can be used for anything, not just education expenses. Also, like 529 plans, contributions can be made within the annual gift tax exclusion, avoiding potential tax implications. And, for the 2025 tax year, a child’s unearned income is partially tax-free, with the first $1,350 not taxed and the next $1,350 taxed at “kiddie tax” rate. Any amount above $2,700 is taxed at the parent’s marginal rate.

There are a few downsides to these accounts to consider. Unlike 529 plans, they offer no tax-deferred growth or tax-free withdrawals for qualified education expenses. And once assets are in the UTMA/UGMA account, they cannot be taken back or transferred to another beneficiary. And finally, because these accounts are considered the child’s assets, they can spend them as they see fit and may impact their ability to qualify for need-based financial aid.

Coverdell Education Savings Accounts (ESA)

Education Savings Accounts (ESAs) are similar to, but not as commonly used as, 529 plans. Like 529 plans, ESAs allow for tax-free distributions to be used on qualified educational expenses. Contributions to ESAs are subject to the same federal gift tax limits as 529 plans. One upside is that ESAs allow for more flexibility in what you can spend on K-12 education expenses. A downside is that there are income limits. In 2025, your annual adjusted modified gross income (AGI) must not exceed $110,000 for single filer or $220,000 for joint filers. There is also an annual $2,000 contribution limit per child and the funds must be used by the time they reach the age of 30. Unused funds can be transferred to another family member (under 30 years old). [2]

Grandparents Can Help

If you are a grandparent who would like to help your grandchild, you can consider funding their existing 529 plan or you can open your own 529 plan account for them. All the aforementioned benefits will apply to 529 accounts opened by a grandparent with the additional benefit that a grandparent-owned 529 plan will not affect a child’s potential financial aid, as is possible with a parent-owned account.

Grandparents can also open custodial accounts which have a bit more freedom of use and flexibility as previously explained. They can also consider gifting appreciated stock and having the grandchild sell small portions at 0% capital gains tax. This is in contrast with 529 plan contributions, which can only be made in cash. If you are a grandparent, talk with your financial advisor about how contributing to your grandchild’s education can work within your overall financial plan.

There is a lot to consider when it comes to what type or combination of accounts you choose to save for your child or loved one’s education. But there is no denying the sooner you save, the better. Talk with your Modera advisor about what works best within your plan and start saving for the future today. We are here to help you with every life milestone, most especially those that impact your children and grandchildren.

Note: Even if education savings is not relevant to you at this time in your life, chances are you know and care about someone who could benefit from this information. Please feel free to pass this article along or send your loved one our way. We are happy to discuss.

[1] The national average cost data is from The College Board’s annual “Trends in College Pricing” report. All Rights Reserved. College cost information used in this tool comes from various governmental and other publicly available sources, including the Integrated Post-Secondary Education Data System of the National Center for Educational Statistics of the Institute of Education Sciences, the statistics, research, and evaluation arm of the U.S. Department of Education. SS&C Technologies, Inc. and its affiliates are not responsible for the completeness or accuracy of information obtained from such third-party sources.

[2] https://www.investopedia.com/terms/c/coverdellesa.asp

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.