What is risk, and how do we manage it?

These are age-old questions when it comes to both investing and life. This is particularly the case today when we have a new and unpredictable war to contend with in Eastern Europe, lingering pandemic concerns, cybersecurity threats, and 40-year highs in inflation.

In its simplest terms, we usually define risk in our daily lives as the possibility of something bad happening, such as loss or injury. When it comes to investing, risk is often measured in much more complex ways.

The problem with most definitions of risk is that they don’t provide a practical road map for you to manage and address risk in real time.

There is another definition of risk that I heard on a podcast recently that caught my attention because of its potential practical applications:

Threats x Vulnerabilities = Risk2

Threats can be thought of as events that are largely out of your control — for example:

- unexpected tragedies (pandemics, terror attacks, hurricanes, and other major weather events)

- geopolitical crises (wars in Russia/Ukraine, corrupt governments)

- financial shocks (inflation spikes, the financial crisis of 2008-09, Brexit, the dotcom bubble bursting, the “Black Monday” stock market crash of 1987)

Vulnerabilities, on the other hand, are things over which you may have some control, such as:

- living beyond your means

- not having enough emergency cash reserves

- making concentrated investment bets (individual stocks, sectors, or countries)

- taking greater investment risk then you can stick with over time

Ignore the Threats and Address the Vulnerabilities

The best thing we can do in times of uncertainty is to focus on what we can control, and that is our financial vulnerabilities. An important question to ask yourself is what vulnerabilities listed above could be addressed or updated to help reduce risk for you and your loved ones?

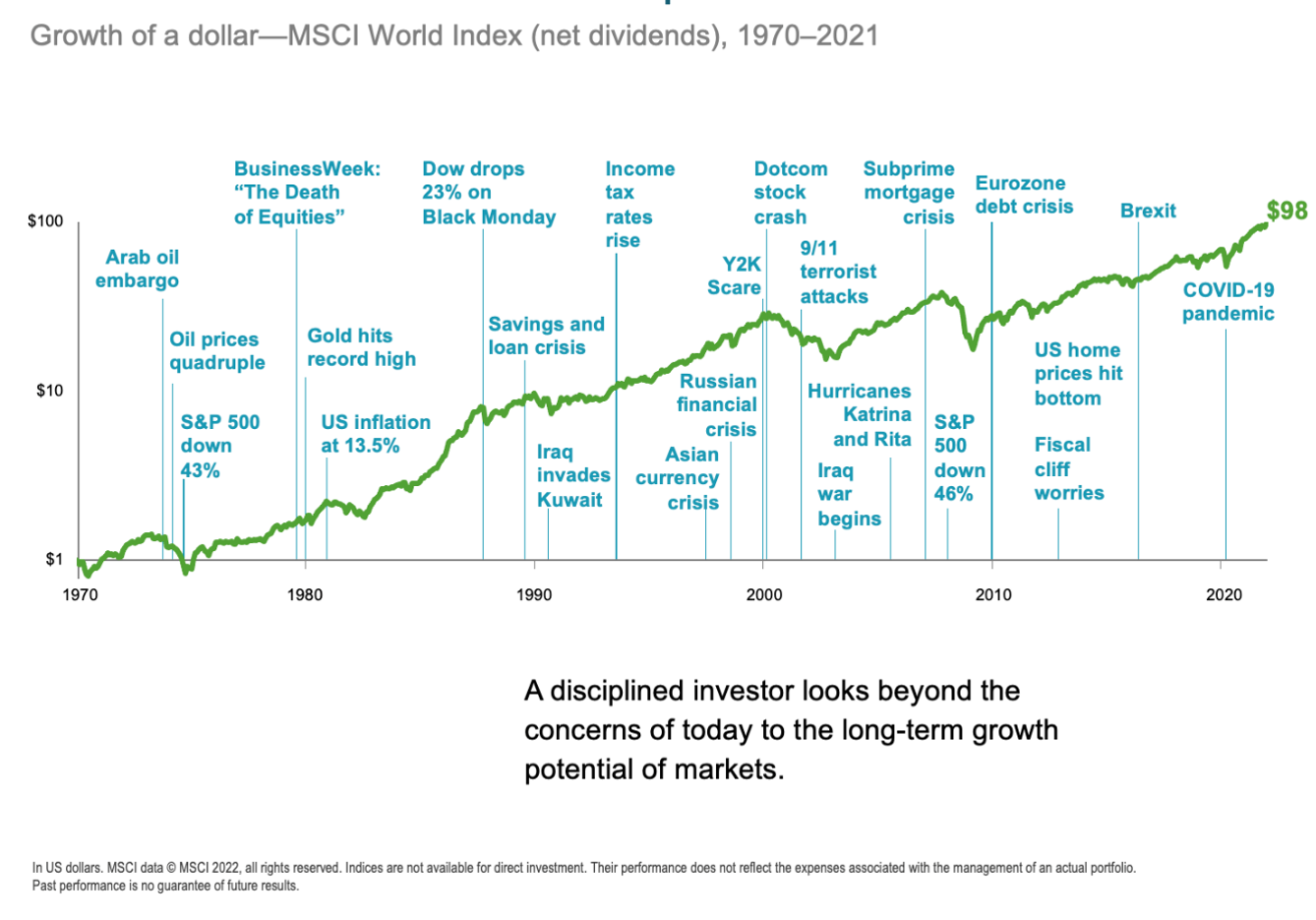

Using investing as a practical use case and the chart below, it is easy to see how threats over time have led to periods of significant financial market volatility. While this can be quite unnerving in the shorter term, a globally diversified portfolio that is managed with a long-term, goal-oriented perspective can make it easier to navigate short-term choppy waters.

The example shows how $1 invested in 1970 in the globally diversified MSCI World Index has since grown to $983, and that was despite many global threats along the way, which are highlighted in the chart. Add a few zeros, and we could also say that if you invested $10,000 in 1970 in the MSCI World Index, you would have amassed around $980,000 today — even though a lot of stressful and uncontrollable events happened during this period.

Be a Stoic

I am a fan of author Ryan Holiday and his writings on Stoicism. He wrote, “The single most important practice in Stoic philosophy is differentiating between what we can change and what we can’t”. Taking the Stoic approach to portfolio management requires you to concentrate on minimizing your vulnerabilities. Good examples are the following:

- Developing an allocation that supports what you are trying to achieve

- Broadly diversifying your holdings

- Utilizing low-cost investment solutions

- Keeping an eye toward taxes

While none of these tactics will help you avoid the temporary impact of a threat, they can help to reduce your long-term vulnerabilities.

To learn more about minimizing your financial vulnerabilities, please get in touch with us.

Control What You Can Control: Minimize Your Vulnerabilities

Patrick D. Runyen, CPA/PFS, CFP®

Director of Advisory, Wealth Manager, Principal

“…I think of as a mathematical equation…Threats x Vulnerabilities = Risk.”

― Stanley McChrystal, Retired United States Army General1

What is risk, and how do we manage it?

These are age-old questions when it comes to both investing and life. This is particularly the case today when we have a new and unpredictable war to contend with in Eastern Europe, lingering pandemic concerns, cybersecurity threats, and 40-year highs in inflation.

In its simplest terms, we usually define risk in our daily lives as the possibility of something bad happening, such as loss or injury. When it comes to investing, risk is often measured in much more complex ways.

The problem with most definitions of risk is that they don’t provide a practical road map for you to manage and address risk in real time.

There is another definition of risk that I heard on a podcast recently that caught my attention because of its potential practical applications:

Threats x Vulnerabilities = Risk2

Threats can be thought of as events that are largely out of your control — for example:

Vulnerabilities, on the other hand, are things over which you may have some control, such as:

Ignore the Threats and Address the Vulnerabilities

The best thing we can do in times of uncertainty is to focus on what we can control, and that is our financial vulnerabilities. An important question to ask yourself is what vulnerabilities listed above could be addressed or updated to help reduce risk for you and your loved ones?

Using investing as a practical use case and the chart below, it is easy to see how threats over time have led to periods of significant financial market volatility. While this can be quite unnerving in the shorter term, a globally diversified portfolio that is managed with a long-term, goal-oriented perspective can make it easier to navigate short-term choppy waters.

The example shows how $1 invested in 1970 in the globally diversified MSCI World Index has since grown to $983, and that was despite many global threats along the way, which are highlighted in the chart. Add a few zeros, and we could also say that if you invested $10,000 in 1970 in the MSCI World Index, you would have amassed around $980,000 today — even though a lot of stressful and uncontrollable events happened during this period.

Be a Stoic

I am a fan of author Ryan Holiday and his writings on Stoicism. He wrote, “The single most important practice in Stoic philosophy is differentiating between what we can change and what we can’t”. Taking the Stoic approach to portfolio management requires you to concentrate on minimizing your vulnerabilities. Good examples are the following:

While none of these tactics will help you avoid the temporary impact of a threat, they can help to reduce your long-term vulnerabilities.

To learn more about minimizing your financial vulnerabilities, please get in touch with us.

Ret. Gen. Stanley McChrystal: The Essence of Leadership

Ret. Gen. Stanley McChrystal: The Essence of Leadership

Source: MSCI, Dimensional Fund Advisors

Follow us on social:

Talk to an experienced financial planner

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.