The Great Resignation: Before You Commit to Quit

July 1, 2022

Meet Greg and Debbie. Over the years, this couple in their mid-fifties managed to save $3 million for their retirement. Their savings, combined with the full Social Security benefits they would receive when they turned 67, meant that Greg and Debbie’s retirement plan was relatively solid.

When the COVID-19 pandemic hit, Greg was hospitalized with the virus. After a slow but full recovery, he and Debbie decided to make some dramatic life changes. Suddenly, life seemed too short and they decided it was time to enjoy retirement sooner than later. Greg and Debbie quit their jobs, began making travel plans, and immediately started living off their retirement savings.

It wasn’t long before they realized their hasty decision was poorly planned. Not only were they quickly burning through their savings, but also after years spent working, Greg and Debbie were getting disinterested in their new slower-paced lifestyle. Faced with the reality of their choices, they began reconsidering their decision to stop working entirely. They found themselves adjusting their lifestyles once again and began looking for ways they could supplement their retirement income for the next several years before they would be able collect Social Security and Medicare.

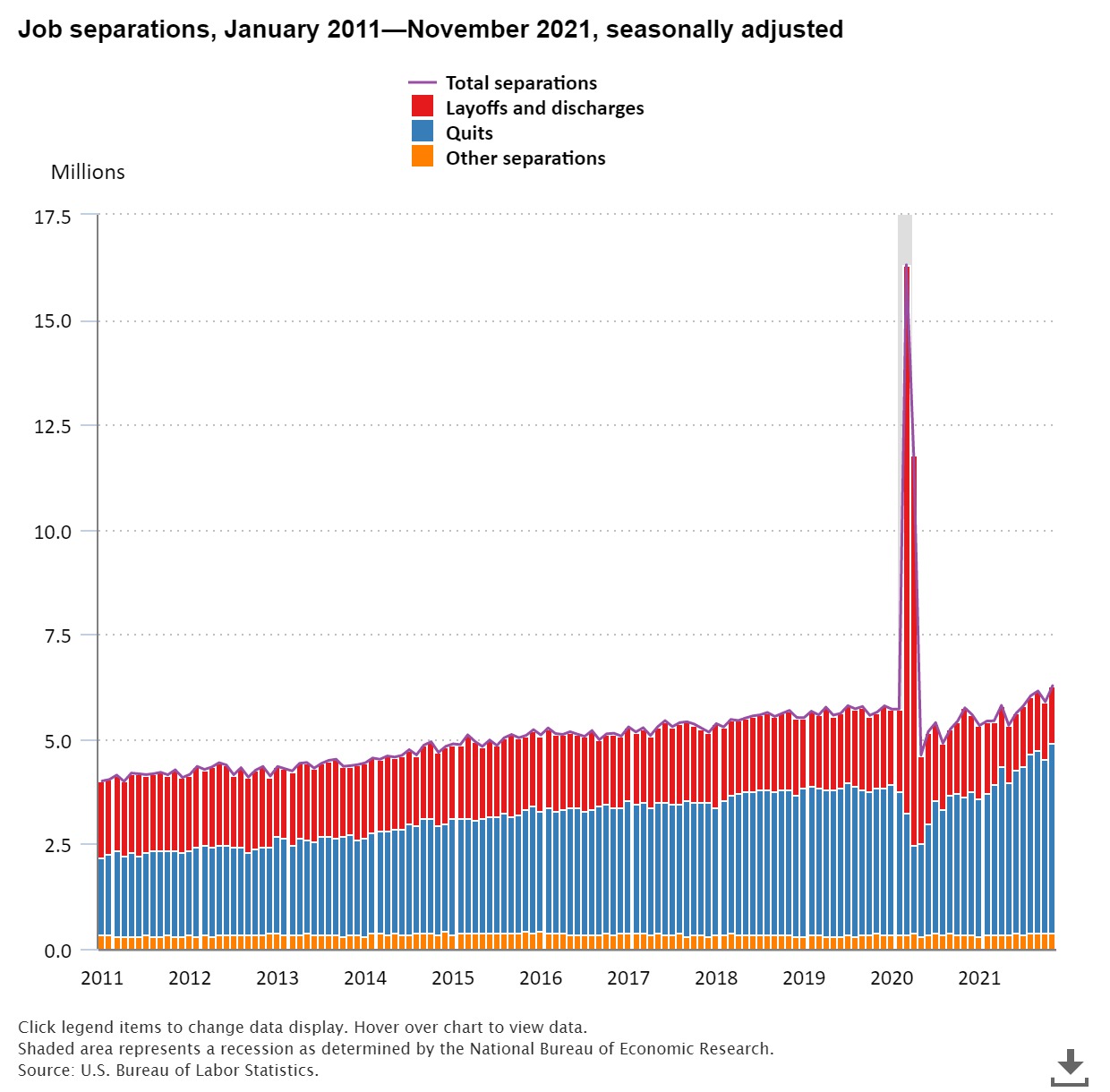

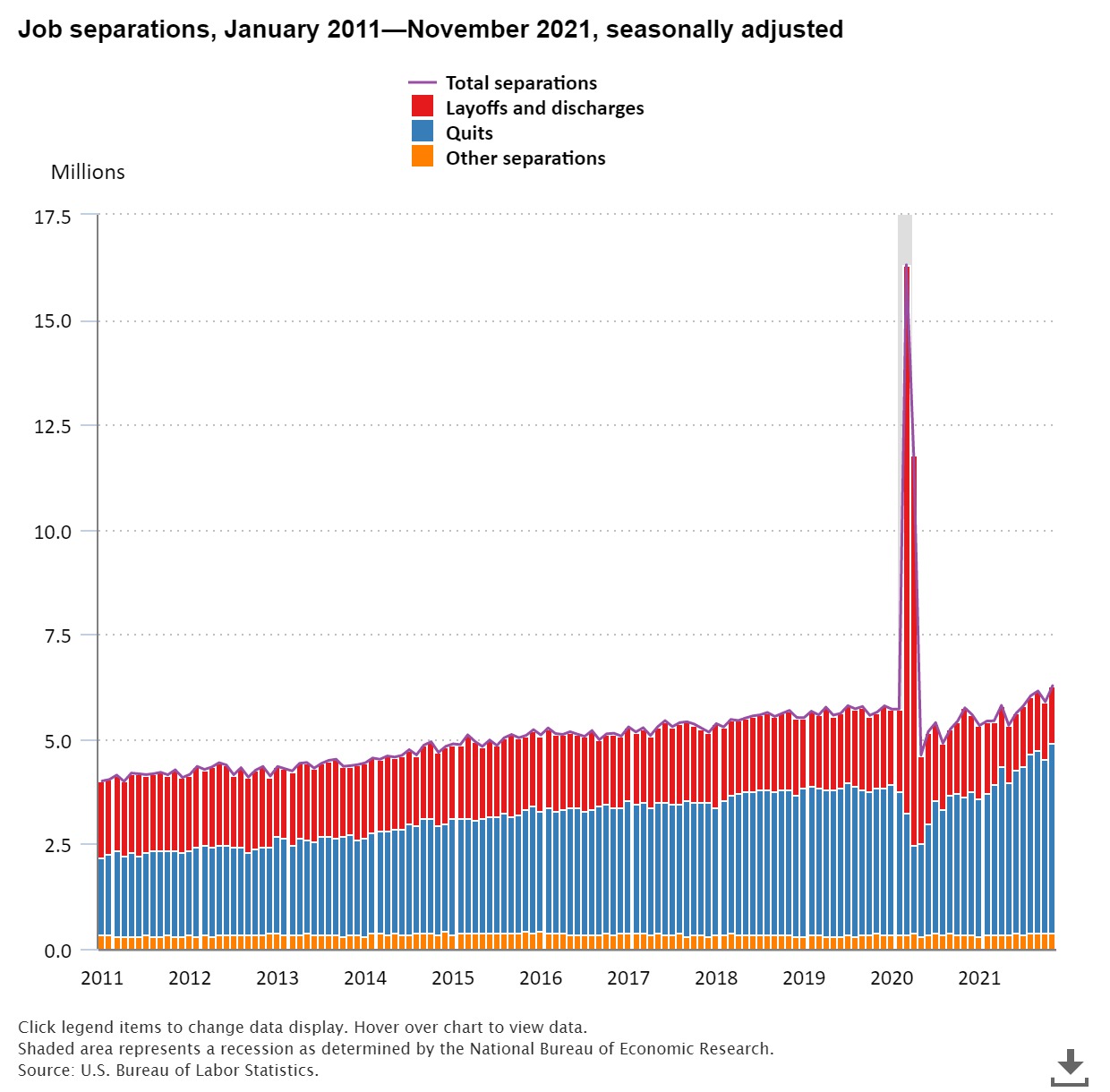

Greg and Debbie are not unique. Stories such as theirs have become increasingly common during the pandemic era. Often referred to as “The Great Resignation,” people have been quitting or changing their current jobs like never before, looking for greener pastures and a perceived better quality of life. According to the U.S. Bureau of Labor Statistics, the number of people who resigned hit a high of 4.5 million during November 20211 and has remained little changed as of April 2022 at 4.4 million2. In addition, the ratio of people quitting jobs relative to other forms of job separation is also increasing, as can be seen from the blue bars the chart below:

People have changed jobs for many reasons over the last two years. Some voluntary changes have been to either to find new employers or self-employment that offer a better quality of life. Some changes have been to temporarily or permanently stop working entirely. In fact, in the first 18 months of the pandemic, there were about 2.4 million more Americans than expected who retired; more than half of the total 4.2 million who left the labor force during this period.3

Some of these people have since “unretired”. Among the reasons is the realization that it is easier said than done to make ends meet over the longer term.

What to Consider Before Making a Career Change

Are you mulling over an early retirement? Perhaps you are thinking of a job change; self-employment, a job at a new company or temporary time away from your current position. Regardless of your reason or goal, there are several things to consider before resigning from your current job.

Retirement options and alternatives

Retirement doesn’t necessarily need to mean that your time working is over as soon as you reach a certain age or that long-planned-for-date circled on the calendar. While some retirees quit work altogether, preferring days on the beach or other relaxing places, others, instead of exiting the workforce completely, enjoy a hobby or passion that may also bring them income. Many tap into prior work experience and pursue part-time consulting work. If desired, there are several potential paths to earning additional income, especially in early retirement, that will allow you to enjoy the best of both worlds. Consider what your options are, full retirement or some form of semi-retirement, and discuss with your advisor before making this important decision.

Time off

Maybe a little time off is what you need. Stepping away from a career, taking time off for sabbatical or quality-of-life reasons, can certainly have its benefits. But how confident are you that similar job opportunities will be there when you are ready to reenter the workforce? Remember, unemployment today sits at historically low rates and could potentially move higher in the future. Also, how long can you realistically be out of the workforce before your skills and competitiveness are less attractive in a potentially less-constrained job market?

New job or business

Perhaps a job change would do you good. Maybe you are thinking now is the time to change career paths or to start your own business? Changing careers can be rewarding in any stage of life, but doing so requires some major considerations:

Income: If this decision means a reduction in your income, how long can you afford to live off that new income level before you can ensure a successful transition? Are you ready for the potential lifestyle implications of ramping up a successful new business venture, such as long hours and time away from loved ones?

Relocation: Not all new jobs will be 100% virtual forever. Companies are starting to implement hybrid home/office work models. Some are going back to in-person, full-time and doing so at their discretion. What if you need to relocate for your new job? What about moving expenses? How could this affect your cost of living, such as housing costs? If you have a family, what are the available opportunities for your spouse and family?

Financial flexibility

Do you have an emergency fund? You should have at least three (ideally six or more) months of current living expenses saved and accessible before you officially quit your job without another income source. Can you afford your monthly debt payments, such as your home mortgage or rent, auto, or education? Do you need to cut back on some other non-essential expenses, such as travel and vacations, during your period of income transition? If you own a home, you may consider opening a home equity line of credit (HELOC) before you quit your job to provide another source of funds for unexpected short-term needs.

Medical costs and other benefits

If you decide to leave your job, would you have health insurance coverage? Can you afford the new monthly premium? Typically, medical insurance costs rise if medical insurance is no longer being subsidized by a full-time employer. Also, would you leave behind any significant benefits (such as unvested equity) offered by your current employer if you quit?

As you can see, there are several things to consider before making the decision to resign from a job or career. For Debbie and Greg, and perhaps many who participated in “The Great Resignation,” quitting their careers was much different in reality than they had expected, even with a significant net worth and savings. Quality-of -life considerations are certainly important, but retiring early, taking time away from a job, or making any significant career change require some forethought and planning. It is important to get assistance in evaluating the variables in your life and to make an active determination of what you can really afford to do and for how long before putting a plan of action into place.

At Modera, we are here to assist you through your major life transitions. Please reach out to us when you are ready.

1 https://www.bls.gov/opub/ted/2022/number-of-quits-at-all-time-high-in-november-2021.htm

2 https://www.bls.gov/news.release/jolts.nr0.htm

3 https://research.stlouisfed.org/publications/economic-synopses/2021/10/15/the-covid-retirement-boom;https://www.washingtonpost.com/business/2022/05/05/retirement-jobs-work-inflation-medicare/

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.