A new feature of the One Big Beautiful Bill Act.

On July 4, 2025, President Donald J. Trump signed into law the One Big Beautiful Bill Act (OBBA), a comprehensive legislative package that includes updates to tax policy, national defense funding, and several new financial planning initiatives.

Among its many provisions is the creation of a new savings vehicle informally known as the “Trump Account for Children” —a tax-advantaged retirement account for minors, designed to give children a financial head start. Eligible children born between 2025 and 2028 will receive a $1,000 government-funded seed contribution, with additional contributions permitted from families and employers. These accounts share similar characteristics with a traditional IRA, including tax-deferred growth and penalties for withdrawals made before age 59½.

As financial professionals, we’re always evaluating new ways to help our clients build long-term wealth and secure their families’ futures. At first glance, the “Trump Account” might resemble just another policy experiment or political soundbite. But when examined more closely, it reveals itself as a potentially transformative planning tool—especially for families planning for the financial future of their children.

Below, we’ll unpack the mechanics of this account, highlight its unique features, and compare it to existing child-focused savings tools like 529 plans, and Uniform Transfers to Minors Act (UTMA) accounts, ABLE accounts, and Custodial Roth IRAs—so you can better understand its place in the evolving landscape of financial planning.

Key Features of the “Trump Account”

Before Age 18

Before the beneficiary turns 18:

- Annual Contribution Limit: $5,000 per year (indexed for inflation).

- No Earned Income Requirement: Unlike Roth IRAs, contributions can be made regardless of the child’s income.

- Funding Sources:

- Parents and other individuals can contribute after-tax dollars (non-deductible).

- Employers may contribute up to $2,500 annually (included in the $5,000 cap).

- Government and charitable contributions are unlimited and do not count toward the cap.

- Investment Restrictions: Funds must be invested in low-cost (≤0.10% expense ratio), unleveraged index funds tracking U.S. equity markets (e.g., S&P 500).

- Withdrawal Rules: No withdrawals are permitted before age 18, except for a full rollover into an ABLE account for beneficiaries with disabilities.

After Age 18

Once the beneficiary turns 18, the account transitions into a more flexible structure:

- Tax Basis: Includes after-tax contributions, pre-tax contributions (from employers or government), and investment growth.

- Investment Flexibility: No restrictions on investment types.

- IRA-Like Treatment: The account is treated similarly to an IRA, with rules such as age 59½ withdrawal eligibility and required minimum distributions (RMDs) likely applying.

- No Aggregation Rules: This allows for strategic planning, such as backdoor Roth contributions.

- Potential Rollover Strategies: There may be opportunities to separate pre-tax and after-tax funds via rollovers (e.g., to a 401(k)) to facilitate tax-free Roth conversions.

How Does It Compare?

The “Trump Account” combines features from several existing account types:

- Like a Custodial Roth IRA: But without income restrictions for contributions.

- Like a 529 Plan: But focused on retirement, not education, and without state tax deductions.

- Like a UTMA Account: But with tax-deferred growth and more structured investment rules.

- Like an ABLE Account: But designed for all minors—not just those with disabilities—and focused on retirement rather than disability-related expenses.

In essence, it’s a hybrid account designed to maximize early retirement savings potential. For a closer look, refer to the comparison charts at the end of the article.

Government Pilot Program: $1,000 for Newborns

As part of a pilot initiative, children born in 2025, 2026, or 2027 are eligible for a $1,000 federal contribution to a “Trump Account.”

- Eligibility: Parents must open a “Trump” account to receive the contribution.

- Mechanics: Details are still being finalized, but the contribution will likely be triggered through a tax return election or a separate filing process.

- Availability: As of now, “Trump” accounts are not yet listed on major custodial platforms.

Is It Worth It? Let’s Look at the Numbers

Assume a “Trump Account” is fully funded at $5,000 per year for the first 18 years of a child’s life. With an 8% annual return (net of inflation), the account would grow to approximately $187,000 by age 18.

If the beneficiary makes no further contributions and the account continues to grow at 7% annually:

- By Age 62: The account could grow to $3.6 million.

- By Age 70: The balance could reach $6.3 million.

This illustrates the power of early, consistent investing and compounding over time.

Final Thoughts

“Trump Accounts “may represent a significant evolution in how we approach retirement planning for future generations. With flexible funding options, tax-advantaged growth, and a strong foundation for compounding, they offer a compelling opportunity for families looking to secure long-term financial stability for their children.

As always, we recommend discussing these accounts in the context of your broader financial plan. If you have questions or would like to explore whether a “Trump Account” is right for your family, please don’t hesitate to reach out.

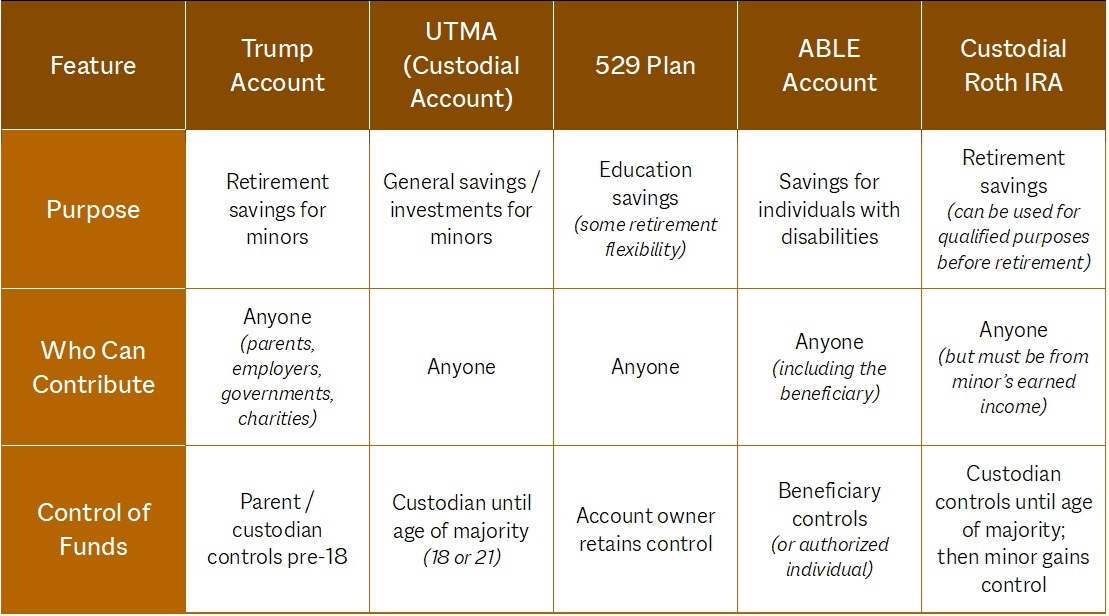

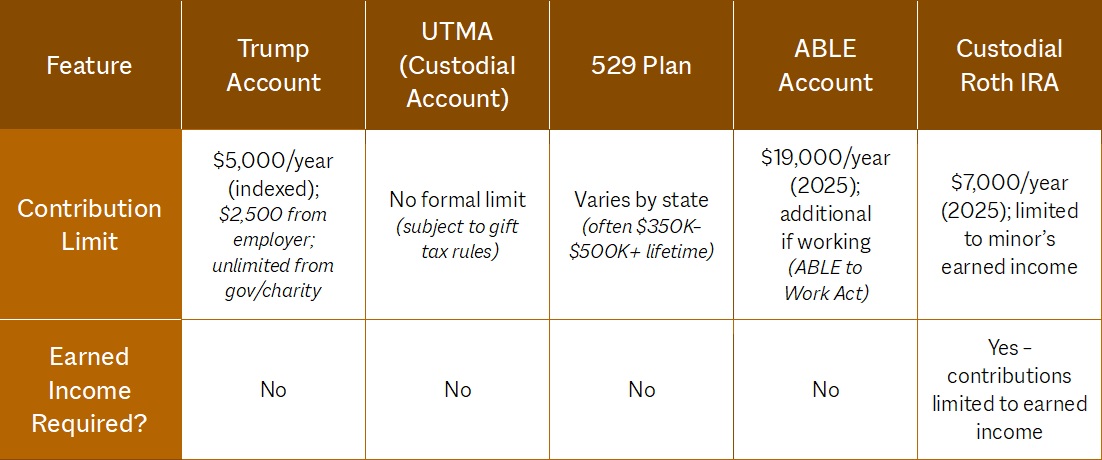

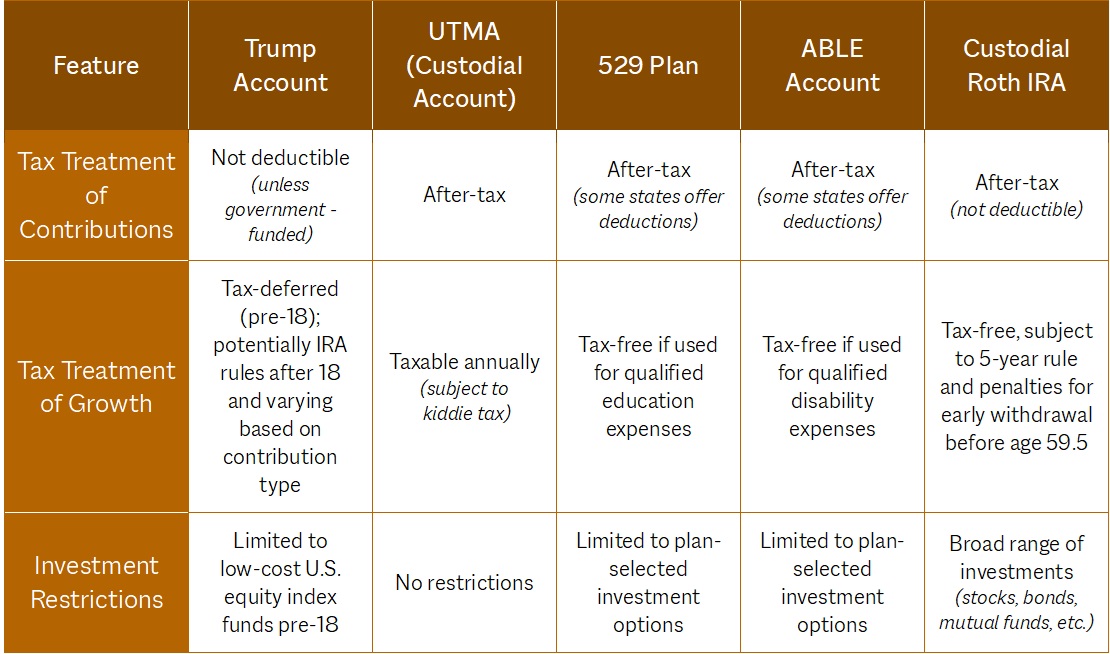

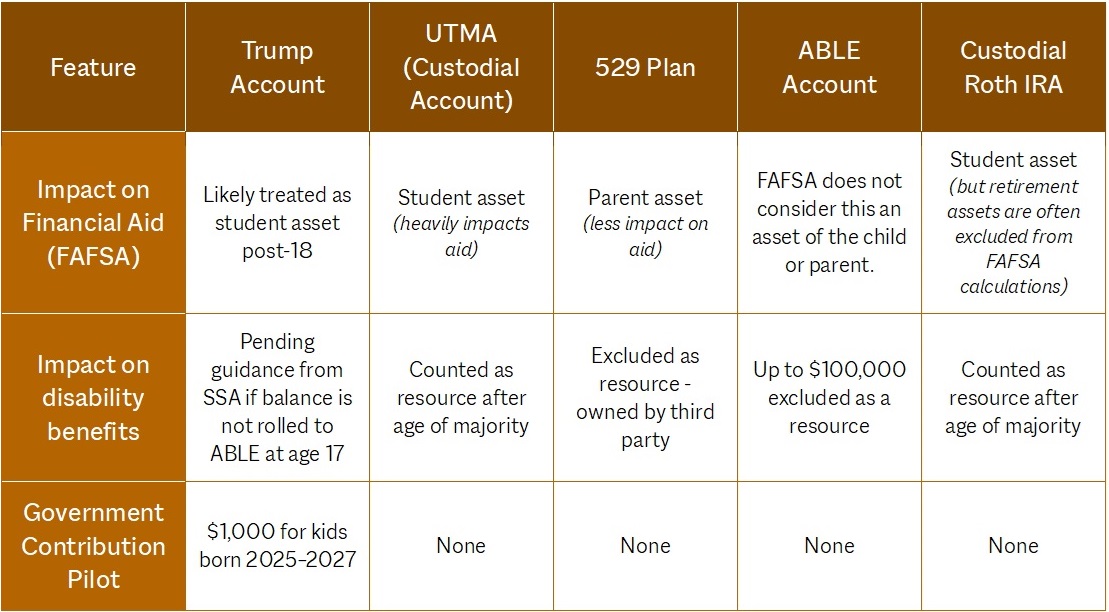

Account Comparisons: Trump, UTMA, 529, ABLE, & Roth IRA

Account Purpose and Ownership

Contribution and Income Rules

Tax Treatment and Investments

Access and Usage

Impact on Benefits and Government Support

Sources:

https://www.savingforcollege.com/article/trump-account-vs-529

https://www.savingforcollege.com/article/what-is-an-ugma-or-utma-account

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.