Social Security is a critically important part of your overall financial and retirement plan that will be around for generations to come. The decision to claim or delay benefits should be carefully considered.

Social Security is a commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program. When the law that created the Social Security system we now know was passed in August of 1935 (Social Security Act of 1935), America was struggling to dig out of the Great Depression and was inching it’s way toward WWII. Germany had just passed the Nuremberg trials, stripping Jews of their civil rights. The unemployment rate was 20%, and the average annual earnings for a worker in the U.S. was $474 (just over $9,000 in today’s dollars). It wasn’t all bad though; 1935 was also the year nylon and swing music were created. Can you imagine a world without the Social Security system, nylon, and the music of Benny Goodman?

There are three parts to the Social Security system:

1. Retirement income

2. Disability insurance

3. Survivors’ insurance

As a financial advisor who specializes in retirement income planning, I tend to only focus on the retirement income program since that is most relevant to my clients, but Social Security is so much more than a monthly check for our nation’s retirees.

Here are a few definitions and explanations that will hopefully help you gain a better understanding of our Social Security system.

Remember that strange acronym, OASDI? Let’s break it down for further clarity:

“OA” stands for Old Age and refers to the retirement income program for seniors, which is what most of us think of when we hear the term Social Security. Sorry to those of you age 62 and up, but remember that when the program was initially created, life expectancy in the U.S. was barely 65. In 1935, age 62 was truly old. To compare, in the first half of 2020 life expectancy was 8 years.

“SDI” stands for Survivors and Disability Insurance, which is the life and disability insurance program also administered by the Social Security Administration.

Singer Jackie DeShannon said it well in 1969 when she penned, “Think of your fellow man. Lend him a helping hand. Put a little love in your heart.”

Social Security is a pay-as-you-go (PAYGO) system, meaning current beneficiaries are receiving a portion of their benefits from those paying into the system right now via payroll taxes. Those receiving benefits today paid for those receiving benefits decades ago. Think of it as one giant, pay-it-forward system.

Current beneficiaries (those receiving benefits today) are dependent on current workers (those paying into the system today). We do not have a choice. In my opinion, sometimes the fewer choices we have, the better off our society is as a whole. Social Security is a perfect example of that. If everyone had a choice whether to participate, the system would be doomed. So, remember, we’re all in this together. Our interests are aligned!

Next, I want to debunk a myth that’s gaining traction. Social Security will not go bankrupt. Or at least it shouldn’t. Let me explain.

Social Security has been around since 1935 and has faced some tremendous challenges as our country dealt with depressions, recessions, wars and hyperinflation. Yet Social Security is still here today providing income for more than 64 million Americans. Some small tweaks to the system will keep it solvent for generations to come.

According to the latest Social Security trustees report, even if no changes are made, current trust fund balances and payroll taxes will cover 100% of projected benefits until 2035. After that time, again assuming no changes are made, there will still be enough income from payroll taxes to cover 75% of ongoing benefits. Now, no one wants to take a 25% cut in income when they may likely need it the most and I do not think our elected representatives will allow such a huge negative impact on the largest block of voters in our country.

The last time the solvency of our Social Security system was addressed was almost 40 years ago in 1983. A lot has changed over the last 40 years, and some modest adjustments to the system appear to be in line with what most Americans want. Polls show most Americans favor raising payroll taxes or extending the retirement age for current workers to ensure the system is solvent for generations to come. Those who say Social Security won’t be around for them are either misinformed or are misrepresenting the facts. And, if we use history as any guide, we have a few more years of procrastination before any real policy changes will be brought to bear. We tend to wait until the storm clouds are within a few miles from shore before we start to leave the beach.

The last time major financial reform happened to the Supplemental Security Income (SSI) system was during a period from 1973 to 1983 when the system was running a cash flow deficit threatening the system’s solvency. Then came the Social Security Amendments of 1977 and 1983, which evolved the system to what we have today. More changes are required and will likely happen at the last minute, making the system solvent again for future generations to come.

It’s rare that I hear a complaint about Social Security, except that the cost-of-living adjustment is too low. Social Security is the bedrock of many retirees’ financial plans. In fact, for many retirees, it represents most of their income in retirement. This statement is frightening when you think that the average benefit payment as of November 2022 was $1,551 per beneficiary.

For many of my clients, Social Security, while important, is not the bedrock of their financial plan. However, it is still a critical decision that all Americans will face as they transition into retirement. And, for most it is the most important financial decision they may make in their retirement years. It’s a decision you and your spouse (if married) will have to live with for the rest of your lives. Thus, I recommend you put at least as much time into this decision as you do your annual vacation.

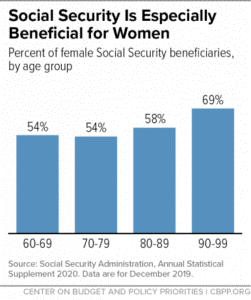

Since women on average tend to live longer, earn less, take more time out of the work force to raise children and thus accumulate less savings and smaller pensions, Social Security is especially important and beneficial for women. Ninety six percent of current survivor’s benefits are paid out to women. Also, women make up more than half of those receiving retirement benefits.

When I am advising a married couple on the most efficient way to claim Social Security, I encourage the men to think about their wives when making this decision. I remind them that our goal is to maximize the benefits from Social Security over both their lifetimes. This conversation usually, but not always, leads a client to defer SS payments as long as possible to max out the surviving spouse’s income should something happen to the higher-earning spouse. There are lots of reasons why you should, and should not, delay Social Security payments and those are beyond the scope of this article so discuss your specifics with your advisor.

Of course, we aim to provide the best service possible and will make every effort to get your cash to you when you need it. That being said, these are investment accounts and not bank accounts, so a little planning goes a long way to making the process as smooth and painless as possible.

We are proudly a fee-only, independently-owned financial planning firm that acts as a fiduciary for our clients. We have built our organization to put our customers’ interests first, as evidenced by our fee-only fee structure and fiduciary responsibility.

If you’re interested in our services, please contact us. If you would like to learn more about financial planning, wealth management, and finding a financial advisor, please visit other areas of our education section.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.