Why working with a financial advisor is about more than just money.

Wealth management is more than asset allocation and tax optimization. It’s a relationship built on trust, empathy, and shared purpose. At its core, it’s a dedicated partnership where the advisor deeply understands the client’s goals, values, and concerns. It’s a connection that helps to empower confident decisions and alleviate financial stress, while ultimately helping to restore time in your life for what matters most. While investment performance and financial planning are essential, the real value of working with a trusted advisor often lies in the emotional and practical benefits that are harder to quantify, but that are deeply felt.

Industry research indicates that experienced advisors often support clients in more than just financial matters—they can offer guidance across a broad range of life decisions and priorities.

A Holistic Framework for Financial Advice

The Emotional and Time Value of Advice research study conducted by Vanguard encourages a broader view of value and one that aligns closely with our philosophy at Modera.[1] Their framework includes:

- Portfolio Value – Strategic investment management tailored to your goals

- Financial Value – Comprehensive planning across retirement, tax, estate, and cash flow

- Emotional Value – Confidence, clarity, and reduced financial stress

- Time Value – Time saved and life enhanced

An additional research study by Vanguard on the value of personalized advice shows that the value of financial advice comes from two key areas: technical knowledge and personal support.[2] On the financial/portfolio side, advisors help with goal planning, portfolio management, and tax strategies. On the emotional/time side, advisors can provide clients with “behavioral coaching” such as helping them cultivate a healthier money mindset and building confidence in financial decisions. They also help reduce stress by streamlining administrative tasks. Together, these elements highlight how advice may deliver both measurable results and meaningful life benefits.

Source: Vanguard research, “The Emotional and Time Value of Advice,” June 2025.

“Behavioral Coaching” does not imply any kind of particular skillset or outcome.

At Modera, we believe that meaningful financial advice extends beyond performance metrics. It’s about understanding the full context of a client’s life and delivering thoughtful, personalized guidance.

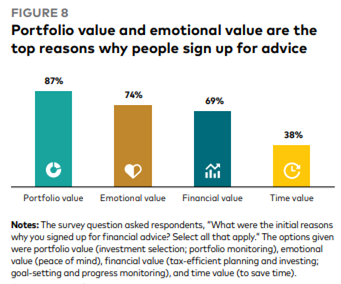

What Drives the Decision to Work with an Advisor?

Financial decisions are rarely made in isolation. They’re shaped by a multitude of influences such as family dynamics, career transitions, major life events, market uncertainty, and personal aspirations. To help navigate these complexities, people may choose to work with a financial advisor.

According to Vanguard, investors may be motivated by a desire to improve their portfolio value through professional management that includes investment selection and ongoing monitoring. Many people value having an advisor—not just for emotional reassurance, but for thoughtful financial planning that incorporates many facets of financial and personal goals, as well as the time saved from no longer managing complex details on their own. These layers of value, some less tangible and not always easy to quantify, are what make the advisor-client relationship so impactful and personal.

Source: Vanguard, “The Emotional and Time Value of Advice,” June 2025.

Vanguard Survey methodology: The investor survey was conducted by Vanguard’s Investment Strategy Group in July 2024 among a sample of 12,443 Vanguard investors. The sample included 7,746 advised clients—both working and retired. The online survey measured the emotional and time-related value of financial advice, with participants responding to questions about financial stress, time spent managing finances, and perceptions of financial advice and well-being.

From Decision to Strategy

Once the decision to work with a financial advisor is made, the more tangible benefits begin to take shape through a more structured and informed approach to managing wealth. The goal of professional portfolio management is to bring discipline to investment selection and to provide ongoing monitoring and timely rebalancing. Advisors and portfolio managers strive to ensure that allocations stay aligned with long-term goals and risk tolerance. Beyond the portfolio, the planning process adds another layer of financial value: setting clear objectives, tracking progress, and adjusting strategies as life evolves. Advisors help navigate tax-efficient planning, coordinate estate strategies, and evaluate insurance needs, all within the context of a broader financial picture. In time, the emotional and time-related value can emerge, as the relationship develops and outcomes begin to materialize.

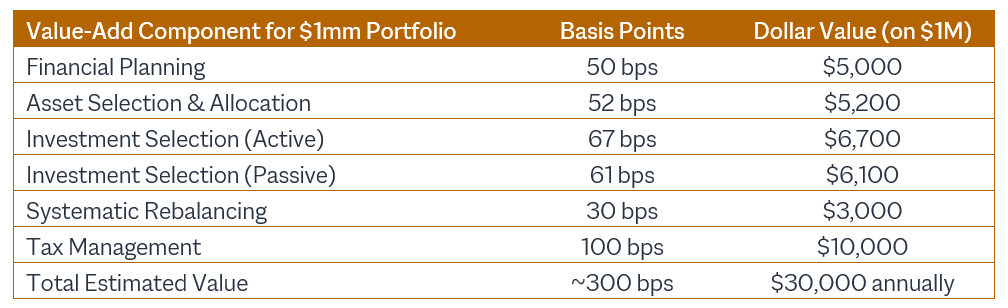

Quantifying the Advisor Advantage

Engaging a professional financial advisor isn’t just about guidance—it’s about measurable value. The chart below illustrates how specific advisor-driven strategies can translate into tangible financial gains.[3] From personalized planning and tax optimization to asset selection and rebalancing, each component contributes to a cumulative benefit that can potentially enhance portfolio performance. According to the Envestnet PMC, “Capital Sigma: The Advisor Advantage,” (2019) study, in a hypothetical scenario, these strategies could generate approximately $30,000 in annual value for an investor with a $1 million portfolio.

Source: Envestnet PMC, “Capital Sigma: The Advisor Advantage,” (2019). The value estimates in the table are based on Envestnet’s analysis using historical data, third-party research, behavioral finance insights, and portfolio modeling. Each component—planning, allocation, selection, rebalancing, and tax management—is backed by cited studies and benchmarks.

Emotional Relief

According to Envestnet’s research study, advised clients were about half as likely to experience high levels of financial stress (14%) compared with self-directed investors (27%). And when asked to compare the experience of self-managing their finances or working with a human advisor, 88% of those advised investors responded they experienced greater “peace of mind” about their finances as compared to 12% who experienced no change in emotional value and 2% who indicated they experienced less. However, these statistics underscore the perceived emotional benefit of having a thoughtful financial partner–perhaps one you feel understands your goals, or who reminds you to keep a long-term focus amid market uncertainty, or helps you maintain some composure when life gets a little complex.

Time is a Valuable Asset

Time is the one resource you can’t earn back. According to the research, 76% of investors who work with advisors reported that they save a median of two hours per week by delegating financial tasks, which adds up to more than 100 hours annually. That’s meaningful time that can be redirected toward family, career, or personal interests. In fact, nearly half (49%) of respondents chose to spend their extra time on leisure activities, while 35% dedicated it to family. Another 29% used the time to focus on exercise, and 27% tackled household tasks. Interestingly, this study indicates that while time value may not be the primary reason people seek professional advice, it often emerges as one of the most appreciated benefits once the relationship is established. For busy professionals, this time back can be especially powerful.[4]

Meaningful Gains

Wealth is more than a balance sheet. It’s a reflection of your current values and your vision for the future. And the value of good financial advice is multidimensional as well. At Modera, we’ve long believed that partnering with a financial advisor is one of the most impactful decisions a person can make. Recent research only reinforces what we believe to be true—that thoughtful advice delivers benefits beyond portfolio management and financial planning and extends into emotional well-being and time saved.

So, if you’ve ever wondered whether working with a financial advisor is worth it, consider this: it’s not just about what you spend and earn, it’s also about what you gain.

If you’re considering our services and ready to experience the full value of advice, we’d be honored to help guide you. For those already working with us, please know how deeply we value our relationship. Across our entire firm, from advisory and client service to research and operations, together we work diligently to provide a wealth management experience that is tailored, thoughtful, and grounded in sophisticated advice and personal care. Your confidence in us is what helps drive our commitment to excellence.

Source: Vanguard research: “The Emotional and Time Value of Advice.”

[1] Vanguard research, “The Emotional and Time Value of Advice” investor survey, June 2025.

[2] Vanguard, “The Value of Personalized Advice,” August 2022.

[3] Source: Envestnet PMC, “Capital Sigma: The Advisor Advantage,” (2019).

[4] Source: Envestnet PMC, “Capital Sigma: The Advisor Advantage,” (2019).

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.