For many high school seniors, the pressure to pursue higher education immediately after graduation can feel overwhelming. Well-meaning parents and school counselors often unwittingly contribute to this pressure through conversations about college plans, arranging campus tours, or assisting with applications.

Students who don’t share the same excitement as their college-bound peers may begin to question themselves or perhaps feel inadequate or frustrated. Society often presents attending a 4-year college right after high school as the only “right” path, but it may not be everyone. Just because some students are not ready to jump into a traditional college setting right away, that doesn’t mean they’re stepping off the path altogether. In many cases, the goal is still a 4-year degree, just with a different starting point. While there are many other great options after high school—such as entering the workforce, enrolling in a trade or vocational school, or joining the military—this article focuses on students who still aim to earn a bachelor’s degree, but may take a less traditional path to get there. Alternatives like beginning at a community college or taking a gap year can offer time to mature, explore interests, and make more informed choices about their future, all while keeping that long-term goal in sight.

The Case for Community College

In 2024, freshman college enrollment increased overall, with some of the most significant gains occurring at community colleges, which saw a 7.1% rise compared to the previous year.[1] Among the 2024 high school graduates, 16.9% enrolled in two-year colleges, while 45.1% chose 4-year programs and 38% pursued other options.[2] There are many reasons why students might choose to begin their postsecondary education at a community college. Let’s explore some of those reasons and the valuable benefits that community colleges can offer.

Academic Readiness

Let’s face it, not everyone is a straight-A student or a confident standardized test taker. Perhaps studying and “applying themselves” in high school came in second behind other non-academic interests and pursuits. Community college can help a student learn the skills and discipline needed to be successful in a 4-year degree program. With smaller class sizes and support services like group and peer tutoring, as well as help with study skills, note-taking and organization, students have the opportunity to strengthen their academic abilities. They also have more flexibility with their course load, which can be helpful for those not ready to take on the minimum credit hours typically required for enrollment at most 4-year institutions.

Community colleges typically offer the same general education classes as 4-year institutions, in a less intimidating setting. A smaller, more intimate environment with the added support a community college offers can help boost a student’s confidence and readiness to transfer to a larger university or college. Attending a community college before gradually transitioning to a university can give a student the time they may need to explore their interests, potential majors, and future careers.

And finally, for those students whose high school transcripts may have put certain universities out of reach, success in a community college transfer program can open doors that once seemed closed. In fact, many state universities have “bridge” or guaranteed admissions programs where students can attain a clear admissions path from a local community college into the university, if certain academic and course requirements are successfully met. Cornell University and highly regarded public schools, such as those in the University of North Carolina and the University of Virginia system (among others), participate in such programs.

Financial Savings

The price of higher education increases every year, including the cost of attending a community college. However, community college costs are still significantly lower compared to the cost of attendance at a 4-year school. Not only is tuition lower, but students attending community college often live at home, which helps eliminate—or at least alleviate—room and board costs.

The average in-state tuition and fees for North Carolina community colleges and public universities are among the lowest in the country. In 2024, the average N.C. in-state tuition and fees were $2,650[3] for community college and $7,690[4] for a 4-year public university. So, for illustration purposes, let’s look at two options for a college freshman in this state.

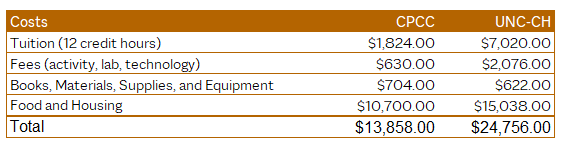

Consider this comparison between the estimated cost of college attendance at Central Piedmont Community College (CPCC), located in Charlotte, NC and one of the largest in the state, and the University of North Carolina at Chapel Hill (UNC) for just one school year ( 2025-2026 ).

Source CPCC 2025-2026 Financial Aid Cost of Attendance Estimates and UNC 2025-2026 Financial Aid In-State Cost of Attendance Budget

This comparison doesn’t include travel, transportation or miscellaneous expenses which would ultimately make the cost of attendance at either school higher. But you can see that the cost of attending UNC for one year is almost $11,000 higher than CPCC. And if the student, like many community college students, resides at home with parents, the cost of food and housing may be significantly reduced or even eliminated, depending on the circumstances. This could boost the total savings of attending community college instead of a 4-year university by as much as $21,500 for just one year. This is a significant savings regardless, but especially when taking into account a student’s readiness (or lack thereof) to attend a 4-year university.

Reminder: Tuition, fees, books, equipment, and materials at a community college are considered qualified education expenses and can be paid for using a 529 plan. If there are remaining funds after completing a degree at a 4-year institution—thanks to savings from attending community college—those funds can be used for graduate school or rolled over to another eligible family member for qualified education expenses.

Minding the Gap

For some students who need a reset and recharge after high school and before starting classes at a college or university, taking a gap year through a structured program may be exactly what they need. A gap year can help alleviate, and perhaps repair, the stress and burnout many high school students experience, while providing valuable time and experiential learning opportunities to help them re-center and refocus— all without losing momentum toward their future academic goals. In fact, a study by the Gap Year Association found that 90% of students who take a gap year enroll in college within a year, with many reporting that they feel more prepared and confident in their academic paths. [5]

Intangible Benefits

The defining elements of a meaningful gap year are intentionality, personal growth, and reflection. Many programs encourage travel, work, cultural exploration, and other activities designed to help students gain life experience, broaden their worldview, and explore interests and hobbies that could later shape their academic or professional pursuits.

Here are just some of the outcomes and benefits reported by those students who chose to take a gap year:[6]

- Reduced stress and burnout

- Better cultural awareness

- Enhanced communication skills

- Increased critical thinking

- Improved self-direction and maturity

- Added relevant experience to resume

- Reignited academic momentum

Finding and Funding the Gap

There are a wide variety of gap year programs to consider, and determining the right one for your student will take a little legwork as well as partnership with your child. A first step is narrowing down what your student wants the experience to be. Is it working at an internship abroad? Teaching English or another language? Adventure or study? Next steps are to choose a destination and time of year to travel. Exploring the possibilities based on some defined preferences and criteria will help you narrow down which program suits the needs and interests of your student. Consult your child’s high school counselor, as they may be aware of and able to recommend a program or two. A simple search on the internet will quickly return several gap year programs and companies to reach out to, as well as information about online and in-person gap year fairs to attend. A few sites to jumpstart your search are Gap Year Association and Go Overseas. You can even hire a gap year consultant to help guide your student through the process of finding and applying to the most appropriate programs for them. The possibilities are vast and your chances of finding a program that suits both you and your student are pretty good.

Gap year programs can range in cost from $5,000 to $30,000 or more depending on the experience and program you choose. When you have finalized your student’s programs of interest, inquire about any possible travel or housing grants available to help defray some of the cost. Some programs may even offer scholarships.

Consider using your education savings plan to fund the gap year. If your child has been admitted to a university and is on the fence about attending, check into whether that university has a deferred enrollment, gap year option. Several Ivy League and state universities offer structured gap year programs that qualify for 529 plan funding through partnerships with accredited higher education institutions. These programs typically count as qualified expenses when they offer college credit as part of a formal academic partnership. Even if your child has not been accepted at a university, it is still possible to use 529 funds to help pay for qualifying expenses in a gap program. However, eligibility can vary by program, so it’s essential to confirm with the program administrator that the credits are issued through an accredited institution before using 529 funds. It is also important to consult with your financial advisor to ascertain how using a 529 plan to fund a gap year affects your child’s college education savings plan or how paying for a gap year with your personal savings affects your overall financial plan.

Final Thoughts

It’s often said that “comparison is the thief of joy,” and that couldn’t be more true when it comes to parenting. Success is not a one-size-fits-all timeline and no two kids are the same. It may be difficult, but it’s important not to define your child’s progress or prospects by looking at their peers, your friends’ children, or even their own siblings or cousins. Sometimes, the most rewarding thing we can do as parents is to let go of our own expectations so we can truly see and support our child’s path. We can still offer guidance along the way by setting up guardrails to help them stay safe, by adding a few lights to illuminate what’s up ahead, and by posting clear signs to keep them pointed in the right direction.

Whether your student chooses a more affordable, smaller start at community college, gains experience and perspective through a gap year, or heads straight into a traditional 4-year program after high school, the most important thing is that they continue moving forward in a way that aligns with who they are and where they want to go. Remember, a detour is not a derailment. In fact, it can be quite the opposite. Sometimes stepping off the expected path temporarily is exactly what a young person needs to move forward with clarity and confidence on their road toward long-term success.

[1] https://www.usnews.com/education/best-colleges/applying/articles/how-college-freshman-fall-2024-enrollment-increased

[2] https://educationdata.org/college-enrollment-statistics

[3] https://educationdata.org/average-cost-of-community-college#north-carolina

[4] https://educationdata.org/average-cost-of-college-by-state

[5] https://www.gapyearassociation.org/about-gya/what-is-a-gap-year/

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.