Put our experienced investment team to work for you.

Our investment philosophy is centered on the pillars of long-term investing, broad diversification and avoiding market timing. We build cost-effective, globally diversified portfolios, and manage them on an ongoing basis. Our comprehensive approach connects the investment process with the client’s financial plan to help achieve their goals. We will construct a portfolio for each client as determined by their objectives, personal circumstances and risk tolerance. This approach aligns well with the fiduciary responsibilities we have for our clients.

There’s no such thing as investing in a vacuum.

The objectives we define for your investment portfolio, and the specific investments we recommend, are a carefully considered reflection of your master financial plan.

When we develop your portfolio allocation, we consider factors in alignment with your goals, including things like:

- How much growth do you need to do what you want to do?

- How much liquidity do you need? When do you need it?

- Are you funding your kids’ education? How much will you need, and when?

- What are your career and retirement plans? When do you plan to retire?

- What is the potential tax liability for your existing holdings? How can we minimize it?

- How much risk are you comfortable with?

Here’s more of what distinguishes our approach to investing:

1. Informed decision-making.

Investing can get technical. We make sure you understand the essential concepts behind your investment options. That way you can make informed decisions that align with your goals, and feel confident in the strategies we implement together.

2. Big-picture perspective.

Our disciplined approach and long-term orientation free you from the emotional drama of news cycles and market cycles, so you can invest your time and energy in more gratifying pursuits. This includes constantly searching for ways to reduce portfolio costs and minimize taxes, so you maximize what really matters.

3. Leveraging scale.

Our breadth and depth of assets managed gives us access to institutional-class shares not available to individual investors or smaller firms. It also opens up lower-cost investment options, and enables us to negotiate favorable trading terms on your behalf.

4. Working with seasoned investment pros.

Beyond the clarity created by sophisticated planning, and the confidence of our day-to-day support, disciplined investing is a benefit of working with a firm of our caliber. Our team is relentless at scouring the vast landscape of potential investments, identifying high-quality vehicles and blending them into a balanced, globally diversified portfolio.

5. Total access to the process.

You hire us to help invest your hard-earned assets. We communicate regularly about our process. We have no house products, hidden fees or hidden agendas. Instead, you enjoy access and transparency.

6. Protecting what you've got.

Most of our clients are focused on preserving and growing their hard-earned capital. Their goal is to weather any big market ups and downs intelligently and achieve stability over the long term. Whatever your objective, whether it’s preservation, moderate growth or aggressive growth, we focus on seeking to maximize returns while minimizing your exposure to risk.

How we invest:

1.

Equities

• Mutual funds, exchange traded funds (ETFs), individual equities and separately managed accounts (SMAs)

• Low cost, tax efficient, fully liquid and transparent

• Diversified across geography, size, and style

2.

Fixed Income

- Mutual funds, ETFs and SMAs

- Allocations may include US Treasurys, municipal, foreign, high yield, inflation-protected, mortgage-backed and corporate bond funds

- Fixed income should smooth the volatility of the portfolio, and provide a source of spending when stock prices are lower

3.

Other/Alternative Asset Classes

- One or more vehicles invested may use one or more funds invested in private real estate, private credit, private equity, infrastructure, or other alternatives

- Investments with low correlations to traditional assets that also seek to provide inflation hedges

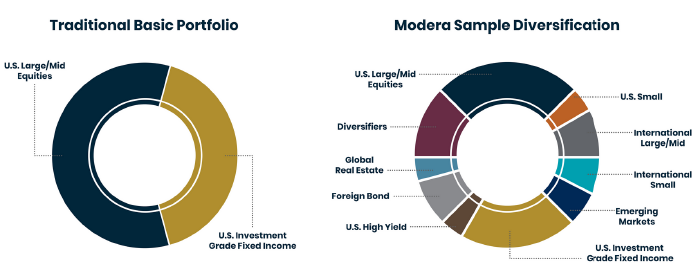

Why we diversify your portfolio:

A traditional portfolio can expose you to a lot of risk. The kind of globally diversified portfolio we build for you incorporates a balanced blend of asset classes and investment vehicles. The goal is to capture as much market growth for you as we can, while insulating you from volatility.

Helpful information on investing:

Meet the leaders of Modera's Investment Department:

Modera’s Investment Department is comprised of research, trading, and portfolio management. We have many CFA® (Chartered Financial Analyst®) charter holders on staff, which means that our analytical capabilities are more robust than ever. We all share a passion for delivering a high quality, objective, repeatable investment experience for our clients.

Want to dive deeper?

We’re happy to send you our white paper — “Evidence-Based Investing: 12 Principles For Growing Your Wealth Over The Long Term.” Sign up to read our whitepaper now and going forward you’ll receive pertinent news and future invitations to our webinars.

Investment Commentary: Q4 2025 A Year In Review