Historical data shows that the markets are efficient and already price in forward-looking expectations for companies and the overall economy.

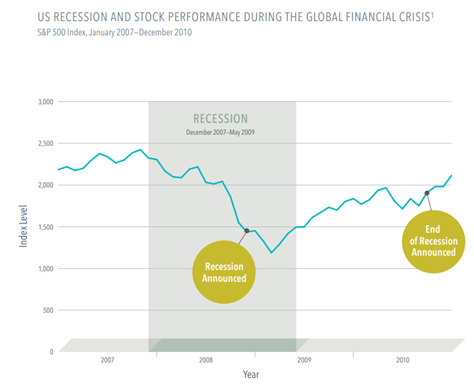

The data supports that conclusion. In the chart below, the shaded area highlights the U.S. recession of December 2007 to May 2009, as defined by the National Bureau of Economic Research. However, the official recession announcement happened a year after the recession started. By then, US stock prices had fallen more than 40%.* The market had already priced in the expectations that a slowed economic situation would erode company profits. On the flipside, the “end of recession” announcement came 16 months after the actual recession. The chart below shows that US stocks had begun trending upward before the recession was over and continued through the official announcement.

A recession is defined as two consecutive quarters of economic decline, traditionally measured by negative gross domestic product (GDP). But there are other indicators as well, such as a decline in employment, a decline in real income, a decline in production, etc. In many respects, whether the headlines declare an official recession or not, the pain points can still feel very real.

But when it comes to your long-term investment strategy, economic cycles are already accounted for, expected, and built into the plan. Even with the speed and 24/7 nature of today’s news environment, the real headline is that there may not be a headline and that the news is often playing catch-up to what the markets have already known.

1 Start and end dates of US recessions, along with announcement dates, are from the National Bureau of Economic Research (NBER).

nber.org/research/data/us-business-cycle-expansions-and-contractions and

nber.org/research/business-cycle-dating/business-cycle-dating-committee-announcements

* Decline based on the S&P 500 Index’s price difference between the actual start of the recession in December 2007 and the official

“in recession” announcement 12 months later.

Source: Dimensional Fund Advisors. Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. In US dollars. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Markets Don’t Wait for Announcements

So let’s get to the punchline first: Markets don’t wait for announcements and smart investors should not focus on headlines.

Historical data shows that the markets are efficient and already price in forward-looking expectations for companies and the overall economy.

The data supports that conclusion. In the chart below, the shaded area highlights the U.S. recession of December 2007 to May 2009, as defined by the National Bureau of Economic Research. However, the official recession announcement happened a year after the recession started. By then, US stock prices had fallen more than 40%.* The market had already priced in the expectations that a slowed economic situation would erode company profits. On the flipside, the “end of recession” announcement came 16 months after the actual recession. The chart below shows that US stocks had begun trending upward before the recession was over and continued through the official announcement.

A recession is defined as two consecutive quarters of economic decline, traditionally measured by negative gross domestic product (GDP). But there are other indicators as well, such as a decline in employment, a decline in real income, a decline in production, etc. In many respects, whether the headlines declare an official recession or not, the pain points can still feel very real.

But when it comes to your long-term investment strategy, economic cycles are already accounted for, expected, and built into the plan. Even with the speed and 24/7 nature of today’s news environment, the real headline is that there may not be a headline and that the news is often playing catch-up to what the markets have already known.

1 Start and end dates of US recessions, along with announcement dates, are from the National Bureau of Economic Research (NBER).

nber.org/research/data/us-business-cycle-expansions-and-contractions and

nber.org/research/business-cycle-dating/business-cycle-dating-committee-announcements

* Decline based on the S&P 500 Index’s price difference between the actual start of the recession in December 2007 and the official

“in recession” announcement 12 months later.

Source: Dimensional Fund Advisors. Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. In US dollars. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Follow us on social:

Talk to an experienced financial planner

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.