With Thanksgiving already upon us and a new year just around the corner, it’s the perfect time to pause and appreciate what we have. This is particularly important for investors, since it’s so much easier to focus on what could go wrong rather than what has gone right. With markets in positive territory for the year to date, it’s helpful to reflect and to maintain perspective as new challenges and opportunities emerge.

First, we can be thankful that financial markets have performed well this year despite market swings. As of this writing, the S&P 500 has returned over 14% (including dividends) year-to-date, while bonds have returned approximately 6.5% as measured by the Bloomberg U.S. Aggregate Bond Index. International stocks have outperformed U.S. stocks for the first time in many years, with developed markets (as measured by the MSCI EAFE Index) returning over 27% and emerging markets (as measured by the MSCI EM Index) returning over 32%. Many diversified portfolios have benefited from this broad-based performance across asset classes.

This resilience underscores an important principle: trying to time markets around short-term events is not only difficult but can be counterproductive. Think back to April, when markets fell close to bear market levels as new tariffs were announced. Markets not only rebounded quickly on rapidly changing information but continued to rise to new all-time highs. Investors who remained disciplined were rewarded for their equanimity.

Second, we can be grateful that inflation has remained moderate, particularly compared to the past several years. Prices have risen by about 3% over the past year, which is above the Federal Reserve’s 2% target but not as high as many feared when increased tariff rates were initially announced.1

This relatively moderate pace of inflation has allowed the Fed to begin cutting interest rates to help support a weakening job market. Historically, lower rates have benefited both stocks and bonds by reducing borrowing costs for businesses and consumers while making existing bonds with higher interest rates more valuable. So, even though inflation and interest rates will remain important factors for markets to watch in the months ahead, current levels appear to be stable.

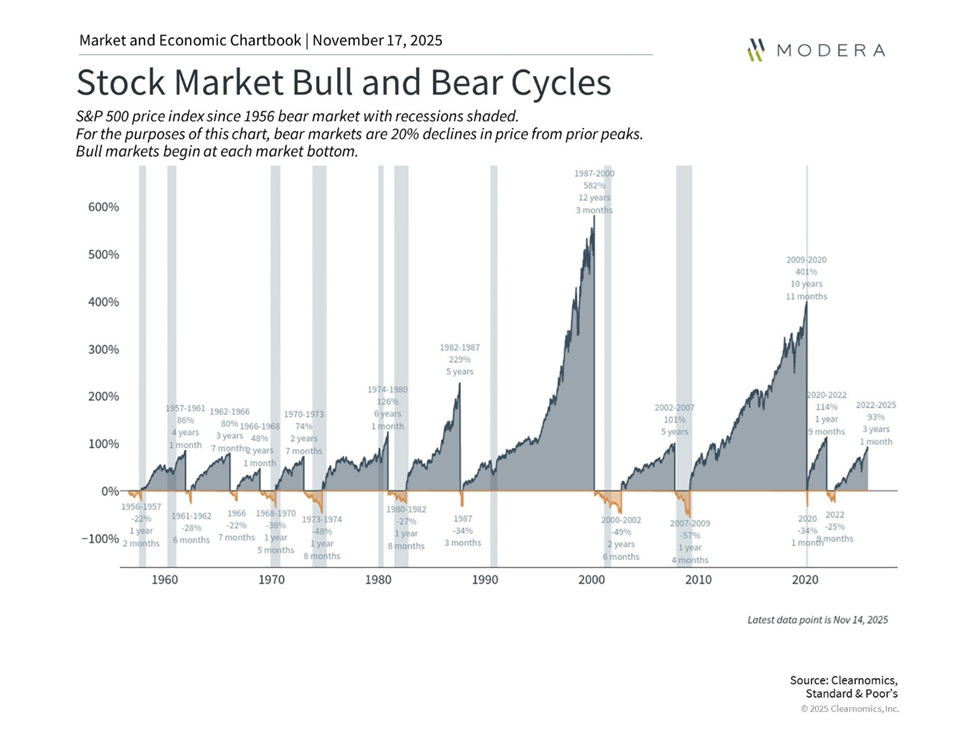

The year ahead will likely bring new sources of uncertainty. There may be worries about recessions, bear markets, and bubbles. This bull market cycle, which began after the market bottom in October 2022, is now entering its fourth year. As the accompanying chart shows, historical bull markets have lasted much longer than bear markets, often running for five to ten years or more.

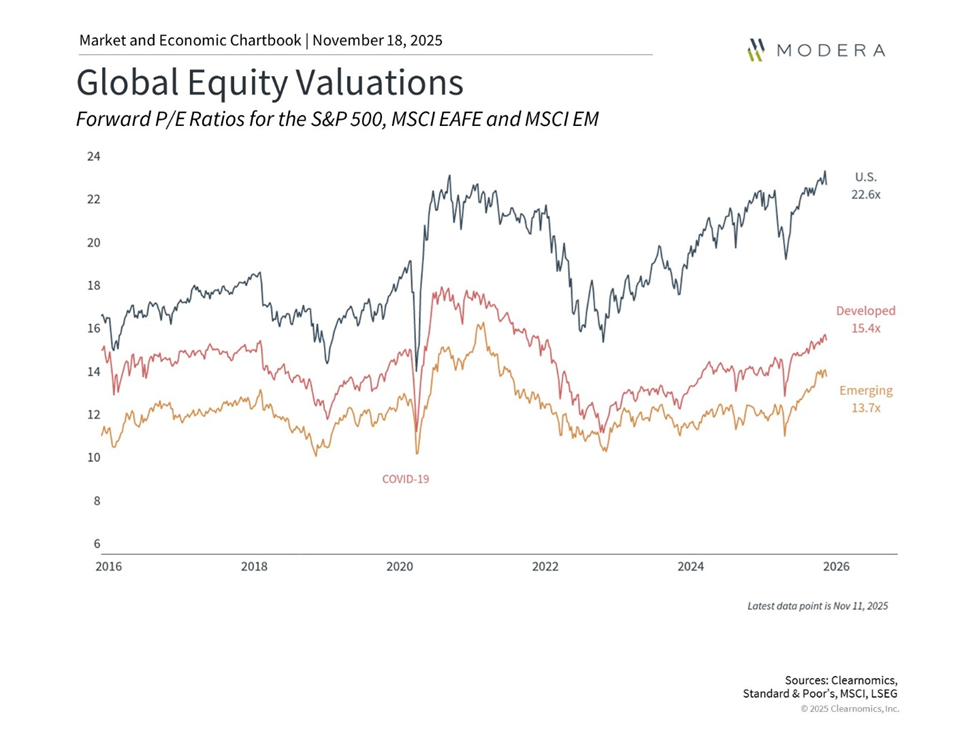

However, as seen in the Clearnomics chart below, the S&P 500 price-to-earnings ratio of 22.6x is above its historical average of 15.9x. These valuations suggest that future returns could be more modest, especially when compared to other asset classes like developed and emerging international equities. Thus, it’s important to have realistic expectations and to remain diversified.

Questions about artificial intelligence are likely to continue. Its effect on stock prices is difficult to predict given the transformative nature of the technology, similar to the challenges of predicting how the internet revolution would unfold beginning in the mid-1990s. News headlines are also likely to rattle investors with ongoing tariff changes, geopolitical worries, midterm elections, and more. As concerning as these issues may be, market history teaches us that overreacting to these events is counterproductive. Long-term investors should consider holding a portfolio tailored to their specific financial goals and that is able to weather different phases of the market and economic cycle.

As you gather with friends and family this holiday season, take a moment to reflect on the many reasons to be thankful. Remember that a properly constructed portfolio should balance different types of investments in a way that aligns them with an individual’s financial goals. This will be the key to navigating challenges and opportunities in the year ahead.

At Modera, we are thankful for the trust you put in us and your continued partnership. We wish you and yours a happy Thanksgiving!

Copyright © 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg. MSCI data © MSCI 2025, all rights reserved.