The conflict between Israel and Iran has captured global attention and created uncertainty in financial markets.

Over the weekend, the U.S. conducted targeted airstrikes on Iranian nuclear facilities. The situation is still evolving, and there are many views on what might happen next.

At Modera, we’ve always maintained a neutral stance on political matters, and that commitment remains unchanged. Our goal is to provide factual, unbiased information to help you understand what’s driving market behavior, not to express political opinions.

First and foremost, humanitarian considerations remain a key concern. While a range of outcomes is possible, a medium-term de-escalation cannot be ruled out. In the near term, however, the uncertainty surrounding the conflict may contribute to heightened volatility in both equity and oil markets.

While this is a serious and unpredictable event from a geopolitical perspective, it may have a lesser impact on financial markets. It is important to emphasize that we are not minimizing the severity of these conflicts. But in my role as CIO, there is the constant reminder that overreacting to these events can be counterproductive. In times like these, it’s more important than ever to maintain perspective and focus on the lessons of history and long-term market trends.

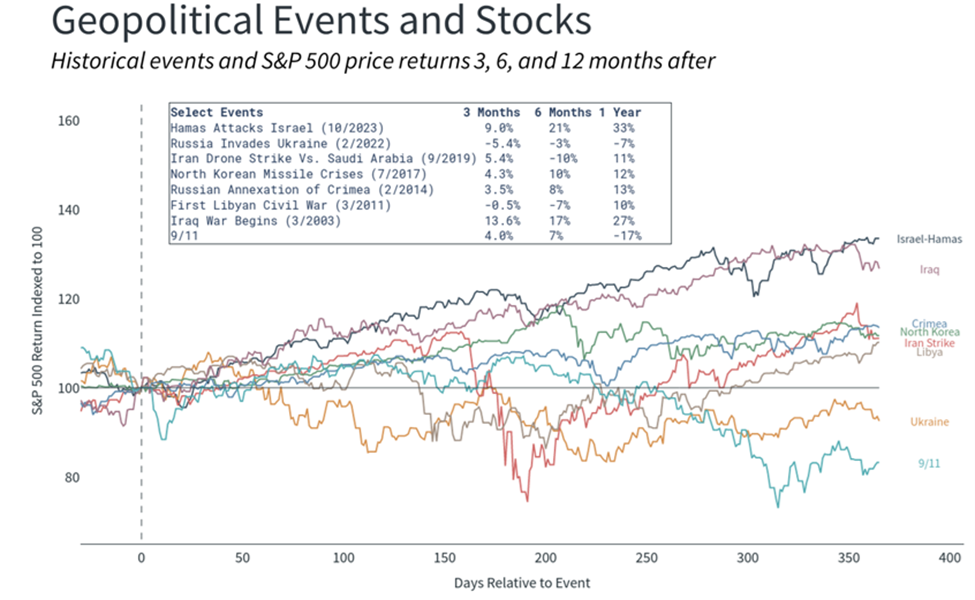

Perhaps the biggest concern for many investors is the risk that such conflicts could escalate into broader global warfare. While this outcome is always possible, recent history does not point in this direction. Instead, even serious conflicts, including Russia’s invasion of Ukraine, Hamas’s attack on Israel, and the war in Afghanistan, have largely remained contained, resulting in only short-term volatility in the stock market.

Sources: Clearnomics & Standard & Poor’s

It is easy to view every event as unique, with its own narrative, causes, and consequences. Yet, one can look for patterns and similarities between events to draw broad conclusions. As investors, both perspectives are important to understand what lessons do and do not apply.

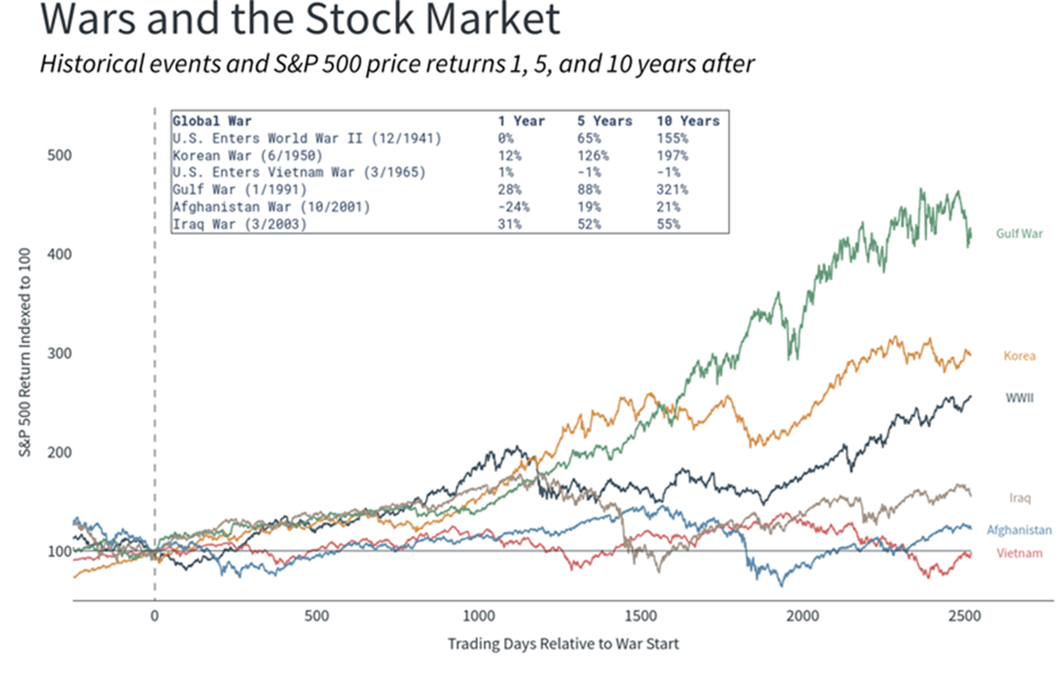

Sources: Clearnomics & Standard & Poor’s

These charts provide some historical perspectives around geopolitical events. These periods show that while there can be market swings in the short term, markets typically have recovered from geopolitical shocks, often within weeks or months of the initial event.

For investors worried about escalating conflicts around the world, zooming out can help provide perspective. From World War II to the Iraq War, markets may have reacted to these conflicts in the short run but were driven by investment fundamentals in the long run.

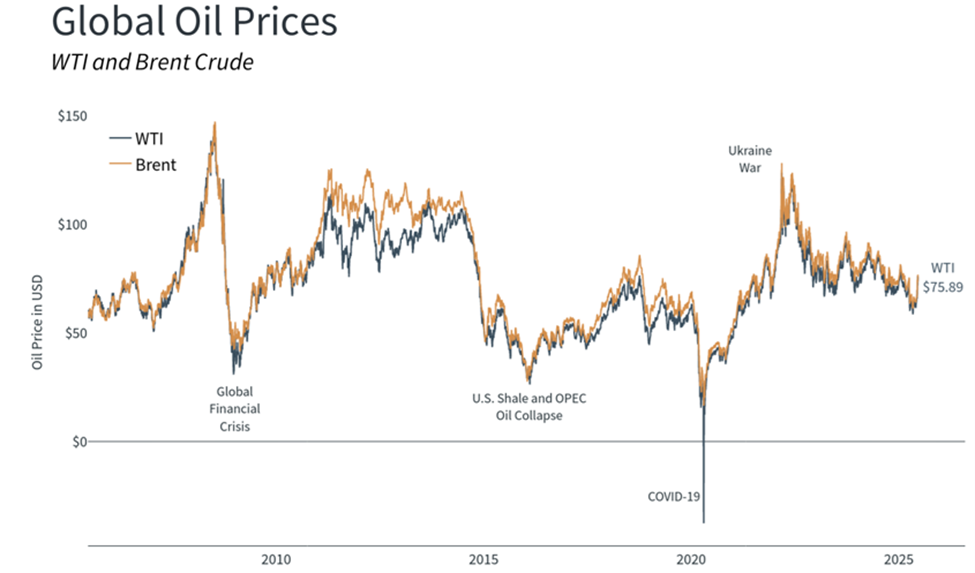

What about oil prices? Oil price volatility is the shortest-term view into how regional conflicts may impact the rest of the world. The immediate market reaction to the latest conflict focused on energy markets, with Brent crude futures rising above $74 per barrel, but have since eased back.

Sources: Clearnomics & LSEG. Latest price as of June 20, 2025

Oil prices affect the global economy since they are still a significant input into all products and services. This is compounded by the possible closure of the Strait of Hormuz in the Persian Gulf, a critical waterway through which approximately one-quarter of the world’s oil supply passes.

Even with the recent price swings, prices remain well below the peaks reached in 2022 during the early stages of the Russia-Ukraine conflict. As of this writing, oil is approximately $74 per barrel. Prices since mid-2021 have fluctuated between $60 and $120 per barrel.

The potential for a sustained oil price shock is different now vs. prior events. The U.S. has grown increasingly energy independent over the past two decades becoming the world’s largest producer of both oil and natural gas. While the U.S. still requires foreign oil and is sensitive to global oil prices, the fact that there is a significant domestic supply helps to insulate the U.S. economy and financial markets.

The impact of wars on portfolios

Again, none of this is to trivialize the humanitarian and societal consequences of these conflicts and wars. For the current situation, much will depend on whether the conflict expands further or begins to de-escalate. The involvement of major powers and threats to critical supply routes add complexity, but history suggests that even significant regional conflicts tend to have limited long-term impact on global financial markets.

While we can point to other times as precedents, the best precedent we have is our experience. We continue to advocate for patience, calm, and a long-term perspective in our investment strategy. Should the situation warrant, we will rebalance as we’ve done before—this year, in 2022, in 2020, and throughout past episodes of market volatility.

As always, we are here for your questions and concerns.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.