The Wall Street Journal recently published an article about “a new Wall Street trade powering gold and hitting currencies” and it’s been the talk of the town. “Debasement trade” may be a new term for many, but it refers to the purported reasons behind the recent astronomical rise in gold, up over 60% year to date, to a current price around $4,300.

If debasement isn’t where the holiday decorations are stored, then what is it? Monetary debasement describes the decline in the purchasing power of a currency, typically caused by an increase in the money supply without a corresponding increase in economic output. Current concerns among investors, including U.S. fiscal policy, rising debt-to-GDP, and a weakening U.S. dollar, are driving a flight to real assets like gold (as well as Bitcoin and other cryptocurrencies) as a hedge against inflation.

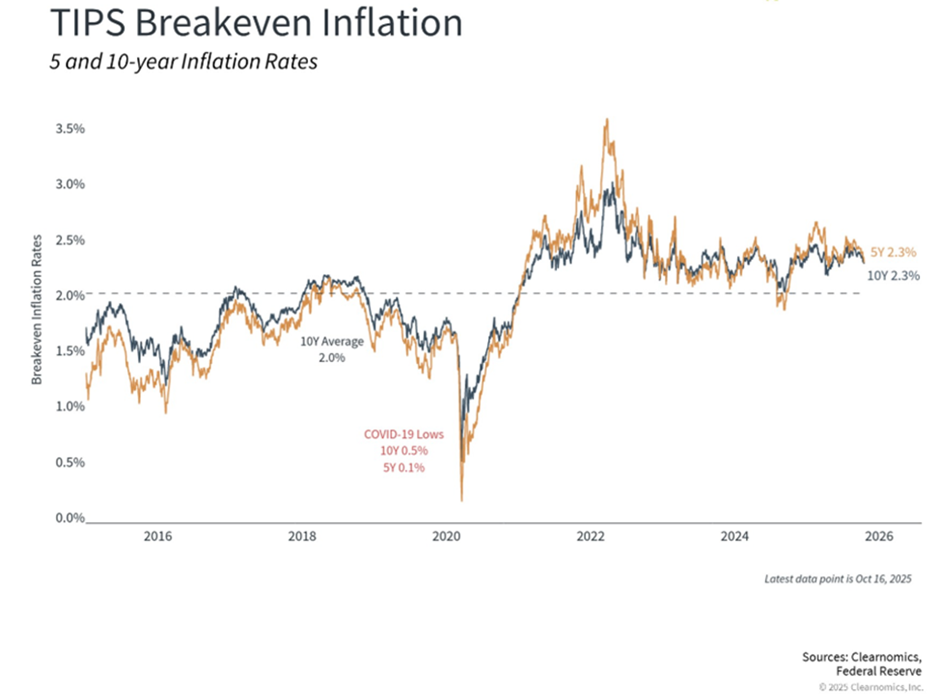

Interestingly, the bond market doesn’t seem to share those inflation fears. As seen in the chart below, the current 5- and 10-year Treasury Inflation Protection Securities (TIPS) breakeven inflation rates are 2.3%, which reflects the market’s expectation for average annual inflation over those time periods.

However, given the fact that the Fed has chosen to lower rates in the hopes of addressing weakness on the employment side of their dual mandate, the possibility remains that inflation could tick up. Is the debasement trade the answer?

We’ve expressed our views on gold as a portfolio asset as recently as March, 2025 in Investor Brief: Burnishing our Thoughts on Gold, and our analysis hasn’t wavered. As we noted, an effective inflation hedge should experience a volatility of returns that closely tracks changes in the Consumer Price Index (CPI). However, gold has experienced extreme price volatility since 1970 when compared with changes in the rate of inflation. Equities, TIPS, and real estate are elements of a well-diversified portfolio that have historically acted as more effective hedges against inflation. Physical gold may offer emotional reassurance, but it comes with opportunity costs and lacks income generation.

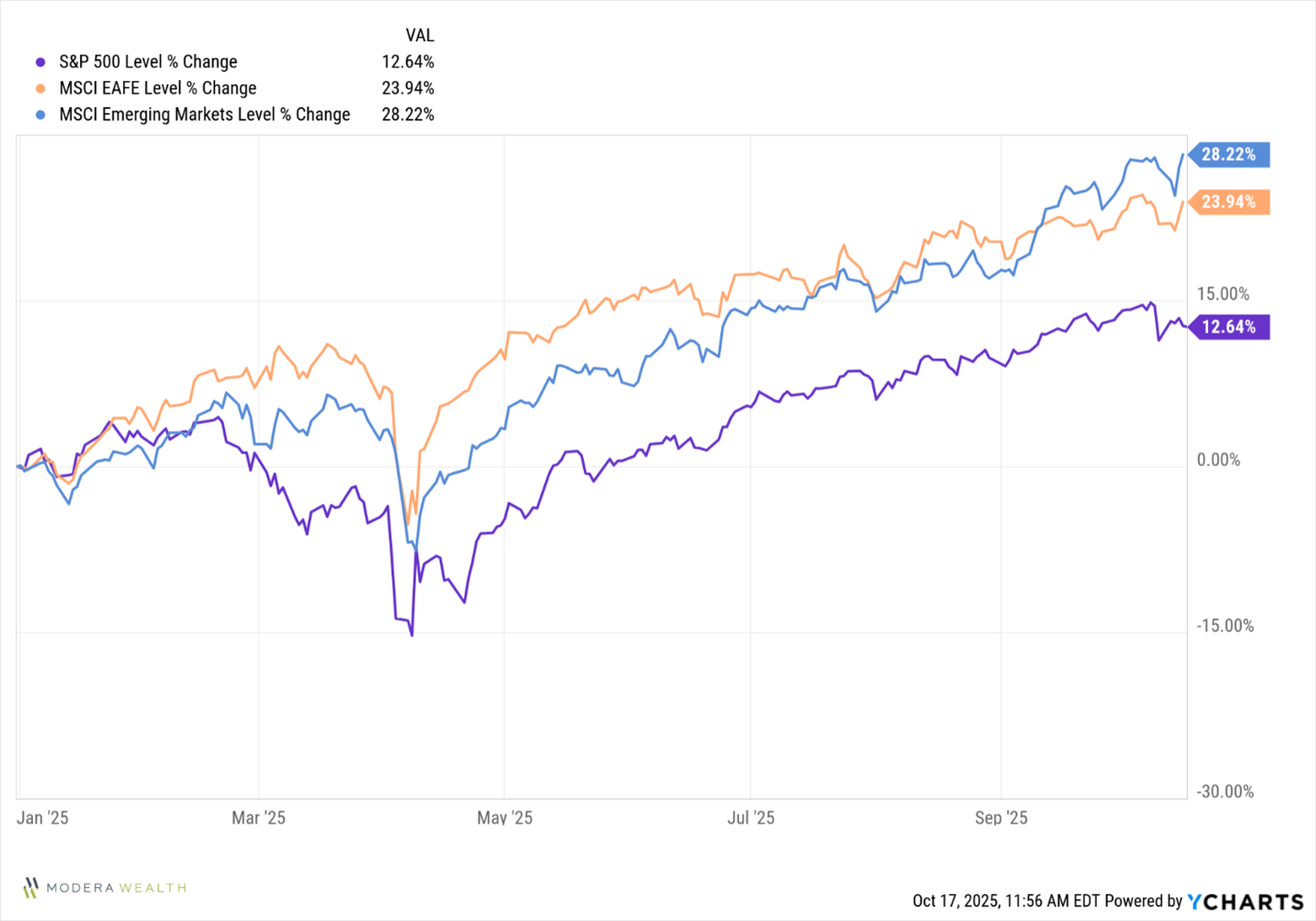

Another asset class that comes in clutch when the U.S. dollar weakens is international equities. So far in 2025, international developed and emerging markets equities (MSCI EAFE and MSCI Emerging) have outperformed U.S. equities (S&P 500) by over 10 percentage points. (see chart in the next section).

For further reading: Investor Brief: International Equities and the Case for Diversification (August 2025)

Our advice: fundamental investment principles still apply

Equities and fixed income are critical

Inflation is a material headwind to the returns of all assets over time, and equities could be one of the best ways to hedge that risk. They represent ownership in real assets and the earnings of businesses and have handily outpaced inflation over the long term.

Our fixed income strategy focuses on four key components: income, risk management, credit quality, and diversification. By holding a broad mix of bond types across sectors and the credit spectrum, we aim to manage risk and seize opportunity. This strategy can help mitigate the effects of inflation, interest rate shifts, and broader economic changes.

Diversification, now more than ever

Diversification isn’t just a buzzword, it’s an effective strategy. This year, international equities are leading U.S. equities reinforcing that principle (see chart below for source).

Avoid market timing

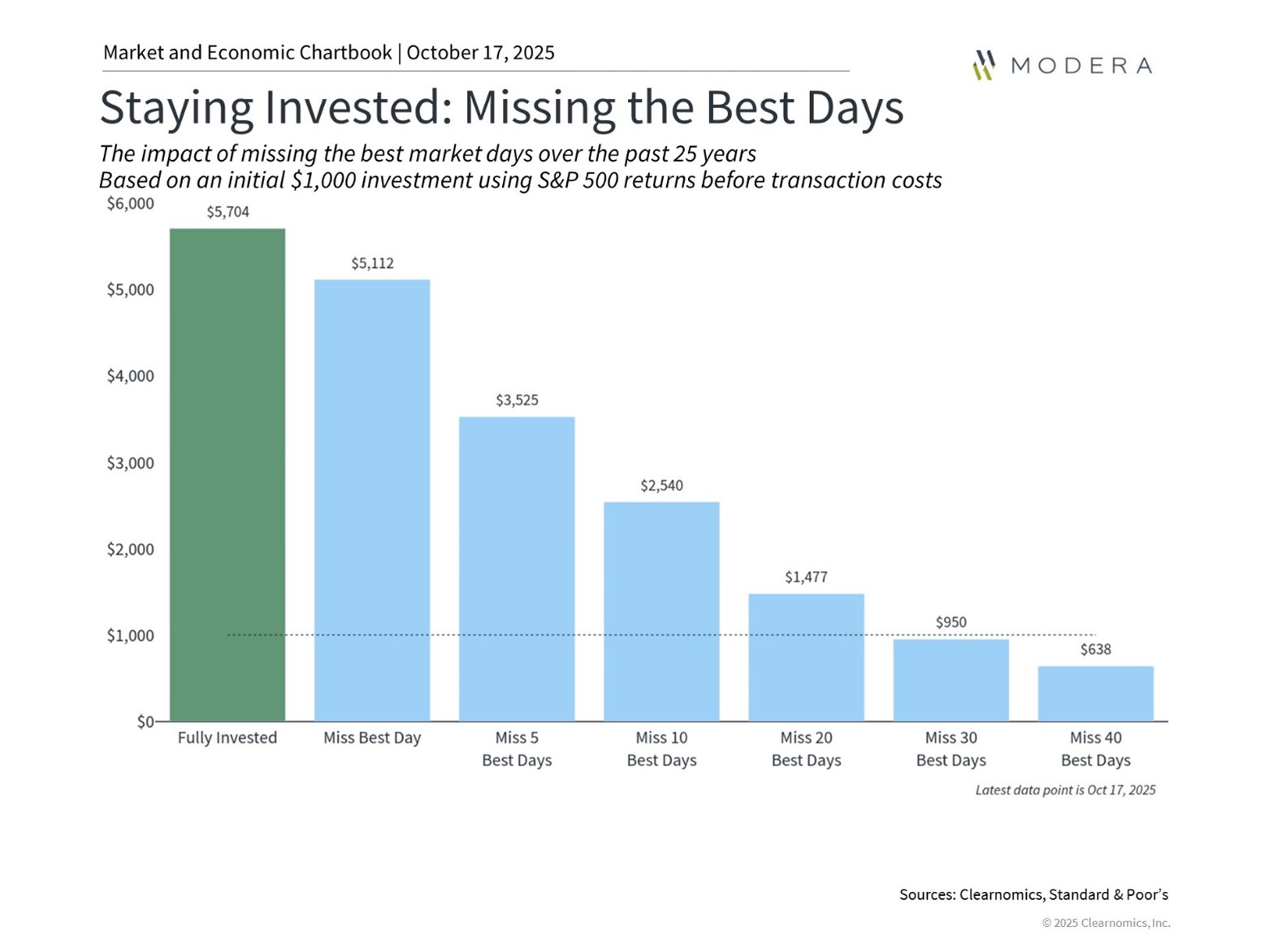

Not only is trying to time the market extremely difficult, but some believe it’s a trading mindset rather than an investing mindset. In the chart below, we see that $1,000 left fully invested in the S&P 500 would have grown to $5,704 over the last 25 years. Just missing the 5 best days over that same time period would have resulted in $3,525. Miss the best 20 and it’s down to $1,477. Many of the best days follow the worst days, so it’s important not to get rattled when markets vacillate.

A long-term focus, with flexibility

Stay agile, but focused. Pay attention to what can be controlled, like spending, taxes, diversification, and allocation, while acknowledging what cannot be controlled, like short-term market movements or political headlines. Remember that the objective of news media is engagement, which attracts advertising dollars. The catchier and more alarming the headline, the greater the engagement. It’s important to stay informed, but not to the detriment of your portfolio (or your mental health).

Get out of debasement and enjoy the sunshine.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

YCharts ©2025 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from the use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

MSCI data © MSCI 2025, all rights reserved.

S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.