Clearly 2025 has not started out the way most investors would have wanted. The stock market has stumbled with the S&P 500 declining year-to-date. While tariffs have garnered the most attention, investors are also concerned about mixed economic signals including weak consumer confidence, hotter inflation, government worker layoffs, and more.

Some are now wondering if there will be a recession, and President Trump did not rule out the possibility in recent interviews. How can investors maintain perspective in this challenging market and economic environment?

It’s important to remember that some investors and economists have been predicting a recession for nearly three years. Just a year ago, many believed a recession would be imminent due to inflation. Even academic indicators of recession, such as the “inverted yield curve” or the “Sahm Rule,” have not proven to be reliable this time around. Instead, not only has the economy grown steadily in the past few years, but markets have also performed well. Despite the current pullback, the S&P 500 has gained over 50% since the market bottom in October 2022.

Historically, recessions occur when the business cycle enters its later stages, or an external shock takes place, such as a pandemic or financial crisis. The current business cycle has shown signs of slowing but has not contracted just yet. Instead, a possible trade war represents an outside shock to consumers, businesses, and global supply chains. Additionally, slower growth—or even two consecutive quarters of negative growth—are quite different from situations like the 2008 global financial crisis or 2020 pandemic shutdown.

The administration has said there may be a period of short-term “turbulence” in the economy. Even if tariffs do not directly harm growth, they have created an environment of uncertainty. The administration has acted more swiftly with broad tariffs compared to President Trump’s first term, making the outcome harder to predict. Only time will tell if tariffs reach rates not seen since the 1930s, or if agreements with major trading partners will be reached.

It’s important to remember that tariffs are often used as a negotiating tactic for broader policy objectives. In the past, market reactions to tariff announcements were more dramatic than their actual economic impact. In 2018, the market fell as tariffs were implemented, but earnings growth was still strong, and GDP was almost 3% that year.

Of course, like a stopped clock that happens to be right twice a day, there will eventually be a recession. However, predicting the timing of economic downturns is difficult. Investing based on the assumption of an economic downturn can lead to suboptimal financial decisions, which is why it’s important to build portfolios that focus on long-term goals rather than near-term uncertainties.

While the thought of a recession can be unpleasant, it’s important to remember that periods of slower economic growth are a natural part of the business cycle. Forecasts are not always correct, and even when they are, markets do not always behave in expected ways. While the past is no guarantee of the future, the market declines and subsequent sharp recoveries in 2020 and 2022 are recent examples of situations where markets can quickly change their tune.

Similarly, short-term market pullbacks are a natural part of investing. Since WWII, the S&P 500 has fallen more than 15% in nine different quarters. Following every single instance, the index was higher a year later with an average one-year gain of 25.1%. Similarly, the S&P 500 has had two-quarter drops of 20%+ just eight times, and over the next year, the index was up by at least 17% with gains every single time.

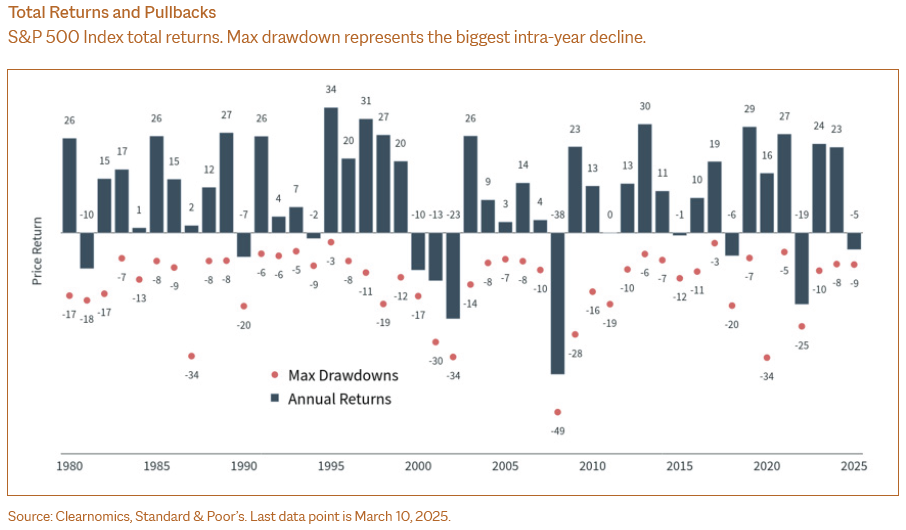

As the chart above shows, the S&P 500 experiences pullbacks on a regular basis, even as it has risen in the long run. It’s important to maintain a broader perspective amid heightened economic concerns.

What does this all mean for your portfolio and financial plan?

The markets are inherently volatile. Your plan is intended to account for periods of volatility. Stick to your plan. History has shown that investors who stay the course have recovered their losses. Don’t abandon your investment mix just because the markets are uncertain. If you want to achieve a return, you have to assume some level of risk. If there were no risk of potential loss, stocks would not be expected to earn a risk premium relative to safer asset classes such as bonds and cash. To generate gains you have to be willing to suffer losses. In fact, losses are a normal part of a properly functioning market. To quote Peter Lynch, the well-known portfolio manager of Fidelity’s Magellan Fund, “You need to know the market is going to go down sometimes. If you’re not ready for that, you shouldn’t own stocks.”

Often headlines can scare us into wanting to sell. If you sell when markets are down, you potentially lock in a loss that could be difficult from which to recover. It’s easy to think one can reinvest the money when the markets calm down, but it’s nearly impossible to know when that moment has arrived. There’s also a risk of waiting too long to get back into the markets and missing out on a gain. Today’s chatter about what the market may or may not do is difficult to act upon. Investors should focus on what they can control: one’s goals, asset allocation, costs and discipline to stick to a diversified portfolio and a sensible long-term investment plan.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.