A quarter century. Looking back at the early 2000s, it’s hard not to wonder how we survived Y2K without smartphones, AI, iPads, Netflix, Zoom calls, hybrid work environments, or electric cars? And when you consider how much has changed since then, it’s no wonder the past quarter century holds more significant moments than we can easily count.

There were many significant events in 2025 alone: wildfires in L.A., tariffs proposed, a Middle East cease-fire, a new Pope, tariffs lifted, Taylor Swift adding $5B to economic growth, an EU trade deal, interest rate cuts, Firefly Aerospace landing a spacecraft on the moon, Warren Buffett retiring. There are many economic moments illustrated on this teeny chart. For a larger version that won’t hurt your eyes, please let me know and I will send you a copy.

I am reminded of a quote from a favorite movie, “Field of Dreams.” In it, the character Doc Graham (played by Burt Lancaster) says, “We don’t recognize life’s most significant moments while they’re happening.”

While big moments may be easy to remember, the small moments can be significant, too. A thoughtful conversation, the glow of a summer sunset, the beauty of a garden walk, the laughter of a child, the crisp tartness of an apple, or the crunch of new-fallen snow underfoot. With that in mind, let’s turn to the defining investment moments of 2025, what we anticipate for 2026, and how we are addressing them in our investment strategy.

A Year That Defied Expectations

If there was a single word to describe 2025, it would be resilient. Investors went on quite a roller coaster ride last year —navigating changing interest rates, persistent inflation, geopolitical uncertainty, trade tensions, and a growing sense that markets, particularly U.S. equities, were priced too high.

The U.S. dollar declined, global trade relationships were strained, and questions arose about interest rates, artificial intelligence (AI), and tariffs. And yet, the economy and markets proved adaptable and resilient.

What Happened in 2025

Equity Markets Delivered Again

U.S. stocks rose to record highs, international markets outperformed, and bonds continued their rebound.

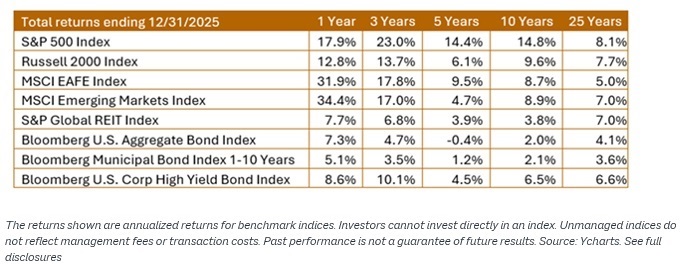

No one expected international equities to gain an impressive 31.9% total return for developed markets (as measured by the MSCI EAFE index) and a 34.4% total return for emerging markets (as measured by the MSCI Emerging Markets index).

International equities benefited from a weakening U.S. dollar (improving economic stability), supportive fiscal policies and better valuations. 2025 was a reminder that when market leadership rotates, it is often when least expected.

In the U.S., the S&P 500 gained 17.9%, marking three consecutive years of double-digit returns, while the Russell 2000 Small Cap index returned 12.8%, far higher than its long-term average.

Corporate earnings exceeded expectations, margins remained high, and productivity improvements, particularly from AI adoption, supported equities.

Bonds For Diversification

Bonds posted positive returns while continuing to serve their traditional role as portfolio stabilizers. The broad-based Bloomberg Aggregate Bond Index returned 7.3%, and high yield corporate bonds returned 8.6%. Although the Federal Reserve cut short-term interest rates by roughly 0.75%, longer-term yields did not decline as much. The 10-year Treasury yield ended the year at 4.17%, down from 4.57% at the start of the year as inflation expectations remained above the Fed’s 2% target.

Key takeaways:

It is a timeless truth that economic cycles rarely move in straight lines, and investment outcomes often surprise both optimists and skeptics.

2025 rewarded patience, diversification, and a willingness to look beyond the loudest headlines.

Don’t ignore the long-term. Despite everything we have experienced this quarter century, the 25-year annualized returns (see above) for equities, real estate, and bonds have been strongly positive.

The Economy Stayed Stronger Than Forecast

Many predicted economic problems in 2025. Tariff concerns were on investors’ radars in early 2025. The Fed did not cut rates as expected. Many worried about the impact of the One Big Beautiful Act (OBBBA). A slowdown seemed a given.

However, those predictions never fully materialized. In fact, U.S. Gross Domestic Product (GDP) surged 4.3% in the third quarter (the strongest reading in two years) driven by resilient consumer spending and renewed business capital spending.

According to the U.S. Bureau of Economic Analysis, consumer spending grew at a 3.5% annualized pace in the third quarter, significantly stronger than in the first half of the year. [1]That strength, however, masked a growing bifurcation. Higher-income households have led the way, while lower-income consumers face increasing pressure. That is something the Fed will be watching closely this year.

Artificial Intelligence: Exuberance Meets Reality

Artificial intelligence (AI) dominated headlines in 2025, drawing comparisons to the dot-com era. Massive capital spending in data centers, semiconductors, power infrastructure, and software became an important source of economic growth and market returns. Valuations in select AI-linked companies expanded rapidly, and market leadership became increasingly concentrated.

But 2025 was not the same as 2000. Many of today’s AI leaders generate real revenues, have strong cash flows, and operate within established business ecosystems. Productivity gains from AI are starting to show up in aggregate economic data. Corporate usage of AI is sure to evolve as more companies see productivity enhancements and efficiencies.

Key takeaway:

Avoid the hype of only focusing on AI and technology. While concerns about an AI bubble are valid, the right question is not whether a bubble exists, but where we are in the process. Alan Greenspan warned of “irrational exuberance” in 1996, yet markets rose for years before the dot-com peak. Bubbles unfold over years, not in one moment. Ultimately, the bubble is a process, not an event.

Late stages of an economic expansion may reward long-term investors who understand that transformational technologies can create enormous value.

Be watchful, skeptical, and realistic in 2026

Even though the economic outlook may be positive, a healthy dose of skepticism is fine, too. History reminds us that we should be disciplined amid the exuberance.

Valuations and Market Breadth

U.S. equity valuations are elevated by historical standards, particularly within the largest technology companies. The so-called “Magnificent Seven” trade at roughly 31 times earnings, compared to 22 times for the overall index and closer to 20 times for the remaining 493 stocks.[2]

This dispersion matters because sustained economic growth could reduce reliance on a narrow group of expensive technology leaders and allow performance to spread across smaller and overseas markets. If growth stumbles, expensive segments like technology could offer less margin for error, making them susceptible in a correction.

Federal Reserve Policy and Interest Rates

The Fed has entered a wait-and-see phase after initial rate cuts. While further easing is likely based on the appointment of the next Federal Reserve chair, no one should want interest rates to go to zero. That is unsustainable. Depending on the circumstances, ultra-low rates are an economic hindrance when unwound. Modestly lower rates, along with stable inflation, have supported housing, capital spending, and equities.

Fiscal Policy, Trade, and Politics

Trade and tariffs will remain recurring headlines in 2026. Ongoing negotiations with Canada, Mexico, China, and the European Union, along with potential Supreme Court rulings on tariff authority, will add layers of worry.

Further, the appointment of a new Fed Chair and the upcoming midterm elections are likely to continue the uncertainty with monetary and fiscal policy.

Earnings Growth Beyond Mega-Caps

Consensus expectations call for higher earnings growth from small-cap companies than from large-cap companies. That is noteworthy, especially as small caps trade at more reasonable valuations than large caps and could offer meaningful upside if growth holds and rates drift lower.

Economic Growth

Early in 2025, business spending slowed as companies took longer to commit to capital expenditures and reduced hiring plans.

Heading into 2026, though, businesses seem to be adjusting to, and working through, tariffs and other economic headwinds. Plus, oil prices are low, bond yields have come down, and the Fed is still considering even lower rates. Taken together, these factors may contribute to a favorable investment environment.

Portfolio Positioning and Long-Term Strategy: Our Call to Action

Predicting outcomes is futile. Preparing portfolios for a range of possibilities is not. Markets may always test our patience and 2025 reminded us that discipline is what truly drives long-term success.

As we enter 2026, we’re continuing to emphasize quality, profitability, and valuation in U.S. equities, where large-cap dominance remains historically wide. Within our current portfolio positioning, U. S. equities represent a larger allocation (approximately 68% U. S., 32% International). At the same time, international markets may offer diversification benefits, and in some cases, relatively attractive valuations.

Overall, our disciplined approach aims to balance opportunity and risk, positioning portfolios for resilience and long-term growth. Staying patient and focused remains key to navigating uncertainty.

Warren Buffett’s mentor, Benjamin Graham, said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” In other words, short-term fluctuations are driven by emotion and even headlines. Meanwhile, long-term growth relies on fundamentals like valuation, earnings, profitability, and cash flows.

Amid a confusing investment environment, the following principles remain core to our approach:

- Maintain broad diversification: Global exposure across asset classes, sectors, and regions remains the most effective way to balance opportunity and risk in an uncertain world.

- Rebalance and manage concentration: After several strong years for U.S. equities and mega-cap technology, rebalancing helps manage risk and maintain alignment with long-term objectives.

- Focus on quality and cash flow: Companies with strong balance sheets, durable business models, and consistent cash generation are better positioned to navigate volatility and deliver long-term value.

- Be selective, not speculative, especially with AI: AI is a powerful multi-year theme, but not every investment tied to it will succeed. Discipline and valuation awareness remain critical.

- Stay long-term oriented: Staying invested, patient, and disciplined remains an important part of a long term investment approach.

Rigidity in thinking is never a good thing. In his recent Thanksgiving Day letter to Berkshire Hathaway shareholders, Buffett offered this advice: “Don’t beat yourself up over past mistakes—learn at least a little from them and move on. It is never too late to improve.”

Investing rewards preparation, humility, and perspective. The road ahead will not be smooth, but the building blocks for long-term wealth creation remain firmly in place.

Our role is to position portfolios thoughtfully so clients can pursue their goals with confidence, regardless of what markets deliver next.

Closing Thought

While not making a prediction, I will note this: as good as technology may become, it will never replace human relationships full of friendship, family, and those significant moments that we all cherish.

“Field of Dreams” is about family and friendship. Thank you for the relationships we continue to build together and the trust and confidence you place in us.

Thank you, also, for reading this far. I look forward to seeing you in the year ahead. Wishing you many more significant moments in a joyful, healthy, happy New Year.

[1] https://www.bea.gov/news/2025/gross-domestic-product-3rd-quarter-2025-initial-estimate-and-corporate-profits

[2] https://www.capitalgroup.com/institutional/insights/articles/fresh-breadth-market-concentration-3-charts.html?utm_source=chatgpt.com

Avantis 2025 Year in Review Disclosures:

Consumer Price Index (CPI): Measures the average change over time in the prices paid by urban consumers for a fixed basket of goods and services. It reflects out-of-pocket spending by households on items such as food, clothing, shelter, and medical care.

Federal Reserve (Fed): The U.S. central bank responsible for monetary policies affecting the U.S. financial system and the economy.

Gross domestic product (GDP): Measures the total economic output in goods and services for an economy.

Personal Consumption Expenditures (PCE): Measures the average change in prices of goods and services consumed by individuals in the United States. It includes a broader range of expenditures, such as those made on behalf of households by non-profit institutions and government programs. The Federal Reserve prefers PCE for setting monetary policy because it provides a more comprehensive view of inflation and consumer behavior.

S&P 500® Index: A market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

Treasury yield: The effective annual interest rate that the U.S. government pays to borrow money through the issuance of its debt securities, such as Treasury bonds, notes, and bills. It is expressed as a percentage and represents the return investors can expect from holding these government securities until maturity.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any Avantis fund. This information is for an educational purpose only and is not intended to serve as investment advice. References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

YCharts ©2025 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from the use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Investment Commentary: Q4 2025 A Year In Review

George Padula, CFA®, CFP®

Chief Investment Officer, Wealth Manager & Principal

Can you believe 2025 is behind us?

A quarter century. Looking back at the early 2000s, it’s hard not to wonder how we survived Y2K without smartphones, AI, iPads, Netflix, Zoom calls, hybrid work environments, or electric cars? And when you consider how much has changed since then, it’s no wonder the past quarter century holds more significant moments than we can easily count.

There were many significant events in 2025 alone: wildfires in L.A., tariffs proposed, a Middle East cease-fire, a new Pope, tariffs lifted, Taylor Swift adding $5B to economic growth, an EU trade deal, interest rate cuts, Firefly Aerospace landing a spacecraft on the moon, Warren Buffett retiring. There are many economic moments illustrated on this teeny chart. For a larger version that won’t hurt your eyes, please let me know and I will send you a copy.

I am reminded of a quote from a favorite movie, “Field of Dreams.” In it, the character Doc Graham (played by Burt Lancaster) says, “We don’t recognize life’s most significant moments while they’re happening.”

While big moments may be easy to remember, the small moments can be significant, too. A thoughtful conversation, the glow of a summer sunset, the beauty of a garden walk, the laughter of a child, the crisp tartness of an apple, or the crunch of new-fallen snow underfoot. With that in mind, let’s turn to the defining investment moments of 2025, what we anticipate for 2026, and how we are addressing them in our investment strategy.

A Year That Defied Expectations

If there was a single word to describe 2025, it would be resilient. Investors went on quite a roller coaster ride last year —navigating changing interest rates, persistent inflation, geopolitical uncertainty, trade tensions, and a growing sense that markets, particularly U.S. equities, were priced too high.

The U.S. dollar declined, global trade relationships were strained, and questions arose about interest rates, artificial intelligence (AI), and tariffs. And yet, the economy and markets proved adaptable and resilient.

What Happened in 2025

Equity Markets Delivered Again

U.S. stocks rose to record highs, international markets outperformed, and bonds continued their rebound.

No one expected international equities to gain an impressive 31.9% total return for developed markets (as measured by the MSCI EAFE index) and a 34.4% total return for emerging markets (as measured by the MSCI Emerging Markets index).

International equities benefited from a weakening U.S. dollar (improving economic stability), supportive fiscal policies and better valuations. 2025 was a reminder that when market leadership rotates, it is often when least expected.

In the U.S., the S&P 500 gained 17.9%, marking three consecutive years of double-digit returns, while the Russell 2000 Small Cap index returned 12.8%, far higher than its long-term average.

Corporate earnings exceeded expectations, margins remained high, and productivity improvements, particularly from AI adoption, supported equities.

Bonds For Diversification

Bonds posted positive returns while continuing to serve their traditional role as portfolio stabilizers. The broad-based Bloomberg Aggregate Bond Index returned 7.3%, and high yield corporate bonds returned 8.6%. Although the Federal Reserve cut short-term interest rates by roughly 0.75%, longer-term yields did not decline as much. The 10-year Treasury yield ended the year at 4.17%, down from 4.57% at the start of the year as inflation expectations remained above the Fed’s 2% target.

Key takeaways:

It is a timeless truth that economic cycles rarely move in straight lines, and investment outcomes often surprise both optimists and skeptics.

2025 rewarded patience, diversification, and a willingness to look beyond the loudest headlines.

Don’t ignore the long-term. Despite everything we have experienced this quarter century, the 25-year annualized returns (see above) for equities, real estate, and bonds have been strongly positive.

The Economy Stayed Stronger Than Forecast

Many predicted economic problems in 2025. Tariff concerns were on investors’ radars in early 2025. The Fed did not cut rates as expected. Many worried about the impact of the One Big Beautiful Act (OBBBA). A slowdown seemed a given.

However, those predictions never fully materialized. In fact, U.S. Gross Domestic Product (GDP) surged 4.3% in the third quarter (the strongest reading in two years) driven by resilient consumer spending and renewed business capital spending.

According to the U.S. Bureau of Economic Analysis, consumer spending grew at a 3.5% annualized pace in the third quarter, significantly stronger than in the first half of the year. [1]That strength, however, masked a growing bifurcation. Higher-income households have led the way, while lower-income consumers face increasing pressure. That is something the Fed will be watching closely this year.

Artificial Intelligence: Exuberance Meets Reality

Artificial intelligence (AI) dominated headlines in 2025, drawing comparisons to the dot-com era. Massive capital spending in data centers, semiconductors, power infrastructure, and software became an important source of economic growth and market returns. Valuations in select AI-linked companies expanded rapidly, and market leadership became increasingly concentrated.

But 2025 was not the same as 2000. Many of today’s AI leaders generate real revenues, have strong cash flows, and operate within established business ecosystems. Productivity gains from AI are starting to show up in aggregate economic data. Corporate usage of AI is sure to evolve as more companies see productivity enhancements and efficiencies.

Key takeaway:

Avoid the hype of only focusing on AI and technology. While concerns about an AI bubble are valid, the right question is not whether a bubble exists, but where we are in the process. Alan Greenspan warned of “irrational exuberance” in 1996, yet markets rose for years before the dot-com peak. Bubbles unfold over years, not in one moment. Ultimately, the bubble is a process, not an event.

Late stages of an economic expansion may reward long-term investors who understand that transformational technologies can create enormous value.

Be watchful, skeptical, and realistic in 2026

Even though the economic outlook may be positive, a healthy dose of skepticism is fine, too. History reminds us that we should be disciplined amid the exuberance.

Valuations and Market Breadth

U.S. equity valuations are elevated by historical standards, particularly within the largest technology companies. The so-called “Magnificent Seven” trade at roughly 31 times earnings, compared to 22 times for the overall index and closer to 20 times for the remaining 493 stocks.[2]

This dispersion matters because sustained economic growth could reduce reliance on a narrow group of expensive technology leaders and allow performance to spread across smaller and overseas markets. If growth stumbles, expensive segments like technology could offer less margin for error, making them susceptible in a correction.

Federal Reserve Policy and Interest Rates

The Fed has entered a wait-and-see phase after initial rate cuts. While further easing is likely based on the appointment of the next Federal Reserve chair, no one should want interest rates to go to zero. That is unsustainable. Depending on the circumstances, ultra-low rates are an economic hindrance when unwound. Modestly lower rates, along with stable inflation, have supported housing, capital spending, and equities.

Fiscal Policy, Trade, and Politics

Trade and tariffs will remain recurring headlines in 2026. Ongoing negotiations with Canada, Mexico, China, and the European Union, along with potential Supreme Court rulings on tariff authority, will add layers of worry.

Further, the appointment of a new Fed Chair and the upcoming midterm elections are likely to continue the uncertainty with monetary and fiscal policy.

Earnings Growth Beyond Mega-Caps

Consensus expectations call for higher earnings growth from small-cap companies than from large-cap companies. That is noteworthy, especially as small caps trade at more reasonable valuations than large caps and could offer meaningful upside if growth holds and rates drift lower.

Economic Growth

Early in 2025, business spending slowed as companies took longer to commit to capital expenditures and reduced hiring plans.

Heading into 2026, though, businesses seem to be adjusting to, and working through, tariffs and other economic headwinds. Plus, oil prices are low, bond yields have come down, and the Fed is still considering even lower rates. Taken together, these factors may contribute to a favorable investment environment.

Portfolio Positioning and Long-Term Strategy: Our Call to Action

Predicting outcomes is futile. Preparing portfolios for a range of possibilities is not. Markets may always test our patience and 2025 reminded us that discipline is what truly drives long-term success.

As we enter 2026, we’re continuing to emphasize quality, profitability, and valuation in U.S. equities, where large-cap dominance remains historically wide. Within our current portfolio positioning, U. S. equities represent a larger allocation (approximately 68% U. S., 32% International). At the same time, international markets may offer diversification benefits, and in some cases, relatively attractive valuations.

Overall, our disciplined approach aims to balance opportunity and risk, positioning portfolios for resilience and long-term growth. Staying patient and focused remains key to navigating uncertainty.

Warren Buffett’s mentor, Benjamin Graham, said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” In other words, short-term fluctuations are driven by emotion and even headlines. Meanwhile, long-term growth relies on fundamentals like valuation, earnings, profitability, and cash flows.

Amid a confusing investment environment, the following principles remain core to our approach:

Rigidity in thinking is never a good thing. In his recent Thanksgiving Day letter to Berkshire Hathaway shareholders, Buffett offered this advice: “Don’t beat yourself up over past mistakes—learn at least a little from them and move on. It is never too late to improve.”

Investing rewards preparation, humility, and perspective. The road ahead will not be smooth, but the building blocks for long-term wealth creation remain firmly in place.

Our role is to position portfolios thoughtfully so clients can pursue their goals with confidence, regardless of what markets deliver next.

Closing Thought

While not making a prediction, I will note this: as good as technology may become, it will never replace human relationships full of friendship, family, and those significant moments that we all cherish.

“Field of Dreams” is about family and friendship. Thank you for the relationships we continue to build together and the trust and confidence you place in us.

Thank you, also, for reading this far. I look forward to seeing you in the year ahead. Wishing you many more significant moments in a joyful, healthy, happy New Year.

[1] https://www.bea.gov/news/2025/gross-domestic-product-3rd-quarter-2025-initial-estimate-and-corporate-profits

[2] https://www.capitalgroup.com/institutional/insights/articles/fresh-breadth-market-concentration-3-charts.html?utm_source=chatgpt.com

Avantis 2025 Year in Review Disclosures:

Consumer Price Index (CPI): Measures the average change over time in the prices paid by urban consumers for a fixed basket of goods and services. It reflects out-of-pocket spending by households on items such as food, clothing, shelter, and medical care.

Federal Reserve (Fed): The U.S. central bank responsible for monetary policies affecting the U.S. financial system and the economy.

Gross domestic product (GDP): Measures the total economic output in goods and services for an economy.

Personal Consumption Expenditures (PCE): Measures the average change in prices of goods and services consumed by individuals in the United States. It includes a broader range of expenditures, such as those made on behalf of households by non-profit institutions and government programs. The Federal Reserve prefers PCE for setting monetary policy because it provides a more comprehensive view of inflation and consumer behavior.

S&P 500® Index: A market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

Treasury yield: The effective annual interest rate that the U.S. government pays to borrow money through the issuance of its debt securities, such as Treasury bonds, notes, and bills. It is expressed as a percentage and represents the return investors can expect from holding these government securities until maturity.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any Avantis fund. This information is for an educational purpose only and is not intended to serve as investment advice. References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

YCharts ©2025 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from the use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Follow us on social:

Talk to an experienced financial planner

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.