Welcome to our Autumn Investment Commentary. I am always anxious about writing this time of year. It still brings back memories of that dreaded “What Did You Do Last Summer?” essay. So, here’s the quick version: summer was wonderful. One daughter got married, the other earned her master’s degree, landed a job, and moved into her own place. I, on the other hand, probably should’ve tackled more yard work and read a few more books. But that’s my summer in a nutshell—full of milestones, moments, and missed chores.

The world of investments did not take a summer vacation. Markets continued rising after the April tariff tantrum, supported by strong earnings, anticipated interest rate cuts, AI-driven tech optimism, and a weaker dollar. In many ways, it feels like the same story all over again—with new twists and familiar themes.

Speaking of stories, I’ve always admired great writers—and Jonathan Clements, former personal finance columnist for The Wall Street Journal, was among the very best. His writing was witty, personal, practical, concise, and consistently actionable. Although he recently passed away, his wisdom lives on in “The Best of Jonathan Clements: Timeless Advice for a Financial Life Well Lived”, which compiles over 70 of the 1,000+ columns he wrote. I have a few extra copies—let me know if you’d like one.

On topic for us this quarter: market updates, thoughts on AI and technological advances, bond investing amid lower rates, and timeless principles.

Before we dive in, consider this quote from professor Marvin Minsky, founder of MIT’s Artificial Intelligence Lab: “In from three to eight years we will have a machine with the general intelligence of an average human being.”

More on this later.

Markets Show Resilience Amid Shifting Conditions

Investors are facing conflicting signals: markets are hitting all-time highs, but labor markets are softening. Concerns about the economy and consumer health contrast with solid GDP growth and stable inflation.

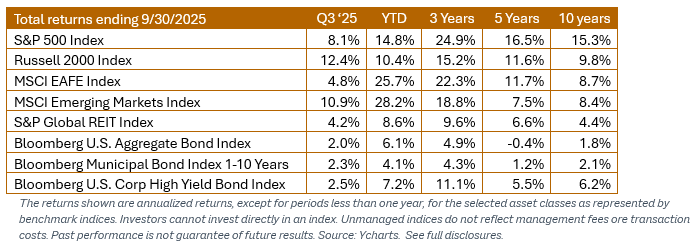

As of September 30, the S&P 500 has gained over 14% year-to-date, driven by easing geopolitical tensions, reduced tariff concerns, strong corporate earnings, and the Federal Reserve’s shift to a more accommodative stance. The AI sector remains a standout, although some analysts caution that the rally may be overextended, raising the risk of a correction if AI-driven expectations fall short.

The big story this year is the strong performance of international stocks. The MSCI EAFE Index of developed markets is up 25.7% year-to-date, while the MSCI Emerging Markets Index has gained 28.2%. If the year ended on September 30, EAFE’s outperformance versus the S&P 500 would be its best since 2006—and second best since 1993 (Source: YCharts). More on our thoughts about international investing: Investor Brief: International Equities and the Case for Diversification.

The Bloomberg U.S. Aggregate Bond Index is now up 6.1% year-to-date while the Bloomberg U.S. Corp High Yield Bond Index is up 7.2%.

Fed Policy Shifts as Economic Risks Evolve

The third quarter marked a meaningful shift in monetary policy. The Federal Reserve (Fed) cut its benchmark federal funds rate by 0.25%, setting a new target range of 4.00%–4.25%. While widely anticipated, the cut has acted as a tailwind for markets in recent months. The Fed is now attempting to balance stubborn inflation with signs of labor market weakness and has signaled the potential for further easing. According to the latest Federal Open Market Committee (FOMC) statement, the Fed “judges that downside risks to employment have risen.” Historically, rate cuts can support both stocks and bonds—assuming economic growth holds steady. Meanwhile, political pressure on the Fed has intensified, with the president’s public criticism of Chairman Jerome Powell raising concerns about the central bank’s independence. The increasing politicization of monetary policy introduces additional uncertainty that investors should watch carefully.

Why bonds now? Fixed Income in lower rate environment

With the Fed cutting interest rates, many ask: “Why buy bonds?” If you expect rates to decline, locking in higher yields now could make sense. But timing the market—whether equities or bonds—is extremely difficult. It’s the wrong framework. Trying to time the bond market is like predicting peak fall foliage: it always happens in autumn, but the exact day is only clear afterward. While some expect the Fed to continue reducing rates, the timing and extent of such reduction will only be known after announcements.

At Modera, our fixed income strategy focuses on four key components: income, risk management, credit quality, and diversification. We also take a total return approach to fixed income investing. By holding a diversified mix of bond types, including across the credit spectrum, we aim to manage risk and seize opportunity. This strategy can help mitigate the effects: inflation, interest rate shifts, and broader economic changes.

Shutdowns and Market Resilience

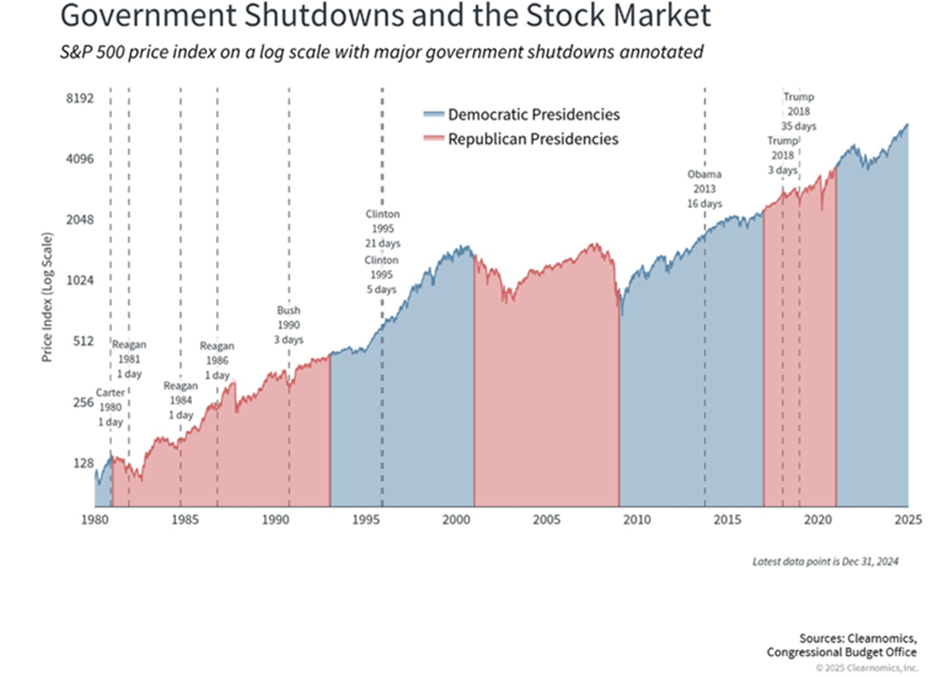

Government shutdowns have not historically posed lasting threats to markets or the broader economy. Still, Washington D.C. is back in the headlines as the federal government enters another shutdown, triggered by policymakers’ failure to reach a new funding agreement. This adds to the uncertainties driven by shifting government policies on trade, taxes, immigration, and more.

Shutdowns have occurred under presidents from both parties, and while the real impact on government workers is significant, markets have generally looked beyond the political gridlock. The accompanying chart shows that even during the most contentious shutdowns—including those in Reagan, Clinton, Obama and Trump administrations—markets remained resilient. Historically, shutdowns have acted as temporary disruptions, not lasting threats to economic growth or long-term investment performance.

Navigating the Noise: Technology, Trends, and Timeless Principles

Artificial intelligence has remarkable capabilities and enormous potential—but caution is warranted. That quote from Marvin Minsky? It’s from a 1970 Life Magazine interview. He called it both a hopeful outlook and a warning against becoming too entranced by technological progress.

Why not just go with anything that has AI in the name? Recall that in the early 2000s, anything with a .com suffix was the next great thing. Who still has a PalmPilot, or those AOL disks offering 100 hours of internet access? WorldCom, the telecom company at the cutting edge of fiber optics is long gone. Netscape, Sun Microsystems, Inktomi, Kodak, Polaroid, Nortel, and Webvan are no longer, as well.

Minksy essentially said we shouldn’t let AI control us. Likewise, we shouldn’t let markets control us or dictate our emotions—or fool ourselves into thinking we can predict or control market outcomes. There is no crystal ball with investing.

Staying the Course with Confidence

As we wrap up this quarter’s commentary, we’re reminded that just as summer gives way to autumn, markets too move through cycles—shaped by innovation, policy, and investor sentiment. While we continually update, adapt, and refine our strategies, the core principles of investing remain steady. Diversification, discipline, and a long-term perspective are not just ideas—they’re proven strategies that help investors stay grounded amid change. This year, international equities are leading U.S. equities, corporate bonds are ahead of Treasurys, and real estate and small caps both have strong, postive returns, reinforcing that principle.

It is important to understand that we believe that markets work. Patient investors know that a long-term perspective may lead to long-term returns. In times of change—whether driven by technology, policy, or market cycles—it’s easy to get swept up in the noise. But long-term investing is about clarity, discipline, and adaptability.

Our focus remains on what can be controlled—spending, taxes, diversification, and allocation—while acknowledging what cannot be controlled, like short-term market movements or political headlines. Markets will always surprise us. However, with a thoughtful strategy, a steady hand, and a long-term perspective, we can help you navigate uncertainty with confidence and your long-term goals in mind.

As always, thank you for your trust and confidence in us and our services. We’re here to guide you through every season of the market.

YCharts ©2025 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from the use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Bloomberg data provided by Bloomberg. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the FTSE and Russell Indexes. MSCI data © MSCI 2025, all rights reserved. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Investment Commentary: Q3 2025

George Padula, CFA®, CFP®

Chief Investment Officer, Wealth Manager & Principal

Market Shifts and Timeless Strategies

Welcome to our Autumn Investment Commentary. I am always anxious about writing this time of year. It still brings back memories of that dreaded “What Did You Do Last Summer?” essay. So, here’s the quick version: summer was wonderful. One daughter got married, the other earned her master’s degree, landed a job, and moved into her own place. I, on the other hand, probably should’ve tackled more yard work and read a few more books. But that’s my summer in a nutshell—full of milestones, moments, and missed chores.

The world of investments did not take a summer vacation. Markets continued rising after the April tariff tantrum, supported by strong earnings, anticipated interest rate cuts, AI-driven tech optimism, and a weaker dollar. In many ways, it feels like the same story all over again—with new twists and familiar themes.

Speaking of stories, I’ve always admired great writers—and Jonathan Clements, former personal finance columnist for The Wall Street Journal, was among the very best. His writing was witty, personal, practical, concise, and consistently actionable. Although he recently passed away, his wisdom lives on in “The Best of Jonathan Clements: Timeless Advice for a Financial Life Well Lived”, which compiles over 70 of the 1,000+ columns he wrote. I have a few extra copies—let me know if you’d like one.

On topic for us this quarter: market updates, thoughts on AI and technological advances, bond investing amid lower rates, and timeless principles.

Before we dive in, consider this quote from professor Marvin Minsky, founder of MIT’s Artificial Intelligence Lab: “In from three to eight years we will have a machine with the general intelligence of an average human being.”

More on this later.

Markets Show Resilience Amid Shifting Conditions

Investors are facing conflicting signals: markets are hitting all-time highs, but labor markets are softening. Concerns about the economy and consumer health contrast with solid GDP growth and stable inflation.

As of September 30, the S&P 500 has gained over 14% year-to-date, driven by easing geopolitical tensions, reduced tariff concerns, strong corporate earnings, and the Federal Reserve’s shift to a more accommodative stance. The AI sector remains a standout, although some analysts caution that the rally may be overextended, raising the risk of a correction if AI-driven expectations fall short.

The big story this year is the strong performance of international stocks. The MSCI EAFE Index of developed markets is up 25.7% year-to-date, while the MSCI Emerging Markets Index has gained 28.2%. If the year ended on September 30, EAFE’s outperformance versus the S&P 500 would be its best since 2006—and second best since 1993 (Source: YCharts). More on our thoughts about international investing: Investor Brief: International Equities and the Case for Diversification.

The Bloomberg U.S. Aggregate Bond Index is now up 6.1% year-to-date while the Bloomberg U.S. Corp High Yield Bond Index is up 7.2%.

Fed Policy Shifts as Economic Risks Evolve

The third quarter marked a meaningful shift in monetary policy. The Federal Reserve (Fed) cut its benchmark federal funds rate by 0.25%, setting a new target range of 4.00%–4.25%. While widely anticipated, the cut has acted as a tailwind for markets in recent months. The Fed is now attempting to balance stubborn inflation with signs of labor market weakness and has signaled the potential for further easing. According to the latest Federal Open Market Committee (FOMC) statement, the Fed “judges that downside risks to employment have risen.” Historically, rate cuts can support both stocks and bonds—assuming economic growth holds steady. Meanwhile, political pressure on the Fed has intensified, with the president’s public criticism of Chairman Jerome Powell raising concerns about the central bank’s independence. The increasing politicization of monetary policy introduces additional uncertainty that investors should watch carefully.

Why bonds now? Fixed Income in lower rate environment

With the Fed cutting interest rates, many ask: “Why buy bonds?” If you expect rates to decline, locking in higher yields now could make sense. But timing the market—whether equities or bonds—is extremely difficult. It’s the wrong framework. Trying to time the bond market is like predicting peak fall foliage: it always happens in autumn, but the exact day is only clear afterward. While some expect the Fed to continue reducing rates, the timing and extent of such reduction will only be known after announcements.

At Modera, our fixed income strategy focuses on four key components: income, risk management, credit quality, and diversification. We also take a total return approach to fixed income investing. By holding a diversified mix of bond types, including across the credit spectrum, we aim to manage risk and seize opportunity. This strategy can help mitigate the effects: inflation, interest rate shifts, and broader economic changes.

Shutdowns and Market Resilience

Government shutdowns have not historically posed lasting threats to markets or the broader economy. Still, Washington D.C. is back in the headlines as the federal government enters another shutdown, triggered by policymakers’ failure to reach a new funding agreement. This adds to the uncertainties driven by shifting government policies on trade, taxes, immigration, and more.

Shutdowns have occurred under presidents from both parties, and while the real impact on government workers is significant, markets have generally looked beyond the political gridlock. The accompanying chart shows that even during the most contentious shutdowns—including those in Reagan, Clinton, Obama and Trump administrations—markets remained resilient. Historically, shutdowns have acted as temporary disruptions, not lasting threats to economic growth or long-term investment performance.

Navigating the Noise: Technology, Trends, and Timeless Principles

Artificial intelligence has remarkable capabilities and enormous potential—but caution is warranted. That quote from Marvin Minsky? It’s from a 1970 Life Magazine interview. He called it both a hopeful outlook and a warning against becoming too entranced by technological progress.

Why not just go with anything that has AI in the name? Recall that in the early 2000s, anything with a .com suffix was the next great thing. Who still has a PalmPilot, or those AOL disks offering 100 hours of internet access? WorldCom, the telecom company at the cutting edge of fiber optics is long gone. Netscape, Sun Microsystems, Inktomi, Kodak, Polaroid, Nortel, and Webvan are no longer, as well.

Minksy essentially said we shouldn’t let AI control us. Likewise, we shouldn’t let markets control us or dictate our emotions—or fool ourselves into thinking we can predict or control market outcomes. There is no crystal ball with investing.

Staying the Course with Confidence

As we wrap up this quarter’s commentary, we’re reminded that just as summer gives way to autumn, markets too move through cycles—shaped by innovation, policy, and investor sentiment. While we continually update, adapt, and refine our strategies, the core principles of investing remain steady. Diversification, discipline, and a long-term perspective are not just ideas—they’re proven strategies that help investors stay grounded amid change. This year, international equities are leading U.S. equities, corporate bonds are ahead of Treasurys, and real estate and small caps both have strong, postive returns, reinforcing that principle.

It is important to understand that we believe that markets work. Patient investors know that a long-term perspective may lead to long-term returns. In times of change—whether driven by technology, policy, or market cycles—it’s easy to get swept up in the noise. But long-term investing is about clarity, discipline, and adaptability.

Our focus remains on what can be controlled—spending, taxes, diversification, and allocation—while acknowledging what cannot be controlled, like short-term market movements or political headlines. Markets will always surprise us. However, with a thoughtful strategy, a steady hand, and a long-term perspective, we can help you navigate uncertainty with confidence and your long-term goals in mind.

As always, thank you for your trust and confidence in us and our services. We’re here to guide you through every season of the market.

YCharts ©2025 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from the use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Bloomberg data provided by Bloomberg. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the FTSE and Russell Indexes. MSCI data © MSCI 2025, all rights reserved. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Follow us on social:

Talk to an experienced financial planner

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.