In my role as CIO, I frequently visit Modera offices to meet with clients and colleagues. On a recent trip, I drove from Charlotte to Asheville, and the weather was terrible—dark, rainy, pea soup fog—and the road was unfamiliar. The lane markings were hard to see, and uncertain conditions made me have to proceed with caution to stay on track. Drawing from my experience as a long-time New England driver, I slowed down and relied on GPS to guide me safely to my destination.

I share this story because President Trump’s tariff announcement has seemed similarly unclear and foggy, and many of us have been feeling uncertain and worried about what this could mean for the economy. In times like these, we must use our experience and long-term investment principles—our portfolio GPS—to navigate uncertain markets. We don’t manage portfolios by reacting like windshield wipers swishing back and forth. Nor do we barrel forward without considering risks. Instead, we stay deliberate and focused on the long-term road ahead.

Market uncertainty is uncomfortable, and the first quarter reminds us of the importance of a balanced portfolio. Just as I used GPS the other night, diversification serves as your investment GPS, reducing risk and uncertainty.

Let’s explore what this means for investors and how we approach portfolio management for you.

The base announcement

The scope of the president’s tariff announcement surprised investors. He introduced a 10% baseline tariff on all U.S. imports, with higher tariffs for countries where the U.S. has large trade deficits: 20% on EU goods, 46% on Vietnam, 24% on Japan, and 26% on India. Imports from China, already facing a 20% tariff, were to incur an additional 34%, bringing the total to 54%. As of this writing, the tariff is 104% in total.

Note: All of these figures are current as of the morning of April 9, 2025. Developments are occurring frequently, and we will continue to provide updated analysis as the situation evolves.

However, there are some positives. Certain products like autos, steel, aluminum, pharmaceuticals, and chips may not face higher tariffs for now. There were supposed to be carve-outs for USMCA-compliant goods, with tariffs potentially dropping if progress is made on border security and fentanyl traffic. This is significant given the strong supply chain ties between the U.S., Canada, and Mexico.

Most countries have responded cautiously, hoping for a reconsideration. JPMorgan’s David Kelly estimates that “economywide prices would be boosted by 1.3%.”1 The true impact on consumers is uncertain, and businesses may hesitate to hire, invest, or purchase inventory.

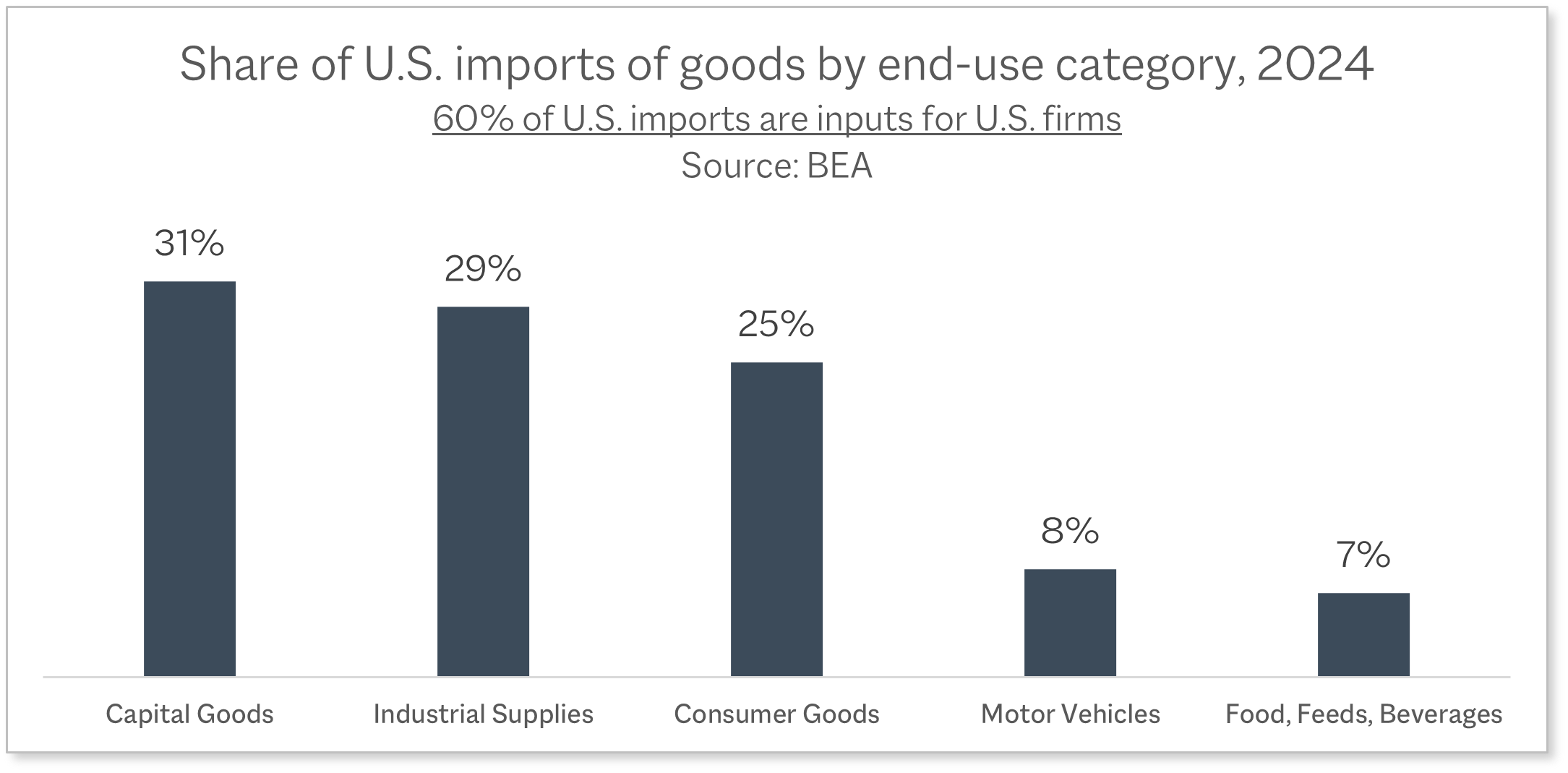

In 2024, U.S. imports totaled about $4 trillion, up from $3.5 trillion in 2021, while exports remained flat over the last 3 years. Of the $3.3 trillion in goods imported, 60% were used as inputs by U.S. firms.

The goal of the tariffs was to reduce foreign purchases, narrow the trade deficit, and decrease demand for foreign currency.2 However, two concerns have emerged: a potential trade war that could slow global growth and higher prices for goods and services, leading to inflation and reduced spending. The bumpy rollout could also hinder corporate investment and onshoring.

Consumer sentiment is cautious, companies may lower earnings estimates, credit spreads are widening, and Treasury yields have dropped as investors seek safer assets. These factors point more to a slowdown than a full recession.

In response, the Federal Reserve may cut interest rates sooner than expected. The president has left the door open for negotiations if other countries address trade imbalances and align with the U.S. on key economic and security issues. Additionally, tax cut discussions may mitigate the impact of these tariffs. The true effects of the tariffs will take time to fully understand.

What does this mean for us?

The focus must be on the fundamentals of investing: diversification, rebalancing, and ensuring asset allocation is across multiple investment types.

What is the wrong thing to do at a time like this? What are we doing now as far as building a portfolio to help protect it from any potential tariff fallout?

Making rash decisions based on emotion and short-term issues is a clear mistake. Volatile markets require both Modern Portfolio Therapy and Modern Portfolio Theory. I fully understand that the present may seem risky. Recall though, that it was just weeks ago when some feared investing at the “top of the market.” Now, there’s an opportunity to invest at lower prices.

History shows that maintaining a long-term approach is one of the most effective strategies for navigating market volatility.

Market pullbacks occur on a regular basis. Since 1980, the S&P 500 on average:

- Has dropped at least 5% roughly 5 times a year.

- Has dropped 10% about once per year.

- Has dropped 25% or more only 6-8 times, depending on how you measure. That’s once every 6 years

Risk does not equate to uncertainty. Risk can be measured and is somewhat predictable, while uncertainty is unpredictable. Markets dislike uncertainty because it complicates risk assessment and asset price determination.

Diversification remains a fundamental tenet for portfolios. Since predicting short-term outcomes is nearly impossible, why not own a broad range of asset classes—U.S. and international large and small cap, real estate, and fixed income? Investing is not about picking one asset class or reacting to daily headlines. It’s about achieving long-term financial goals over years and decades.

Over the last 25 years—scratch that—over the last century, markets have faced global economic shifts, including wars, recessions, bubbles, pandemics, political changes, and technological revolutions. Throughout, diversification has helped manage risks while maintaining a long-term focus.

Review of Q1

- In Q1, the S&P 500 declined 4.3% while the Nasdaq fell slightly more than 10%. This was the first negative quarter since Q3, 2023.

- Q1 was one of the best relative returns for international equities in decades. Developed market international stocks (MSCI EAFE) gained 7.0 % and emerging market stocks (MSCI EM) increased 3.0% in the quarter.

- Value outperformed growth, both in large cap and small cap asset classes.

- Meanwhile, the Bloomberg U.S. Aggregate Bond index gained 2.8%.

- The end of Q1 marked five years since the March 2020 lows due to Covid. Since then, most equity asset classes are up double-digits annualized.

The market’s direction will depend on corporate earnings and economic performance, especially once there’s more clarity. Fortunately, S&P 500 earnings-per-share growth remains strong, even with increased costs from tariffs, indicating strong fundamentals despite trade concerns.

Bonds play a key role in these conditions, offsetting stock pullbacks. When interest rates fall, bond prices rise, as existing bonds with higher yields become more valuable, supporting bonds and balanced portfolios when equities struggle.

The Federal Reserve and interest rates

Federal Reserve Chairman Powell has acknowledged the uncertain effects of tariffs and other policies on inflation and economic growth. With limited visibility into trade policy outcomes, the Fed’s March Summary of Economic Projections forecast 1.7% GDP growth for 2025, below 2% for the first time since 2022. Investors expect persistent inflation despite a strong job market, leading to consensus forecasts of 3-4 rate cuts in 2025.

Consumer sentiment

All these factors are affecting consumer sentiment, and it’s understandable that many households are worried about higher prices after recent inflation. But surprisingly, consumer spending is still holding up pretty well. The strong job market, with unemployment at just 4.1%, and wages continuing to rise (even after accounting for inflation) are helping households stay financially stable. Of course, this isn’t true for everyone, but many are still in solid financial shape.

Why do we emphasize a long-term approach?

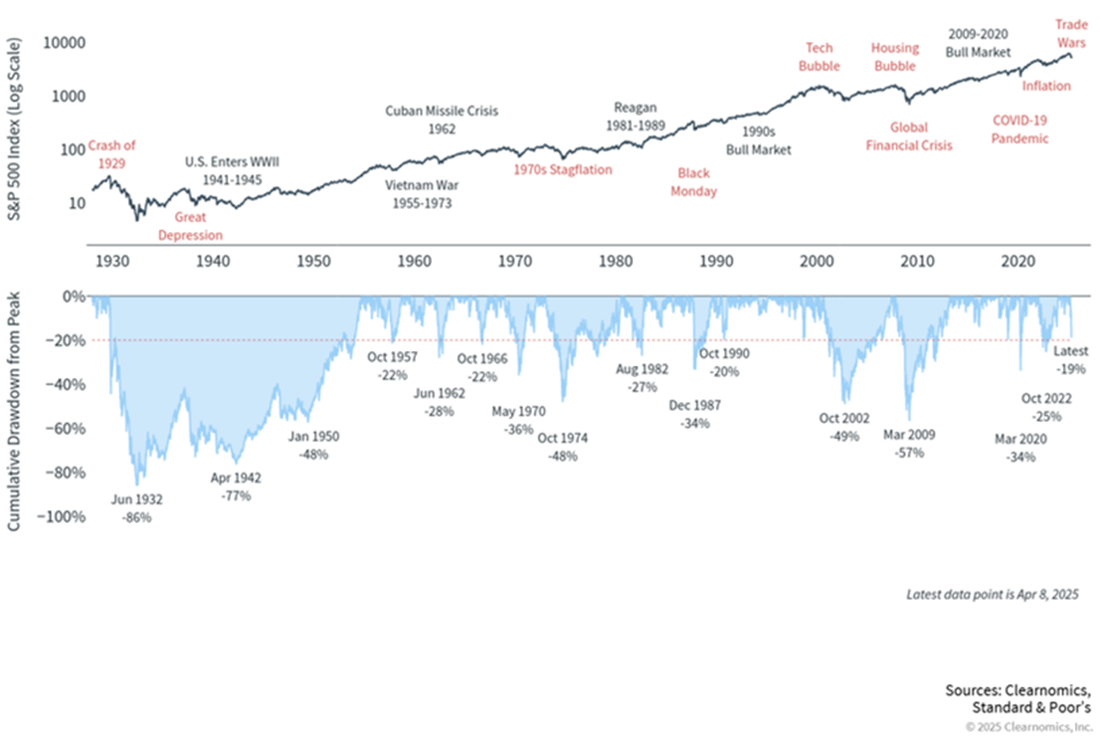

Markets operate in long cycles, and we may face more downturns before things turn around. But when they do, you’ll want to be invested. Drawdowns in equity markets are part of the process. While each downturn may feel unique due to different causes, they’re a feature, not a bug. Strong equity returns come with volatility. Eventually, we’ll see new all-time highs and perhaps 30% declines—just don’t ask which will come first.

While there will always be reasons to sell, remember, stocks represent businesses that grow, invest, and return value to shareholders. Despite the many bumps along the way, the evidence overwhelmingly supports staying the course through tough times.

Stock Market Drawdowns Since 1928

S&P 500 Index price returns (top) and drawdowns from prior peak (bottom)

Two quotes to end on

David Booth, founder and chairman of Dimensional Fund Advisors, recently wrote in a Financial Times article:

“[H]istory shows us that markets have overcome every previous ‘unprecedented’ challenge. The Great Depression, world wars, the inflation crisis of the 1970s, Black Monday in 1987, the Great Recession of 2008… Each crisis can feel like the end of the world when it happens, yet the pattern of recovery stays remarkably consistent. Over 50 years of working in finance has consistently shown me two things: We cannot predict the future, but despite that uncertainty, markets have eventually bounced back.”3

In 2008, during the middle of the global financial crisis, Warren Buffet stated,

“In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”4

These quotes help illustrate why keeping a long-term perspective is key to staying on track.

Much like relying on GPS to navigate through unfamiliar roads and challenging weather, navigating uncertain market conditions requires a steady, thoughtful approach. In both cases, having a clear strategy and focusing on long-term goals helps you stay on course. Diversification and a disciplined investment strategy serve as your guide, helping you manage volatility and stay focused on the road ahead.

As your advisors, we’re here to educate and empower you, to help you make informed decisions. A strong financial strategy goes beyond investing—it’s about tax planning, risk management, rebalancing, cash flow, charitable giving, and estate planning, too.

Thank you for taking the time to read this, and as always, thank you for the trust and confidence you place in us and our services. We truly appreciate it.

Investment Commentary: Q1 2025

George Padula, CFA®, CFP®

Chief Investment Officer, Wealth Manager & Principal

As spring begins, so does a season of renewal and growth. The first quarter of 2025 certainly roared in like a lion, with tariffs and trade dominating the spotlight.

In my role as CIO, I frequently visit Modera offices to meet with clients and colleagues. On a recent trip, I drove from Charlotte to Asheville, and the weather was terrible—dark, rainy, pea soup fog—and the road was unfamiliar. The lane markings were hard to see, and uncertain conditions made me have to proceed with caution to stay on track. Drawing from my experience as a long-time New England driver, I slowed down and relied on GPS to guide me safely to my destination.

I share this story because President Trump’s tariff announcement has seemed similarly unclear and foggy, and many of us have been feeling uncertain and worried about what this could mean for the economy. In times like these, we must use our experience and long-term investment principles—our portfolio GPS—to navigate uncertain markets. We don’t manage portfolios by reacting like windshield wipers swishing back and forth. Nor do we barrel forward without considering risks. Instead, we stay deliberate and focused on the long-term road ahead.

Market uncertainty is uncomfortable, and the first quarter reminds us of the importance of a balanced portfolio. Just as I used GPS the other night, diversification serves as your investment GPS, reducing risk and uncertainty.

Let’s explore what this means for investors and how we approach portfolio management for you.

The base announcement

The scope of the president’s tariff announcement surprised investors. He introduced a 10% baseline tariff on all U.S. imports, with higher tariffs for countries where the U.S. has large trade deficits: 20% on EU goods, 46% on Vietnam, 24% on Japan, and 26% on India. Imports from China, already facing a 20% tariff, were to incur an additional 34%, bringing the total to 54%. As of this writing, the tariff is 104% in total.

Note: All of these figures are current as of the morning of April 9, 2025. Developments are occurring frequently, and we will continue to provide updated analysis as the situation evolves.

However, there are some positives. Certain products like autos, steel, aluminum, pharmaceuticals, and chips may not face higher tariffs for now. There were supposed to be carve-outs for USMCA-compliant goods, with tariffs potentially dropping if progress is made on border security and fentanyl traffic. This is significant given the strong supply chain ties between the U.S., Canada, and Mexico.

Most countries have responded cautiously, hoping for a reconsideration. JPMorgan’s David Kelly estimates that “economywide prices would be boosted by 1.3%.”1 The true impact on consumers is uncertain, and businesses may hesitate to hire, invest, or purchase inventory.

In 2024, U.S. imports totaled about $4 trillion, up from $3.5 trillion in 2021, while exports remained flat over the last 3 years. Of the $3.3 trillion in goods imported, 60% were used as inputs by U.S. firms.

Source: BEA

The goal of the tariffs was to reduce foreign purchases, narrow the trade deficit, and decrease demand for foreign currency.2 However, two concerns have emerged: a potential trade war that could slow global growth and higher prices for goods and services, leading to inflation and reduced spending. The bumpy rollout could also hinder corporate investment and onshoring.

Consumer sentiment is cautious, companies may lower earnings estimates, credit spreads are widening, and Treasury yields have dropped as investors seek safer assets. These factors point more to a slowdown than a full recession.

In response, the Federal Reserve may cut interest rates sooner than expected. The president has left the door open for negotiations if other countries address trade imbalances and align with the U.S. on key economic and security issues. Additionally, tax cut discussions may mitigate the impact of these tariffs. The true effects of the tariffs will take time to fully understand.

What does this mean for us?

The focus must be on the fundamentals of investing: diversification, rebalancing, and ensuring asset allocation is across multiple investment types.

What is the wrong thing to do at a time like this? What are we doing now as far as building a portfolio to help protect it from any potential tariff fallout?

Making rash decisions based on emotion and short-term issues is a clear mistake. Volatile markets require both Modern Portfolio Therapy and Modern Portfolio Theory. I fully understand that the present may seem risky. Recall though, that it was just weeks ago when some feared investing at the “top of the market.” Now, there’s an opportunity to invest at lower prices.

History shows that maintaining a long-term approach is one of the most effective strategies for navigating market volatility.

Market pullbacks occur on a regular basis. Since 1980, the S&P 500 on average:

Risk does not equate to uncertainty. Risk can be measured and is somewhat predictable, while uncertainty is unpredictable. Markets dislike uncertainty because it complicates risk assessment and asset price determination.

Diversification remains a fundamental tenet for portfolios. Since predicting short-term outcomes is nearly impossible, why not own a broad range of asset classes—U.S. and international large and small cap, real estate, and fixed income? Investing is not about picking one asset class or reacting to daily headlines. It’s about achieving long-term financial goals over years and decades.

Over the last 25 years—scratch that—over the last century, markets have faced global economic shifts, including wars, recessions, bubbles, pandemics, political changes, and technological revolutions. Throughout, diversification has helped manage risks while maintaining a long-term focus.

Review of Q1

The market’s direction will depend on corporate earnings and economic performance, especially once there’s more clarity. Fortunately, S&P 500 earnings-per-share growth remains strong, even with increased costs from tariffs, indicating strong fundamentals despite trade concerns.

Bonds play a key role in these conditions, offsetting stock pullbacks. When interest rates fall, bond prices rise, as existing bonds with higher yields become more valuable, supporting bonds and balanced portfolios when equities struggle.

The Federal Reserve and interest rates

Federal Reserve Chairman Powell has acknowledged the uncertain effects of tariffs and other policies on inflation and economic growth. With limited visibility into trade policy outcomes, the Fed’s March Summary of Economic Projections forecast 1.7% GDP growth for 2025, below 2% for the first time since 2022. Investors expect persistent inflation despite a strong job market, leading to consensus forecasts of 3-4 rate cuts in 2025.

Consumer sentiment

All these factors are affecting consumer sentiment, and it’s understandable that many households are worried about higher prices after recent inflation. But surprisingly, consumer spending is still holding up pretty well. The strong job market, with unemployment at just 4.1%, and wages continuing to rise (even after accounting for inflation) are helping households stay financially stable. Of course, this isn’t true for everyone, but many are still in solid financial shape.

Why do we emphasize a long-term approach?

Markets operate in long cycles, and we may face more downturns before things turn around. But when they do, you’ll want to be invested. Drawdowns in equity markets are part of the process. While each downturn may feel unique due to different causes, they’re a feature, not a bug. Strong equity returns come with volatility. Eventually, we’ll see new all-time highs and perhaps 30% declines—just don’t ask which will come first.

While there will always be reasons to sell, remember, stocks represent businesses that grow, invest, and return value to shareholders. Despite the many bumps along the way, the evidence overwhelmingly supports staying the course through tough times.

Stock Market Drawdowns Since 1928

S&P 500 Index price returns (top) and drawdowns from prior peak (bottom)

Two quotes to end on

David Booth, founder and chairman of Dimensional Fund Advisors, recently wrote in a Financial Times article:

In 2008, during the middle of the global financial crisis, Warren Buffet stated,

These quotes help illustrate why keeping a long-term perspective is key to staying on track.

Much like relying on GPS to navigate through unfamiliar roads and challenging weather, navigating uncertain market conditions requires a steady, thoughtful approach. In both cases, having a clear strategy and focusing on long-term goals helps you stay on course. Diversification and a disciplined investment strategy serve as your guide, helping you manage volatility and stay focused on the road ahead.

As your advisors, we’re here to educate and empower you, to help you make informed decisions. A strong financial strategy goes beyond investing—it’s about tax planning, risk management, rebalancing, cash flow, charitable giving, and estate planning, too.

Thank you for taking the time to read this, and as always, thank you for the trust and confidence you place in us and our services. We truly appreciate it.

1 J.P. Morgan: Tariff Turmoil and Investment Strategy

2 https://www.wsj.com/finance/currencies/trump-tariffs-us-dollar-217b3dc9

3 https://www.ft.com/content/7f38e24b-4947-4806-a88b-51aa0ae231b3

4 https://www.nytimes.com/2008/10/17/opinion/17buffett.html

Follow us on social:

Talk to an experienced financial planner

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.