During 2025, an estimated 69 million Americans will receive about $1.6 trillion in Social Security benefits, while the average retiree will get a monthly Social Security check of $1,975.[1]

That is a big financial help for many. Unfortunately, Social Security recipients are not seeing much of an increase in their checks these days. The Social Security Administration (SSA) uses its official Cost of Living Adjustment (COLA), which is based on inflation, to determine how much these benefits increase each year.

What is COLA?

The purpose of the COLA is to protect Social Security benefits from inflation, but many retirees may feel the actual inflation rate outpaces these adjustments. This raises the question: just how does the Social Security Administration determine the annual cost-of-living adjustment?

The SSA calculates COLA using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which is determined annually by the Bureau of Labor Statistics.[2]

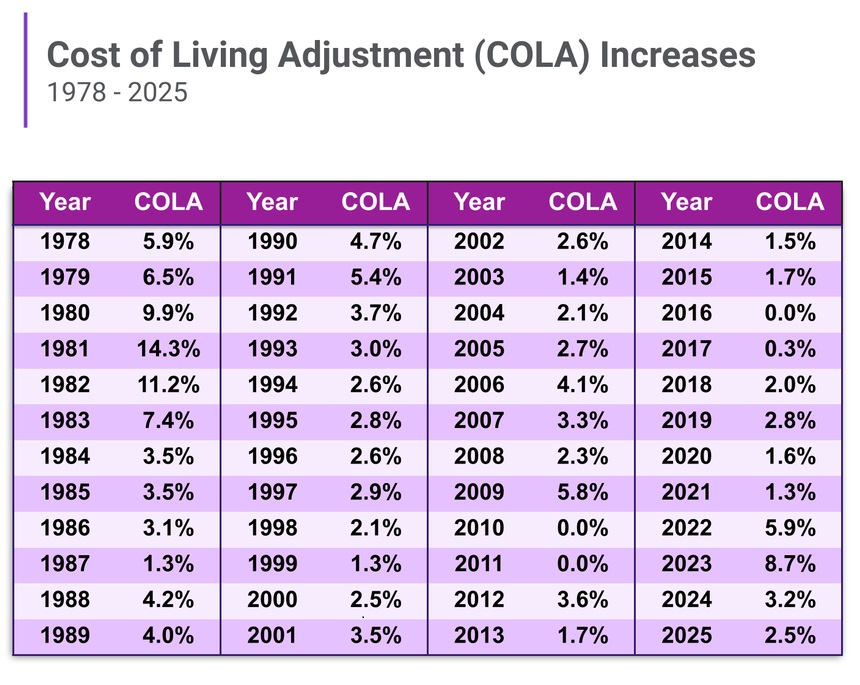

In October of 2024, the Social Security Administration announced that Social Security beneficiaries will receive a 2.5% increase in their benefits in 2025. Based on the average monthly benefit of $1,975, the increase is roughly $50. While this increase is disappointing in comparison to the 3.4% COLA in 2024 and the 8.7% COLA in 2023, it is in line with the 2.6% average annual increase over the past 2 decades.[3]

Data Source: Social Security Administration, Image by Motley Fool

What Does This Mean for You?

Impact of Medicare Part-B Premiums and the Hold Harmless Provision

Social Security recipients are often also enrolled in Medicare. Medicare Part-B premiums are withheld from monthly Social Security benefits and reduce the amount they receive. In 2025 the standard monthly premium for Medicare Part-B enrollees is $185—up from $174.70 in 2024— representing a 5.9% increase which is considerably higher in percentage terms than the 2.5% COLA for this year.[4]

There is a “Hold Harmless” provision designed to protect beneficiaries from Medicare premium increases that exceed their COLA[5]. However, this provision does not apply if:

- You are in your first year of Medicare benefits.

- You are in a higher income bracket (individuals earning $106,000+ or couples earning $212,000+).

Avoid Surprises in Your Retirement

You may be among our clients who are, or expect to be, in higher income brackets during your retirement years, where the Hold Harmless provision may not apply.

If this is the case and you are enrolled in both Medicare and Social Security, you could be subject to an additional surcharge on your Medicare premiums, further reducing your net Social Security benefit. This surcharge known as the Income-Related Monthly Adjustment Amount (IRMAA) is in addition to the “standard” monthly premium for Medicare Plan B cited above, and depending on your income, can be as much as $443.90 per month higher[6].

Navigating Social Security and Medicare can be complex, but planning ahead can help minimize financial surprises. Rest assured, we are taking into account these considerations and their impact as we develop and monitor your financial plan. If you have any questions, please do not hesitate to reach out to your advisor.

[1] https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

[2] https://www.ssa.gov/news/press/factsheets/colafacts2025.pdf?ftag=YHF4eb9d17

https://www.nasdaq.com/articles/social-security-cola-update-heres-how-much-average-benefit-will-increase-2025

[4] https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/what-does-medicare-cost

[5] https://www.investopedia.com/terms/m/medicare-hold-harmless-provision.asp#:~:text=The%20Medicare%20hold%20harmless%20provision%20is%20a%20statutory%20restriction%20that,2

[6] https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles