An incredibly strong housing market over the last few years coupled with rising interest rates has put affordability out of reach for many home buyers.

U.S. consumers clearly focused on their financial goals of home ownership beginning in 2020 as we all spent more time at home during the pandemic. Scarce supply of existing homes for sale, limited new construction supply, and record low interest rates helped push home prices to their fastest pace of gains since before the financial crisis of 2007-2009.

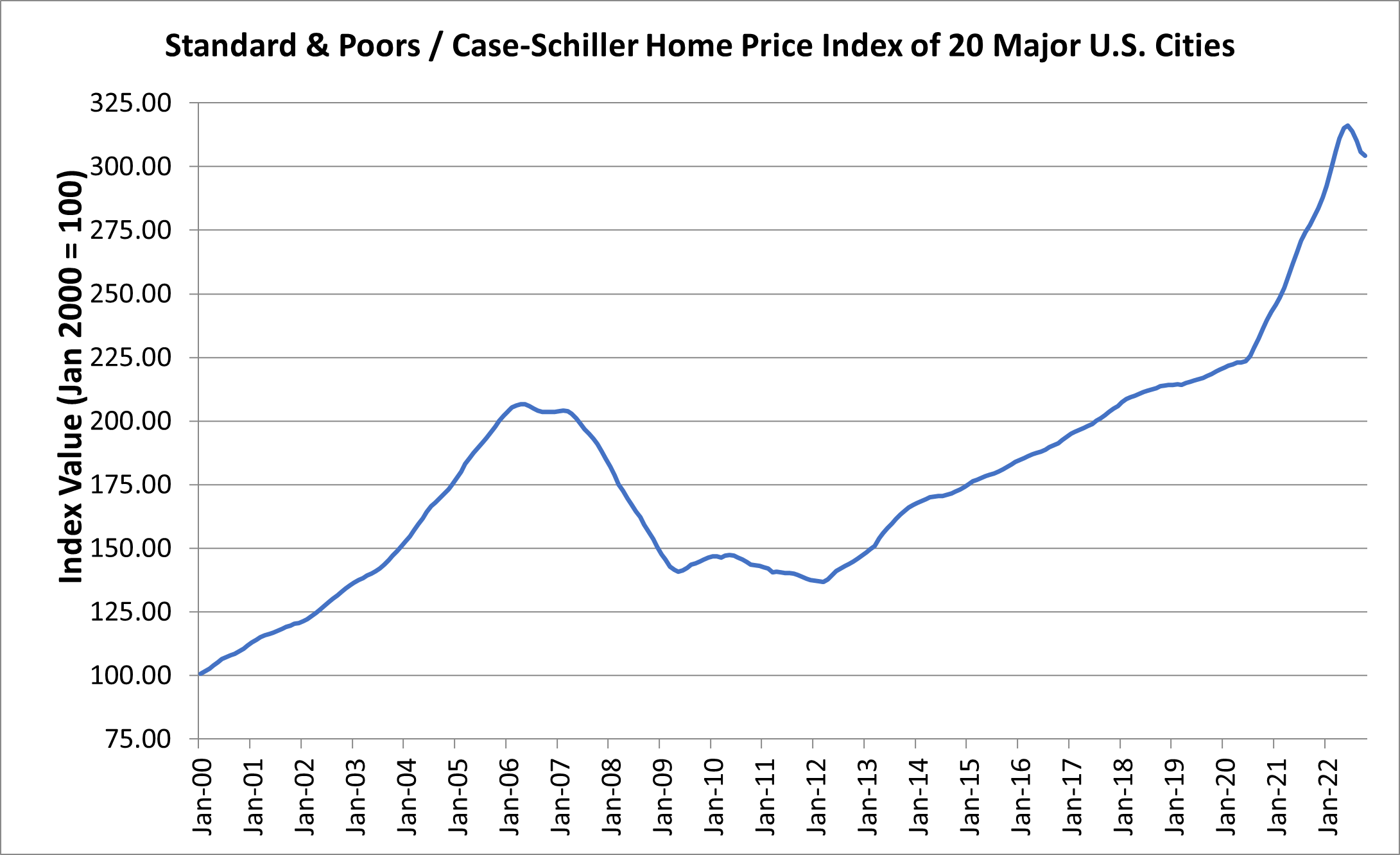

Below is a chart of a home price index for the largest 20 U.S. cities compiled by Standard & Poor’s:

This index began in January 2000, so the index shows price movement relative to that date. Note how the index rose more than 100% from 2000 to 2006 but then abruptly fell more than 25% through early 2009 during the Great Recession. Notice in 2020 how price gains accelerated with prices only beginning to decline gradually beginning in the middle of 2022.

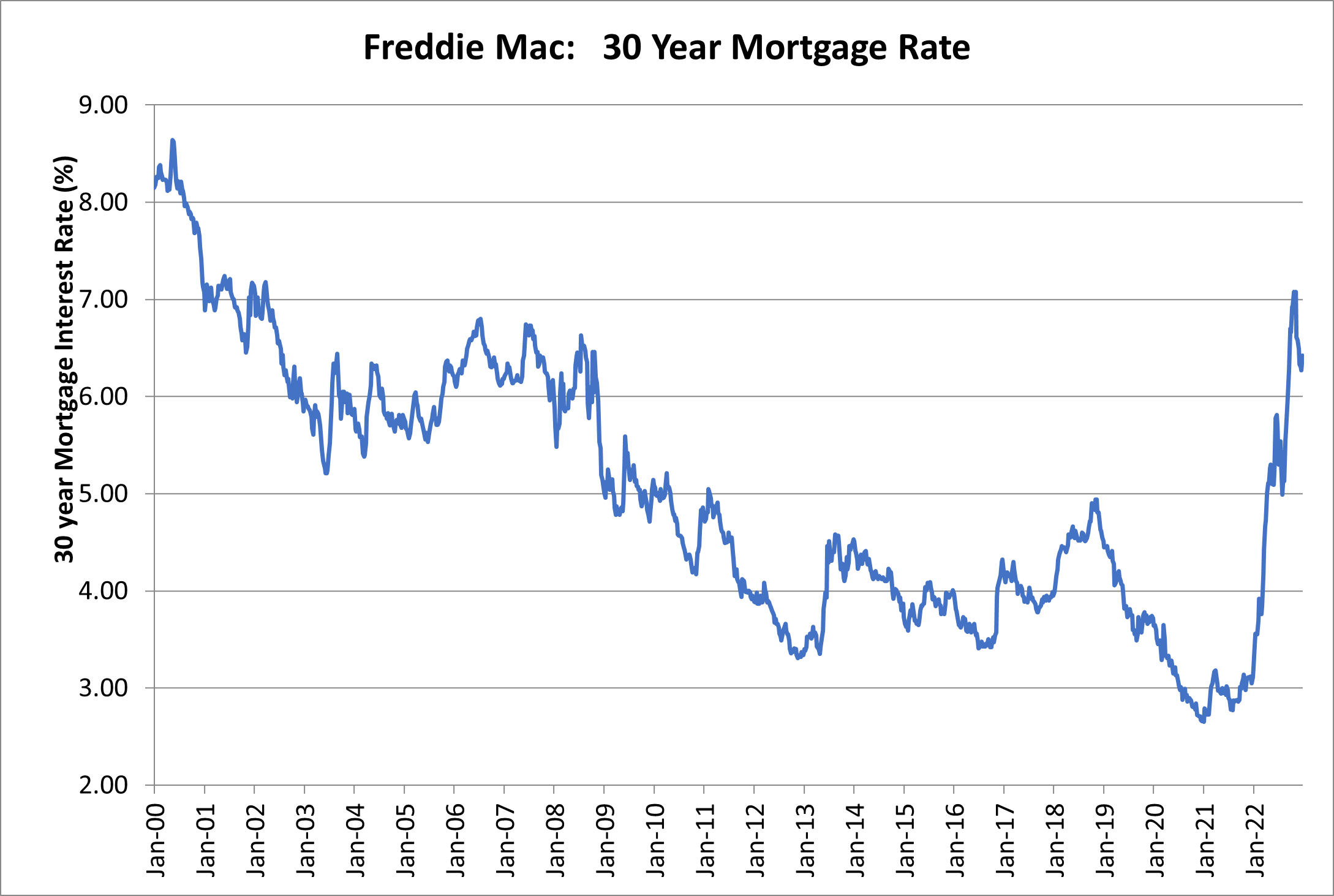

In an effort to slow inflation and moderate growth in the economy the Federal Reserve has embarked on a rapid pace of interest rate increases during 2022. This has resulted in a steep increase in mortgage rates to levels not seen in over 15 years.

The following table shows a nationwide average interest rate for a 30-year fixed-rate mortgage as compiled by Freddie Mac’s Primary Mortgage Market Survey:

The combination of higher home prices and higher interest rates has made home affordability look dramatically different today compared with only a few years ago. For example, a $400,000 home with a 30-year mortgage in 2020 at a 3.5% interest rate would result in a monthly payment of just under $1,800 (excluding taxes and insurance). Assuming that same house today has seen price growth similar to the nationwide index and now costs $550,000, with 30-year mortgage rates now closer to 6.5% the monthly payment for that same house would be just under $3,500 – nearly twice as high!

With affordability becoming increasingly more challenging it is important for prospective home buyers to know what their finances should look like before beginning their home search. Banks will look at your personal finances carefully to determine if you qualify for taking out a new loan, either for your primary residence or a vacation home. They will compare your earnings relative to your ongoing debt obligations to compute some ratios that you will likely need to fit within for loan approval:

Consumer Debt Ratio: Monthly Nonhousing Debt Payments ÷ Monthly Net (After-Tax) Income = Keep Under 0.20

For example:

- Monthly minimum payments on student loans, auto loans, credit cards = $1,200

- Monthly income after taxes = $7,000

- Consumer debt ratio = $1,200 ÷ $7,000 = 0.17 … This is below 0.20, so that is good

Housing Cost Ratio: Monthly Nondiscretionary Housing Costs ÷ Monthly Gross (Before-Tax) Income = Keep Under 0.28

For example:

- Monthly mortgage payment, property taxes, home insurance, association fees = $2,500

- Monthly paycheck before taxes = $10,000

- Housing cost ratio = $2,500 ÷ $10,000 = 0.25 … This is below 0.28, so that is good

Debt-to-Income Ratio: All Debt and Housing Costs ÷ Monthly Gross Income = Keep Under 0.36

For example:

- Combine the above items: $1,200 + $2,500 = $3,700

- Monthly paycheck before taxes = $10,000

- Debt-to-income ratio = $3,700 ÷ $10,000 = 0.37 … This is above 0.36, meaning one of the following: You will need to pay off some auto/student/credit card debt to qualify for a loan, your mortgage may be subject to a higher interest rate, or you should consider a lower-priced home.

It’s usually safe to assume that you will need to reinvest 1% to 2% of the home value back into the property each year in ongoing maintenance and repairs, so have that factored into your ongoing budget ahead of time.

You should also make sure that the overall expenses with homeownership still allow you to pursue other financial goals, like saving roughly 15% of your pre-tax income for retirement savings and having adequate cash flow to save for other planning needs, such as kids’ college education. The same analysis can apply to a second home purchase if you just add the additional expenses of the second home on top of your primary residence costs to see if the above ratios are still satisfied. If the numbers look good with the value of the home you want to purchase, and the home purchase would not impede your other financial goals, then approach several local banks to get some loan quotes and review bankrate.com to review quotes from nationwide providers.

Young professionals are usually best suited to focus on a 30-year fixed-rate mortgage to stretch out their repayment horizon so that your monthly payment is lower. This will allow you to have additional monthly cash flow that you can add to your retirement and investment accounts, which over time could earn a rate of return higher than your mortgage interest rate. In other words, paying the minimum payment on your mortgage and investing the rest should serve you well over a long mortgage term.

For midcareer professionals considering upgrading homes or buying a vacation home, it may make sense to pursue a 15-year mortgage so that your mortgage payment is scheduled to end once you approach your targeted retirement date.

Reviewing these specific decisions with your financial advisor can help you review the various options to hopefully give you confidence in your decision. Please reach out to your advisor if we can help run some scenarios for you!