Market and Economic Review

By Bill Hansen, CFA®, CMT, Co-Chief Investment Officer, Principal

Equity Markets

Source: YCharts

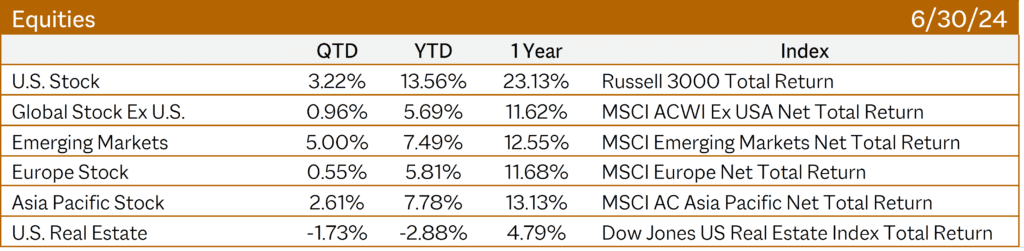

In the first half of the year, U.S. stocks extended a bull market, with the S&P 500 reaching a series of record highs, led by technology and communications services stocks. Year to date, U.S. stocks continued to lead foreign markets and real estate.

The second quarter of 2024 was similar to the first in a couple of ways:

- Large U.S. companies performed better than small U.S. companies.

- Growth companies (in particular large growth) outperformed value companies.

One difference we saw in the second quarter was that emerging international stocks outperformed developed international as well as U.S. stocks (more thoughts on that below).

U.S. stocks also led international stocks over the past 12 months, but other markets showed respectable 10%+ total returns1.

Fixed Income Markets

Source: YCharts

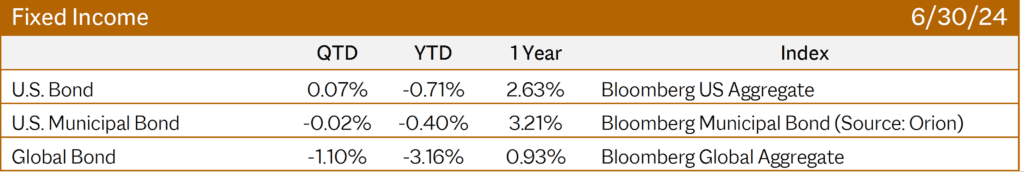

During the quarter, the Federal Reserve (Fed) continued to hold the overnight federal funds rate steady at 5.25%, while the European Central Bank lowered its record-high deposit rate by 25 basis points to 3.75%, for the first time since 2019.

U.S. aggregate and municipal bond returns were relatively flat for the quarter, along with global bond returns which were down slightly and have underperformed year to date. Over the past 12 months, all these types of bonds have had slightly positive total returns (see table above).

The 4.36% yield on the benchmark 10-year U.S. Treasury bond2 is down from the recent high in October 2023 but remains higher than it has been over most of the past decade.3 With current inflation readings in the 3% range, investors can now earn a slightly positive return after considering inflation on many fixed-income investments.

Economic Indicators

The labor market remains healthy, with non-farm payrolls averaging gains of about +220,000 per month over the past 6 months, including all available revisions, compared with a 6-month average of about 207,000 in January of this year. The unemployment rate (U3) increased slightly from 3.7% at year-end 2023 to 4.1% at the end of June 2024. But even after this increase, the current level still reflects close to full employment in the economy.4

Inflation (as measured by the 12-month percent in the CPI-U) was +3.3% in May. Although this level remains above the Fed’s 2% long-term target, it represents significant progress from the 6%+ inflation readings we saw as recently as early 2023.5 However, we believe the path from 3% inflation to the 2% target may take longer than many expect.

As of the time of this writing, futures markets were predicting a 77% chance of a rate cut of at least 25 basis points (0.25%) by the September 18, 2024 Fed meeting.6 While we believe this may prove optimistic, we are encouraged by continued job growth and moderating inflation.

Spotlight on International Stocks

By Ed Baldrige, CFP®, Principal & Wealth Manager

During the second quarter, international stocks continued to lag U.S. equities as developed international markets, as represented by the MSCI ACWI ex U.S. Index, added 5.69% while emerging markets, as represented by the MSCI Emerging Markets Index, were up 7.49%.7 International stocks’ share of the value of world markets has fallen to 36% as the U.S. market continues to increase in market value. This is a major turnaround from the financial crisis of 2008 when international stocks made up more than 60% of the world’s markets.8

Should investors consider this a worrisome sign or an opportunity to add to international stocks? It’s hard to say. But the U.S. dominance over the past sixteen years is largely due to the growth and profitability of American companies’ earnings per share which have grown by 162% since March of 2008 compared to ex U.S. global markets where earnings have dropped by 2% in dollar terms over the same period.8 Another major factor is the strength of the U.S. dollar during that stretch which also favored U.S. stocks. For example, this year through June 30, 2024 the MSCI All-Cap World ex-US index is higher by about 6% in dollar terms vs. 11% in local currency terms, much closer to the U.S. returns (S & P 500 index) of 15% year to date.9

Will the U.S. continue to dominate? The world is a big place full of innovative people, dynamic companies and changing demographics. Keeping a global perspective has rewarded investors over the years. One thing we know for certain is that markets change and being positioned to capture returns wherever they may occur is a smart investment strategy.

AI, Technology and the New, New Thing

By George Padula, CFP®, CFA®, Co-Chief Investment Officer, Principal & Wealth Manager

Many of the world’s top companies are focused on technology, prompting some investors to question why they should own anything else. A few months ago, we wrote that Artificial Intelligence (AI) is everywhere, like the air we breathe. I’ll switch and say that AI is like an iceberg in which the headlines capture only a small portion of AI’s impact beneath the surface.

For example, utilities have the infrastructure to support the massive energy requirements of AI.

Further, energy companies are using AI to boost operational efficiencies, fine tune production, automate drilling, and even reduce carbon emissions.

In finance, banks and insurers use AI to analyze customer trends, run risk models and monitor regulatory requirements. Moreover, AI has a critical role in combatting money laundering and financial fraud.

AI in healthcare is transformative. Who wouldn’t want AI to help improve the diagnosis and treatment of life-threatening illnesses like cancer, stroke, diabetes, and heart disease? When expertly applied by experienced medical professionals, AI promises significant societal gains.

The widespread adoption of AI will require substantial infrastructure, including data center construction, new equipment, efficient cooling systems, and enhanced power generation capabilities. Cost efficiencies will improve as AI matures and develops. Through it all, the realities of investment math loom. Just as with icebergs, what’s underneath-valuations, cash flows, profits, quality of credit and earnings-are crucial for sustainable investment success.

Quality portfolios also require rebalancing, tax efficiency, and alignment with long-term planning goals. It also means diversifying globally and across multiple economic sectors. Since AI extends far beyond the tech sector, permeating nearly every industry, why not invest broadly?

50 Ways to Gain Exposure

By Sarah DerGarabedian, CFA®, Director of Investment Management, Principal

To the tune of Paul Simon’s 1975 hit “50 Ways to Leave your Lover”

“The problem is all inside your head”

She said to me

“The answer is easy if you

Take it logically

I’d like to help you in your struggle

So you see

There must be 50 ways

To gain exposure”

“It seems you want AI, EV, and crypto, too

Nvidia, Apple, Tesla

Microsoft and GOOG

But I’ll repeat myself

At the risk of being rude

There must be 50 ways

To gain exposure

Fifty ways to gain exposure”

Just buy an ETF, Jeff

You don’t need a new plan, Jan

It’s all in the fund, son

Just listen to me

Put down the phone, Joan

You don’t need a margin loan

Just leave it to me, Lee

And set yourself free

“You’re worried that inflation’s

Rising every day

I wish there was something I could say

To help you see that you’re OK”

I said, “I appreciate that

And would you please explain

About the 50 ways?”

She said, “if you have stocks

And bonds that they call TIPs

Your portfolio is positioned

To slip inflation’s grip”

And then she smiled at me

And I realized I don’t need to flip

There must be 50 ways

To gain exposure

Fifty ways to gain exposure

Just buy an ETF, Jeff

You don’t need a new plan, Jan

It’s all in the fund, son

Just listen to me

Put down the phone, Joan

You don’t need a margin loan

Just leave it to me, Lee

And set yourself free!”

On behalf of Modera’s investment team, thank you for your continued trust and confidence in Modera. We appreciate your relationship with all of us. If you have any questions or comments, please contact your advisor who can pass them along to our team.

Sincerely,

Bill, Ed, George, and Sarah

Investment Commentary: Q2 2024

Edwin R. Baldrige III

Wealth Manager, Principal

George Padula

Chief Investment Officer, Wealth Manager & Principal

Sarah DerGarabedian

Director of Investment Strategy, Principal

Modera’s investment team is pleased to provide our market review for the second quarter of 2024.

Market and Economic Review

By Bill Hansen, CFA®, CMT, Co-Chief Investment Officer, Principal

Equity Markets

Source: YCharts

In the first half of the year, U.S. stocks extended a bull market, with the S&P 500 reaching a series of record highs, led by technology and communications services stocks. Year to date, U.S. stocks continued to lead foreign markets and real estate.

The second quarter of 2024 was similar to the first in a couple of ways:

One difference we saw in the second quarter was that emerging international stocks outperformed developed international as well as U.S. stocks (more thoughts on that below).

U.S. stocks also led international stocks over the past 12 months, but other markets showed respectable 10%+ total returns1.

Fixed Income Markets

Source: YCharts

During the quarter, the Federal Reserve (Fed) continued to hold the overnight federal funds rate steady at 5.25%, while the European Central Bank lowered its record-high deposit rate by 25 basis points to 3.75%, for the first time since 2019.

U.S. aggregate and municipal bond returns were relatively flat for the quarter, along with global bond returns which were down slightly and have underperformed year to date. Over the past 12 months, all these types of bonds have had slightly positive total returns (see table above).

The 4.36% yield on the benchmark 10-year U.S. Treasury bond2 is down from the recent high in October 2023 but remains higher than it has been over most of the past decade.3 With current inflation readings in the 3% range, investors can now earn a slightly positive return after considering inflation on many fixed-income investments.

Economic Indicators

The labor market remains healthy, with non-farm payrolls averaging gains of about +220,000 per month over the past 6 months, including all available revisions, compared with a 6-month average of about 207,000 in January of this year. The unemployment rate (U3) increased slightly from 3.7% at year-end 2023 to 4.1% at the end of June 2024. But even after this increase, the current level still reflects close to full employment in the economy.4

Inflation (as measured by the 12-month percent in the CPI-U) was +3.3% in May. Although this level remains above the Fed’s 2% long-term target, it represents significant progress from the 6%+ inflation readings we saw as recently as early 2023.5 However, we believe the path from 3% inflation to the 2% target may take longer than many expect.

As of the time of this writing, futures markets were predicting a 77% chance of a rate cut of at least 25 basis points (0.25%) by the September 18, 2024 Fed meeting.6 While we believe this may prove optimistic, we are encouraged by continued job growth and moderating inflation.

Spotlight on International Stocks

By Ed Baldrige, CFP®, Principal & Wealth Manager

During the second quarter, international stocks continued to lag U.S. equities as developed international markets, as represented by the MSCI ACWI ex U.S. Index, added 5.69% while emerging markets, as represented by the MSCI Emerging Markets Index, were up 7.49%.7 International stocks’ share of the value of world markets has fallen to 36% as the U.S. market continues to increase in market value. This is a major turnaround from the financial crisis of 2008 when international stocks made up more than 60% of the world’s markets.8

Should investors consider this a worrisome sign or an opportunity to add to international stocks? It’s hard to say. But the U.S. dominance over the past sixteen years is largely due to the growth and profitability of American companies’ earnings per share which have grown by 162% since March of 2008 compared to ex U.S. global markets where earnings have dropped by 2% in dollar terms over the same period.8 Another major factor is the strength of the U.S. dollar during that stretch which also favored U.S. stocks. For example, this year through June 30, 2024 the MSCI All-Cap World ex-US index is higher by about 6% in dollar terms vs. 11% in local currency terms, much closer to the U.S. returns (S & P 500 index) of 15% year to date.9

Will the U.S. continue to dominate? The world is a big place full of innovative people, dynamic companies and changing demographics. Keeping a global perspective has rewarded investors over the years. One thing we know for certain is that markets change and being positioned to capture returns wherever they may occur is a smart investment strategy.

AI, Technology and the New, New Thing

By George Padula, CFP®, CFA®, Co-Chief Investment Officer, Principal & Wealth Manager

Many of the world’s top companies are focused on technology, prompting some investors to question why they should own anything else. A few months ago, we wrote that Artificial Intelligence (AI) is everywhere, like the air we breathe. I’ll switch and say that AI is like an iceberg in which the headlines capture only a small portion of AI’s impact beneath the surface.

For example, utilities have the infrastructure to support the massive energy requirements of AI.

Further, energy companies are using AI to boost operational efficiencies, fine tune production, automate drilling, and even reduce carbon emissions.

In finance, banks and insurers use AI to analyze customer trends, run risk models and monitor regulatory requirements. Moreover, AI has a critical role in combatting money laundering and financial fraud.

AI in healthcare is transformative. Who wouldn’t want AI to help improve the diagnosis and treatment of life-threatening illnesses like cancer, stroke, diabetes, and heart disease? When expertly applied by experienced medical professionals, AI promises significant societal gains.

The widespread adoption of AI will require substantial infrastructure, including data center construction, new equipment, efficient cooling systems, and enhanced power generation capabilities. Cost efficiencies will improve as AI matures and develops. Through it all, the realities of investment math loom. Just as with icebergs, what’s underneath-valuations, cash flows, profits, quality of credit and earnings-are crucial for sustainable investment success.

Quality portfolios also require rebalancing, tax efficiency, and alignment with long-term planning goals. It also means diversifying globally and across multiple economic sectors. Since AI extends far beyond the tech sector, permeating nearly every industry, why not invest broadly?

50 Ways to Gain Exposure

By Sarah DerGarabedian, CFA®, Director of Investment Management, Principal

To the tune of Paul Simon’s 1975 hit “50 Ways to Leave your Lover”

“The problem is all inside your head”

She said to me

“The answer is easy if you

Take it logically

I’d like to help you in your struggle

So you see

There must be 50 ways

To gain exposure”

“It seems you want AI, EV, and crypto, too

Nvidia, Apple, Tesla

Microsoft and GOOG

But I’ll repeat myself

At the risk of being rude

There must be 50 ways

To gain exposure

Fifty ways to gain exposure”

Just buy an ETF, Jeff

You don’t need a new plan, Jan

It’s all in the fund, son

Just listen to me

Put down the phone, Joan

You don’t need a margin loan

Just leave it to me, Lee

And set yourself free

“You’re worried that inflation’s

Rising every day

I wish there was something I could say

To help you see that you’re OK”

I said, “I appreciate that

And would you please explain

About the 50 ways?”

She said, “if you have stocks

And bonds that they call TIPs

Your portfolio is positioned

To slip inflation’s grip”

And then she smiled at me

And I realized I don’t need to flip

There must be 50 ways

To gain exposure

Fifty ways to gain exposure

Just buy an ETF, Jeff

You don’t need a new plan, Jan

It’s all in the fund, son

Just listen to me

Put down the phone, Joan

You don’t need a margin loan

Just leave it to me, Lee

And set yourself free!”

On behalf of Modera’s investment team, thank you for your continued trust and confidence in Modera. We appreciate your relationship with all of us. If you have any questions or comments, please contact your advisor who can pass them along to our team.

Sincerely,

Bill, Ed, George, and Sarah

1 YCharts

2 JP Morgan Weekly Market Recap 7/1/24

3 FRED Chart

4 Bureau of Labor Statistics, “BLS Data” summary spreadsheet

5 Bureau of Labor Statistics, CPI-U spreadsheet

6 CME FedWatch tool

7 YCharts, see equities table above

8 The Economist: June 27, 2024

9 JP Morgan Guide to the Markets, page 42

YCharts ©2023 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from the use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Follow us on social:

Talk to an experienced financial planner

"*" indicates required fields