Personally, I can’t remember a time when our political divisions seemed greater than they do now. The political noise makes it hard to maintain a clear-eyed, objective view of where we are economically.

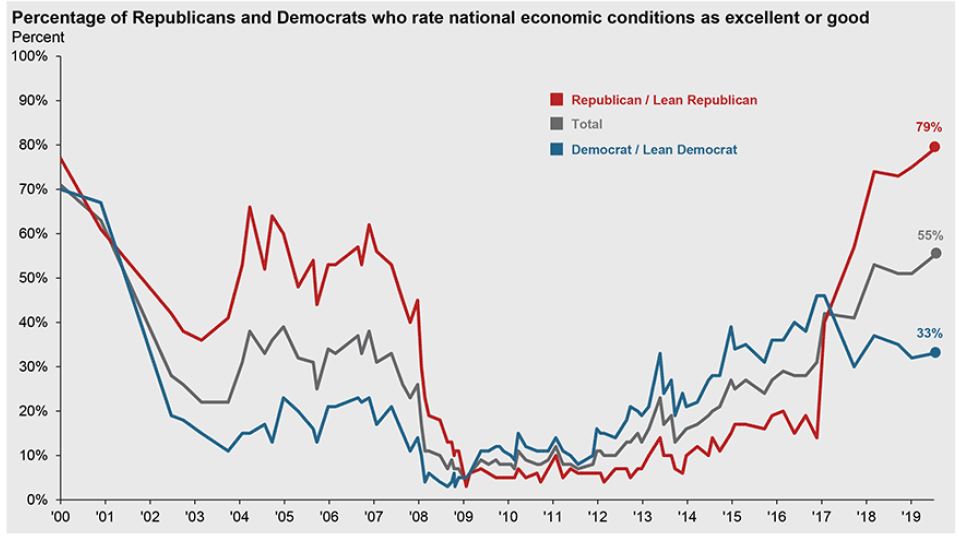

I recently came across the following chart created by Pew Research Center as part of an economics presentation by a J.P. Morgan Economic Strategist. It depicts consumer confidence over time by people who lean Republican or Democrat. Predictably, Republican leaning consumers were more optimistic when a Republican held the White House, and Democratic leaning consumers were more optimistic when a Democrat was in office. The differences in perceptions are stark. The inflection points where optimism shifted along party lines coincide with the years when the presidency changed parties: Bush was inaugurated in January 2001, Obama in January 2009, Trump in January 2017.

Source: Pew Research Center, J.P. Morgan Asset Management. Pew Research Center. July 2019. “Public Views of Nation’s Economy Remain Positive and Deeply Partisan”. Question: Thinking about the nation’s economy, how would you rate economics conditions in this today today.. as excellent, good, only fair, or poor? Guide to the Markets – U.S. Data are as of December 31, 2019.

Source: Pew Research Center, J.P. Morgan Asset Management. Pew Research Center. July 2019. “Public Views of Nation’s Economy Remain Positive and Deeply Partisan”. Question: Thinking about the nation’s economy, how would you rate economics conditions in this today today.. as excellent, good, only fair, or poor? Guide to the Markets – U.S. Data are as of December 31, 2019.

This chart is fascinating because it shows how our emotions actually change our perceptions of reality. Same economy – different experience. Surely, this phenomenon must be worse in our current overheated political environment. Politics are emotional, sometimes triggering our most primal fear and anger. And we know that emotions are dangerous for investors. There are likely Republican-leaning investors who, because of their political biases, missed the bull market years from 2009-2016 and Democratic-leaning voters who missed positive stock returns since the 2016 election.

My intent in sharing this chart is to help people maintain some perspective about our current bitter political divides and the economy. The truth is, politicians from both sides of the aisle have the potential to mess up the economy if they have an unfettered ability to pursue their own policy agendas. Politicians are so often short-term thinkers, and can be overly concerned with their own popularity and preservation of power. Yet economic policy decisions are best made with a long-term focus. For that reason, political divisions and a divided government are likely protecting us from the extreme policy agendas from both sides of the political spectrum. It would be nice, however, if things weren’t at such a fevered pitch!

Let’s take a deep breath

As investors who want to maintain our sanity, it’s important to remember that the smart people who run successful businesses work hard to adapt to whatever economic and regulatory environment presents itself. Some will fail but most will succeed. Politicians can make things easier or harder but, in a free market system, most well-managed businesses will find ways to operate profitably.

I’ve written many times about how unreliable economic forecasting is, so I’m certainly not going out on any limbs with a forecast of my own. At present, our economy is growing but the rate of growth is slowing in the face of some significant headwinds. We won’t be in a recession unless growth turns negative and stays negative for two quarters. No one knows when this will occur or what the specific triggers might be. In this time of political dysfunction, it’s important to maintain a long-term perspective and remember that our economy is inherently resilient. Economic recessions are temporary and, if you are prepared, not to be feared.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Politics and Investing

Karen Keatley, MBA, CFA®, CFP®

Emeritus Advisor, Principal

For many months, the recurring theme in the news has been the economy: when will we experience a recession or bear market and how bad will the downturn be? Unfortunately, the economic commentary has, more than ever it seems, become infused with politics.

Personally, I can’t remember a time when our political divisions seemed greater than they do now. The political noise makes it hard to maintain a clear-eyed, objective view of where we are economically.

I recently came across the following chart created by Pew Research Center as part of an economics presentation by a J.P. Morgan Economic Strategist. It depicts consumer confidence over time by people who lean Republican or Democrat. Predictably, Republican leaning consumers were more optimistic when a Republican held the White House, and Democratic leaning consumers were more optimistic when a Democrat was in office. The differences in perceptions are stark. The inflection points where optimism shifted along party lines coincide with the years when the presidency changed parties: Bush was inaugurated in January 2001, Obama in January 2009, Trump in January 2017.

This chart is fascinating because it shows how our emotions actually change our perceptions of reality. Same economy – different experience. Surely, this phenomenon must be worse in our current overheated political environment. Politics are emotional, sometimes triggering our most primal fear and anger. And we know that emotions are dangerous for investors. There are likely Republican-leaning investors who, because of their political biases, missed the bull market years from 2009-2016 and Democratic-leaning voters who missed positive stock returns since the 2016 election.

My intent in sharing this chart is to help people maintain some perspective about our current bitter political divides and the economy. The truth is, politicians from both sides of the aisle have the potential to mess up the economy if they have an unfettered ability to pursue their own policy agendas. Politicians are so often short-term thinkers, and can be overly concerned with their own popularity and preservation of power. Yet economic policy decisions are best made with a long-term focus. For that reason, political divisions and a divided government are likely protecting us from the extreme policy agendas from both sides of the political spectrum. It would be nice, however, if things weren’t at such a fevered pitch!

Let’s take a deep breath

As investors who want to maintain our sanity, it’s important to remember that the smart people who run successful businesses work hard to adapt to whatever economic and regulatory environment presents itself. Some will fail but most will succeed. Politicians can make things easier or harder but, in a free market system, most well-managed businesses will find ways to operate profitably.

I’ve written many times about how unreliable economic forecasting is, so I’m certainly not going out on any limbs with a forecast of my own. At present, our economy is growing but the rate of growth is slowing in the face of some significant headwinds. We won’t be in a recession unless growth turns negative and stays negative for two quarters. No one knows when this will occur or what the specific triggers might be. In this time of political dysfunction, it’s important to maintain a long-term perspective and remember that our economy is inherently resilient. Economic recessions are temporary and, if you are prepared, not to be feared.

Modera Wealth Management, LLC (Modera) is an SEC-registered investment adviser. SEC registration does not imply any level of skill or training. For information pertaining to our registration status, the fees we charge including how we are compensated and by whom, additional costs that may be incurred, our conflicts of interest, any disclosed disciplinary events of the Firm or its personnel, and the types of services we offer, please contact us directly or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov) to obtain a copy of our disclosure statement, Form ADV Part 2A, and ADV Part 3/Form CRS. In addition, our Privacy Notice outlines how we handle your non-public personal information. Please read these documents carefully before you make a decision to hire Modera, invest or send money.

This material is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This material is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this material are relevant as of the date of publication and are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Follow us on social:

Talk to an experienced financial planner