Markets hate uncertainty.

Since President Trump’s April 2 “reciprocal” tariff announcement, the news has been moving fast.

Although tariffs have been wide ranging, U.S. – China trade restrictions have been in the forefront. Recently, both countries have escalated their tariffs, with U.S. imports of Chinese goods reaching a 145% increase and Chinese imports of U.S. goods rising to 125%. The headlines have been concerning. How will businesses handle this disruption? Will China tariffs mean empty shelves as trade dries up and supplies dwindle? Will we experience a recession this year? Will we have a return of high inflation due to these added tariff costs?

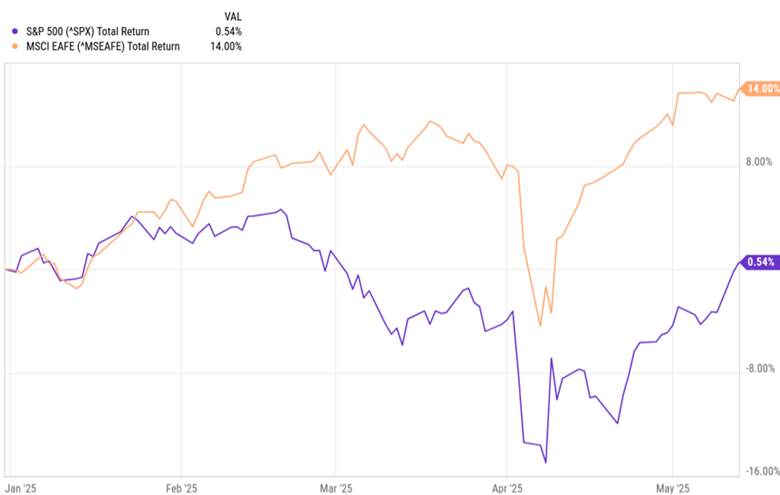

The financial markets have reacted. Between April 3-4, the S&P 500 sold off more than 10% as markets priced in the increased economic uncertainty. At its lowest point, the S&P 500 sold off more than 18% and the international EAFE index declined more than 14% from its highs.[1]

The market has since had a strong recovery, rallying on each positive announcement as uncertainty decreased.

On April 9, the S&P 500 advanced 9.5% as a 90-day pause on “reciprocal” tariffs was announced for all countries except China.[2] Sometimes “less bad” can be good for the market.

Despite trade tensions cooling elsewhere, the U.S.- China trade war continued unabated. U.S. tariffs peaked at 145% on April 10 followed by China’s tariffs reaching 125% on April 11.

On May 12, tensions eased when the U.S. and China reached a major trade agreement after successful negotiations in Geneva, Switzerland over the preceding weekend. The two countries have agreed to suspend and pause various tariffs, effectively reducing them by 115% each. The deal has the U.S. retaining a 30% tariff on Chinese goods, and China keeping a 10% tariff on U.S. imports. Improved communication and the release of a joint statement by the countries have fueled optimism that better cooperation and mutually beneficial long-term resolutions can be enacted.

This cooling of trade tensions has brought with it a recovery in the stock market. As of its May 13 close, the S&P 500 returned to positive territory and the international EAFE index delivered a strong 14% return year-to-date.

Source: YCharts

Although considerable uncertainty remains, the market has applauded potentially taking the “worst case scenarios” off the table. Reducing tariffs on Chinese goods from 145% to 30% ends what was effectively an embargo on China that had companies scrambling for alternatives. The likelihood of a recession over the near term is similarly reduced, though a slowdown of economic activity is still possible.

Although these tariff pauses are only for 90 days, this buys the U.S. and foreign governments time to meet and negotiate longer-term deals. It also gives businesses much needed time to add flexibility to their supply chains and find lower cost options for imported goods.

What does this mean for inflation?

An inflation “tug-of-war” has been raging behind the scenes.

Tariffs directly raise inflation by increasing the cost of importing goods. Some of the direct impact of tariffs could be mitigated by sourcing products locally or from lower cost regions. Retailers would likely absorb some of these price increases, but ultimately, consumers will end up paying higher prices for tariff-affected goods. Lowering the tariff rates eases some of the direct impact.

The likelihood of an economic slowdown or recession caused by the increase in tariffs has overshadowed their direct impacts. Because recessions tend to reduce inflation by reducing demand in the economy and thus reduces prices, lower tariffs lessen the risk of an economic slowdown, dampening this disinflationary impact.

One way to measure the market’s inflation expectations is to look at the breakeven inflation rate, which is the difference in yield between Treasurys and Treasury Inflation-Protected Securities (TIPS). TIPS pay both income and an inflation adjustment, whereas a Treasury only pays interest. The breakeven inflation rate reflects the level of future inflation at which the returns of Treasurys and TIP would be the same, indicating where the market sees inflation over the period.

When the “reciprocal” tariffs were announced on April 2, the market priced in lower inflation, as the market anticipated that the impact of an economic slowdown would offset any direct inflation impacts from tariffs. As trade fears eased, both the direct impact of inflation and the deflationary impact of an economic slowdown were reduced. As a result, inflation expectations have normalized.

Source: YCharts

Uncertainty is likely to remain high as 90-day tariff pauses transition into longer-term resolutions. But for long-term investors, uncertainty is nothing new. The economic reality is that recessions are a normal part of the business cycle and inflation is a persistent headwind to a portfolio’s returns. Instead of reacting to every headline, it is better to have a long-term plan – and stick to it. Instead of changing your portfolio with the fluctuations in the market, build it to be resilient and able to withstand all the bumps in the roads you are certain to encounter.

©2025 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

"*" indicates required fields

If you are not a current client but would like to receive pertinent information about how we help people like you, please sign up now. We will send you helpful content and webinar invitations. Thanks for your interest!