Financial Planning Through a Client’s Life Stages

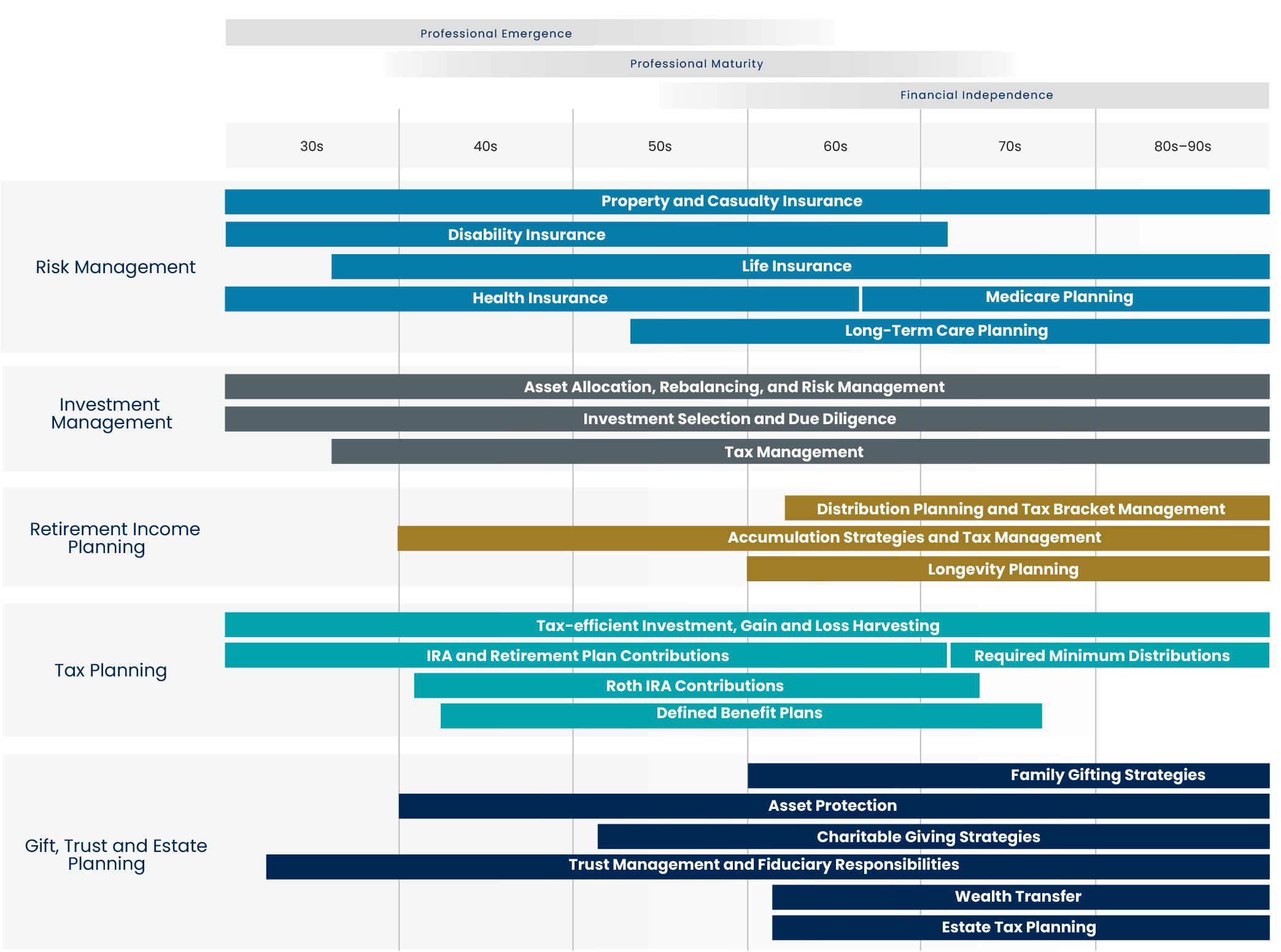

October 13, 2022This simple financial map was designed to provide some perspective for managing your finances at different life stages and may help this ongoing process feel a bit more manageable and less intimidating.

Are you protecting your financial future from its most significant risks? Are you investing your savings in a manner that is in line with your financial goals? Are taxes consuming more of your income than they should?

If you’re like most people, these types of questions are probably bouncing around in the back of your mind, and thinking about them makes your head spin. The good news is, this doesn’t have to be the case.

In our nearly four decades of providing financial planning services to individuals and families, we’ve learned to appreciate the importance of identifying and focusing on the financial issues most relevant to each client. We’ve found that considering a client’s age can be a simple yet effective way to pinpoint his or her financial planning needs. For example, while a young professional probably does not need a strategy for gifting assets to heirs, he or she may need to consider a strategy for receiving income in the event that he or she becomes disabled and is unable to work.

For years, we have used an age-based financial map to help guide our clients towards their financial goals. We figure it is about time that we share the wealth (pun entirely intended). Our age-based financial map illustrates those aspects of insurance, investment management, tax planning and estate planning that are generally most relevant at different times in a person’s life. A breakdown of how these financial planning considerations evolve is included below:

- In your 30s and 40s. Adequate property, disability, liability and life insurance are crucial to the protection of your financial future. Determining the best way to take advantage of savings opportunities in IRA and other retirement plan accounts is important. Investing your savings prudently can help you accumulate the wealth needed to achieve your goals. Wills, trusts and other important estate planning documents also can be critical to providing financial security for your spouse and children in the event of your death or incapacity.

- In your 50s. At this age you may have accumulated a reasonable amount of assets. As a result, your life insurance needs may have decreased from what they were in your 30s and 40s. However, your disability, liability and property insurance are likely still critical. You also may wish to start considering long-term care insurance. Your income has likely increased, and an effective savings strategy is also very important, as is maintaining a prudent investment strategy for those assets. Careful tax planning can help you maximize your accumulation of wealth to fund your retirement and other financial goals.

- In your 60s. Evaluating your need for long-term care insurance is usually very important at this stage of life. You should evaluate your annual spending and start to consider how you may fund your spending from your investment assets in retirement. Retirement income planning, including the identification of a sustainable withdrawal strategy and the minimization of taxes on that income, can help you maximize the mileage you’ll get from your savings. Roth Conversions and tax bracket-filling strategies may be considered during this period. You also should evaluate when you’d like to begin receiving your social security benefits, as you will generally be eligible for benefits as early as age 62. Since you likely have been building your net worth for a number of years, and your family tree has likely evolved, you may wish to consider re-evaluating your estate plan.

- In your 70s. Tax laws require you to start taking annual minimum distributions from certain retirement accounts such as IRAs. Qualified Charitable Distributions (QCDs) is a tax-efficient charitable giving strategy that may fit your situation starting in your early 70s. Developing effective family gifting and wealth transfer strategies may now be of greater importance for you.

- In your 80s and 90s. Maintaining your retirement income through effective investment management and income tax planning still remains a top priority. Achieving philanthropic goals and continuing your wealth transfer strategies may be of increasing priority for many. Maintaining up-to-date durable powers of attorney and health care proxies can ensure that your loved ones have the ability to care for you in the event that such care becomes necessary.

It is hard to make the right financial decisions if you don’t know what actions you need to take. That’s why our age-based financial map can be such a useful resource. By identifying which financial matters are most important to you, you’ll be able to work towards your financial goals more effectively and can achieve greater peace of mind.

Contact an Experienced Wealth Management Advisor Near You

We are proudly a fee-only, independently-owned financial planning firm that acts as a fiduciary for our clients. We have built our organization to put our customers’ interests first, as evidenced by our fee-only fee structure and fiduciary responsibility.

If you’re interested in our services, please contact us. If you would like to learn more about financial planning, wealth management, and finding a financial advisor, please visit other areas of our education section.

Contact us

"*" indicates required fields

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.