A Guide to 401(k) Plans for Small Business Owners

July 12, 2022

A key aspect of effectively managing a small business is establishing a retirement plan that is appropriate for your organization.

Assessing the right-fit retirement plan is an area in which we frequently advise among our clients who are small business owners. As many of our clients grow their businesses, we have helped them replace their existing company retirement plans with 401(k) plans. In general, 401(k) plans can provide more options and flexibility than other types of retirement plans. Here, we will explore some of the key attributes of 401(k) plans and the potential benefits they can provide on both a personal level and in various aspects of managing your business.

New Talent Acquisition and Retention

Business owners can often face challenges with attracting and hiring top talent. Of course, they want to staff their organizations with the most qualified candidates, but highly experienced or specialized professionals are typically more likely to accept positions at larger organizations with more generous benefit packages. A 401(k) plan can provide the edge in hiring since many jobseekers view 401(k)s as more robust than other types of retirement plans and, frankly, 401(k)s are simply more well-known and recognized. Additionally, 401(k)s can help you retain key talent through certain plan characteristics, such as gradual vesting of company contributions.

Personal Retirement Savings

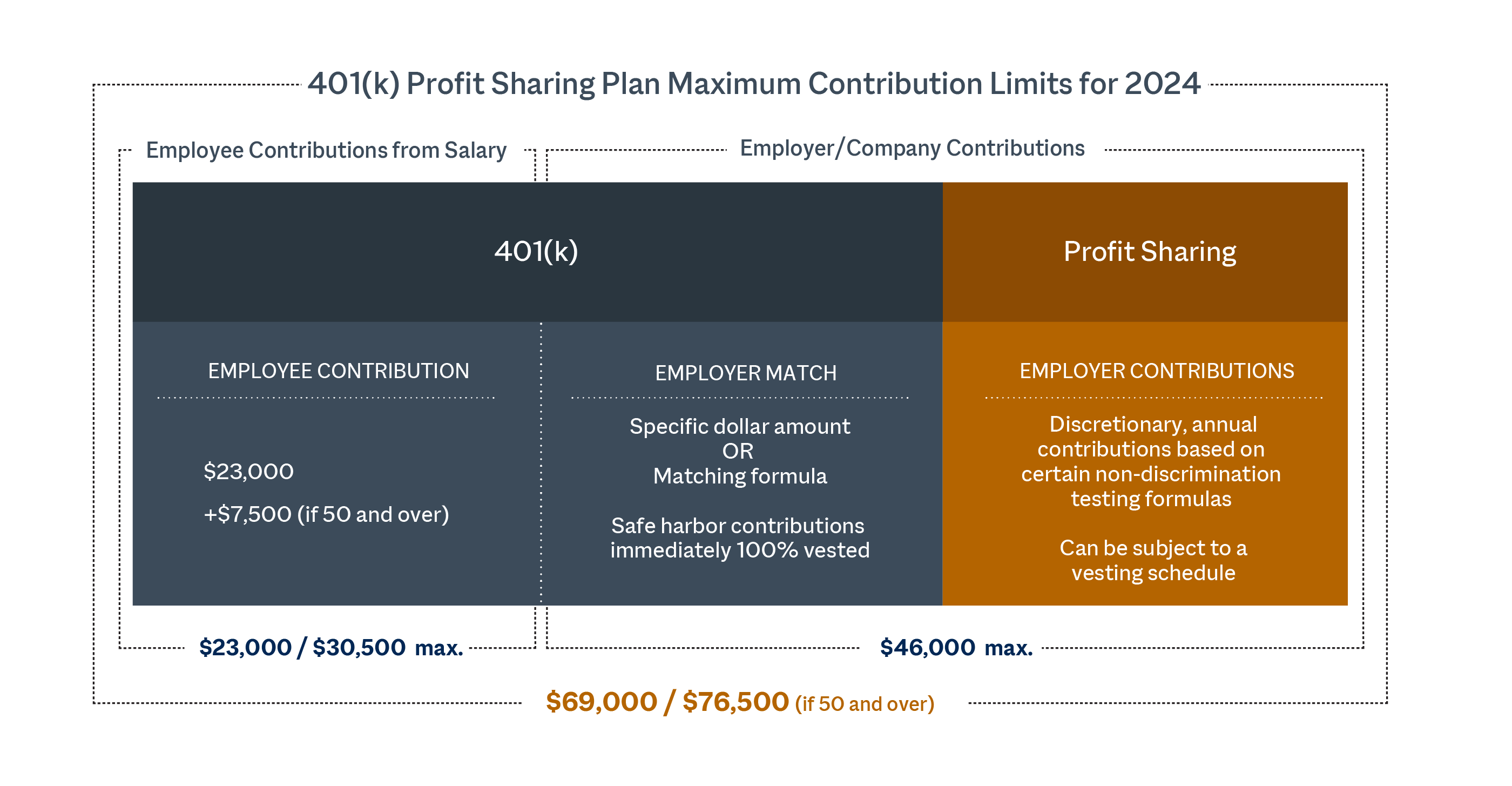

Another benefit of 401(k) plans is that they can provide a tremendous opportunity to save for your own retirement as a business owner – sometimes significantly more than other types of retirement plans such as SEPs or SIMPLE IRAs. It is important to note that a 401(k) is a type of Defined Contribution plan. In 2024, the IRS has set the maximum contribution for Defined Contribution plans at $69,000 and $76,500 for individuals age 50 and over. In order to maximize contributions up to the annual Defined Contribution limits, it is typically important for a 401(k) plan to include a profit-sharing component. As a business owner, you will contribute to your 401(k) account both as an employee and as an employer through a combination of 401(k) salary deferrals, company matching contributions, and company profit-sharing contributions, as described below:

- 401(k) Salary Deferrals (Employee Contribution) – up to $23,000 in 2024 ($7,500 additional catch-up contribution for participants age 50 and over for a total of $30,500 in 2024).

- 401(k) Matching Contributions (Employer Contribution) – Company matching contributions can be based on a set dollar amount or a specific matching formula, but a common type of company contribution is the safe harbor contribution. Generally, a safe harbor contribution can be either a match of up to 4% of salary based on each employee’s salary deferrals or a nonelective contribution of 3% of employees’ salaries regardless of whether the employee contributes to the plan themselves. Under the safe harbor rules, the company contribution is immediately 100% vested.

- Profit-sharing Contributions (Employer Contribution) – This refers to additional formula-based, company contributions which gives employees a share of the company’s profits. Profit-sharing contributions can be discretionary, meaning the company can elect whether it will make contributions from year to year. However, certain criteria must be met so that the profit-sharing contributions do not discriminate in favor of highly compensated employees in order to comply with ERISA regulations. Profit-sharing contributions can be subject to a vesting schedule to encourage employee retention.

Hypothetical Scenario:

Janet, a business owner, has established a Safe Harbor 401(k)/Profit Sharing Plan as her company’s retirement plan for her and her employees. Janet is 55 years old and receives $200,000 of annual W-2 income from her company. She maximizes her employee deferrals at $23,000 and is eligible for the maximum catch-up contribution of $7,500 since she is over the age of 50, bringing her total “employee” contributions to $30,500. When Janet set up her company’s 401(k) plan, she elected to include safe harbor matching contributions using the basic matching formula of up to 4% salary. Thus, Janet is able to make an $8,000 matching contribution from her company’s assets (4% of $200,000). Lastly, Janet completes a company profit-sharing contribution of $38,000 into her account, while minimizing the company’s profit-sharing contributions to her employees and still keeping the 401(k) plan in compliance from a non-discrimination perspective. Thus, Janet is able to maximize her 2024 401(k)/profit-sharing plan contribution up to the IRS limit of $76,500: $30,500 + $8,000 + $38,000 = $76,500.

Tax Benefits for your Business

In addition to acting as a tool to promote key talent acquisition and retention, as well as serving as a great vehicle for retirement savings, a 401(k) plan can also provide business owners with several tax benefits.

If a business owner completes salary deferrals on a pre-tax basis, they can reduce their taxable income by up to $30,500 in 2024, if over the age of 50. Company matching and profit-sharing contributions, including those made to the business owner’s own account, are also tax-deductible to the employer, subject to certain limits.

There are also several 401(k)-related tax credits available to small business owners. Small businesses, those with 100 employees or less, can qualify for a tax credit for each of the first 3 years, when starting a new 401(k) plan for the first time. Another tax credit exists for plans that provide for auto-enrollment of new hires, incentivizing small business owners to add automatic enrollment as a feature of their plan. Lastly, plan management/administrative expenses paid by the business may be deducted as a business expense. Note, you cannot deduct startup costs and claim the previously mentioned credit on the same expenses.

As always, Modera is here to help evaluate your specific needs and potential options as you choose the right retirement plan for your business. Please reach out to your wealth manager if you have any questions.

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.