Investment Commentary: Q4 2023

January 19, 2024

Hello everyone and welcome to 2024!

Between the end of October and the beginning of January, there always seems to be this year-end rush, and not just for investment or tax reasons. There are family gatherings, friends to meet, places to be. My wife and daughters love to bake, and I love to eat their creations. So, when trying to come up with a theme for this article, recipes came to mind.

A well-executed recipe requires not only quality ingredients that are mixed proportionately with precise measurements, but also a good amount of patience while everything comes together. The steps to achieve deliciousness may not always be so straightforward. Recipes may require some adjusting; a pinch more of this, an extra dash of that. Too much heat and your cake may get burned on the edges, while not enough heat may leave you with a goopy mess.

All this activity in my home got me thinking, “Isn’t the recipe for investment success very much the same?” Like baking a cake, a well-constructed portfolio starts with all the right ingredients; a solid knowledge of asset classes, allocated appropriately, mixed proportionately and tested over time. The end result is a portfolio that supports the investor’s goals. Sometimes adjustments are made. Sometimes, investments take more time than expected to bear out, but we believe that they eventually will. That old adage applies; you have to break some eggs to make a cake. Same is true with your investment portfolio.

Let’s look at what was cooking in 2023

Economic factors:

While it is no surprise that short-term interest rates are higher than they were at this time last year, longer-term rates, including mortgages, are barely higher. This year, and especially the last 2 months of 2023, investors attempted to digest the Federal Reserve’s changes and anticipate the future direction of the economy. At the same time, employment remained strong, inflation came down quickly and the manufacturing and service sectors remained stable

Markets:

*All Data from above charts is from Ycharts. See full disclosures.

Just like that watched pot that never boils, 2023 required a lot of patience.

The year started out strong for equities, slowed midyear and rallied again in the fourth quarter. It was clearly a lesson in rebalancing, not timing markets and staying diversified.

Markets rallied across the board in Q4; as longer-term rates came down, the Fed signaled it would stop raising rates, and the fabled “soft landing” seemed to be taking hold.

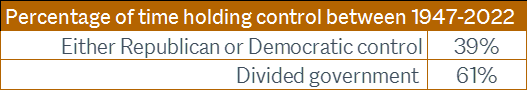

In 2023, the S&P 500 gained 26.3% and bonds ranged from +5.5% for the U.S. Aggregate Bond index to +13.4% for high-yield corporate bonds.

The Russell 200 Small Cap Index returned roughly 14% for the quarter and developed international stocks (MSCI EAFE) gained 10.5%, allowing both to finish the year at +16.9%and+18.9%, respectively. MSCI Emerging markets ended the year up more than 10% as the U.S. dollar came down.

Real estate gained 16% in Q4, more than wiping out losses through the first three quarters of 2023.

The 5% in cash from earlier this year seemed nice for a time, but these returns show why it is so important to focus on the longer term and to stay invested.

Bond returns rebounded massively from the losses in 2022. The S&P 500 swung from -18% to +26%. If you were not investing across the board, rebalancing, and keeping your allocation, those rebounds didn’t occur. To use the recipe analogy, the right mix takes time to come together.

What about being invested in just a few of the biggest companies and leaving it as that?

Consider that in 1970, three of the largest market capitalization companies in the U.S. were Xerox, Kodak, and Sears Roebuck. In 2000, four of the largest companies in the S&P 500 were Lucent, Cisco, Citigroup, and AOL. We don’t know if 2023’s magnificent 7 (Apple, Microsoft, Nvidia, Meta, Google, Amazon, Tesla) will still be around in the next decade. What we do know is that being diversified will give us the best chance of owning them or the others that may take their place.

What will we, or others, be thinking about in 2024?

We receive and read a lot of research, investment outlooks, summaries, and predictions. While there are many themes to consider I am going to focus on four: innovation, interest rates, housing, and elections.

Innovation

There have been a lot of headlines on Artificial Intelligence, or AI. Many have asked, “Are we invested in AI? How can I invest in AI? How is the best way to get into AI?”

The best answer I can give about the pervasiveness of AI comes from a friend whose firm was bought by Nvidia 3 years ago. He said “AI is everywhere. It is like the air we breathe. What we are seeing today was being developed years ago.”

Perhaps, AI should really be called “Adaptive Innovation.” The investments that so many companies across financial services, retail, housing, energy, healthcare firms, industrial, manufacturing sectors are making in advanced computing power have been occurring for decades. They will continue to develop and adapt.

You, our clients, by virtue of being invested, are already in the companies that are taking advantage of and innovating in AI. It is every company. Not just the tech companies – every company.

However, we can be skeptical. Nothing lasts forever. The late Charlie Munger, legendary investor and vice chairman of Berkshire Hathaway, was skeptical of the AI hype. He said, “I think old-fashioned intelligence works pretty well.”

Interest rates

Short-term interest rates are higher than they have been in years, however the Federal Reserve has signaled that their hikes may be about over. In other words, the bond market thinks that the Fed is lowering the heat on rates.

The chart below from the Federal Reserve Bank of St. Louis shows the yields on 2-year treasuries, 10-year treasuries and the Fed Funds Rate over the past four years. The rate on the 10-year treasury bond has dropped from 5% in mid-October to 4% now, while the Fed Funds Rate is still at 5.33%.

Source: Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS];Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 2-Year Constant Maturity, 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, January 7, 2024.

If the bond market is correct, the higher-rate headwind may become a tailwind of lower rates. Innovation, capital growth, and investments will certainly benefit from a stable rate environment.

Housing

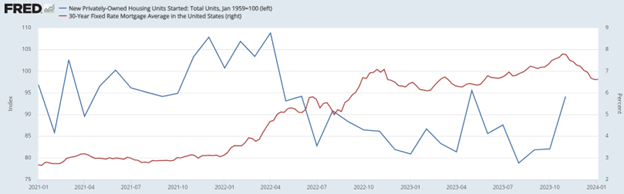

Housing costs were a large factor in the high inflation rates of 2021 and 2022. Now, the lower interest rates should help both potential home purchasers and builders. The chart below shows the average fixed mortgage rates from 1990 onward, with a 6.5% rate line overlayed for reference. The 30-year fixed rate mortgage, below 5% for more than a decade, is now 6.6%. Too much “spice” is a shock and when mortgage rates climbed above 7%, buyers and sellers were similarly shocked.

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, January 7, 2024.

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, January 7, 2024.

There needs to be some equilibrium. Over the past few months, we have started to see a bit of relief with mortgage rates coming down and housing starting to pick up.

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States; U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Total Units [HOUST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST, January 7, 2024

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States; U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Total Units [HOUST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST, January 7, 2024

Elections

This year, 2024, will be the biggest year for global elections in history, with nearly 4 billion people voting in national elections in 60 countries across the globe. Many headlines throughout the year will go back and forth, up and down, and inside and out, trying to make sense of it all.

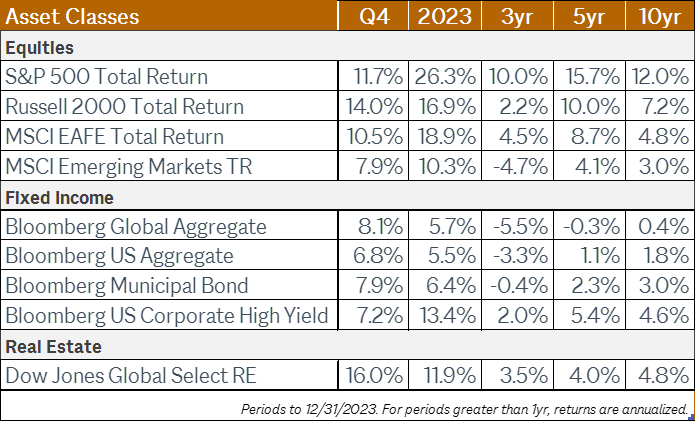

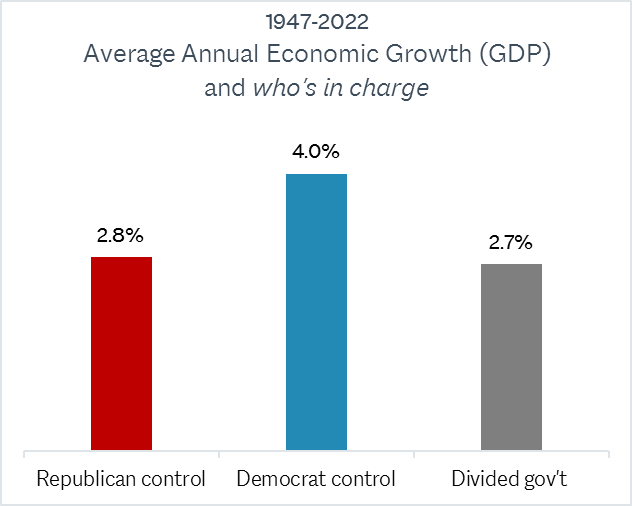

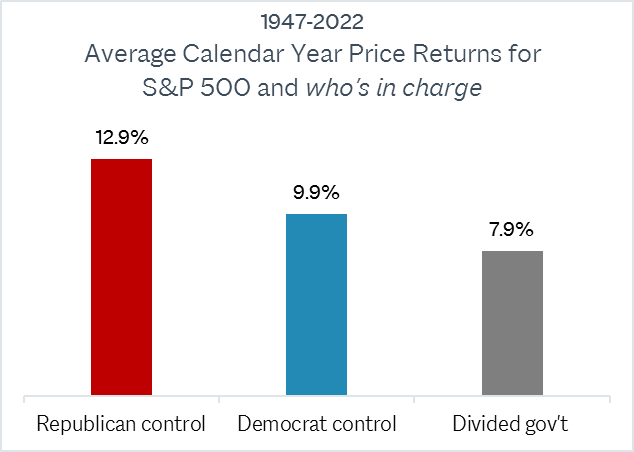

In the U.S., we have our presidential election. Over the years, both economic and stock market growth have occurred independent of who won. The graphs below show that since 1947, U.S. economic growth was better when Democrats controlled both the executive and legislative branches of government, but in terms of the stock market, Republican control seemed to be better.

We have had a divided government more than 60% of the time, and you can see that economic and market growth has occurred, and should continue to occur, in any environment over the long term.

Source: Information derived from JP Morgan Guide to the Markets-US as of Dec, 2023; JPM Asset Mgmnt, BEA, Standard & Poors, Factset. Data is calendar year.

What is your recipe for investing success?

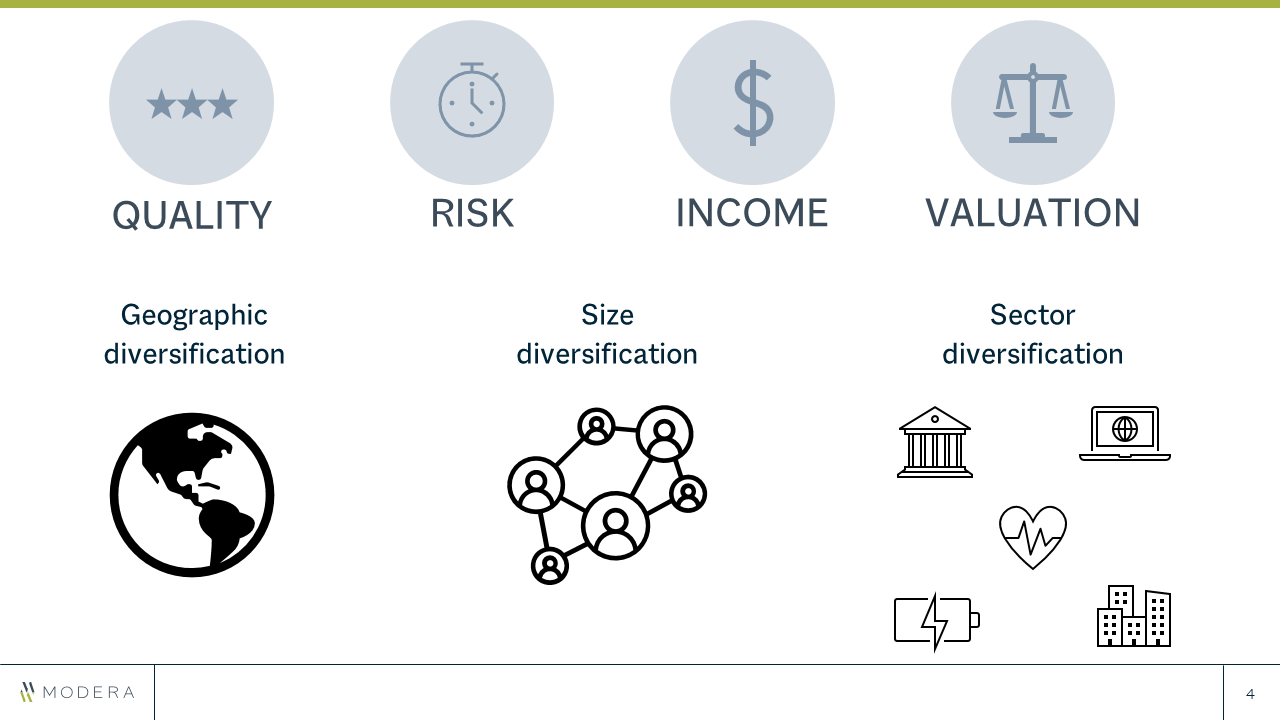

This graphic, used in our November webinar, nicely illustrates the theme of having an effective recipe for investing success. These pillars are key ingredients to our disciplined, strategic approach for investing, portfolio management and financial planning.

Quality across the board, whether in the funds, the underlying managers, or the factors of investing, is also critical. We want to make sure we understand risks in the context of the portfolio and as a part of a financial plan. We consider income generation from multiple sources to be critical for portfolio construction. Valuation plays a key role because chasing what’s hot without regard to valuation is not a solid approach. Diversification supports asset classes, across economic sectors globally.

We will keep talking about these pillars and concepts over and over, throughout the year, and in many different ways because they are so important. They are the foundation of a well-constructed portfolio; the recipe to achieve our client’s goals.

On behalf of all of us here at Modera, I thank you for your trust and confidence. We appreciate your support and value our relationship with you. Our best wishes to you, your families, your friends, and loved ones for a healthy, happy, and wonderful new year ahead.

P.S. If you have read this far, thank you. Please give me a shout and I will send you my sister’s special spiced pecan recipe.

Indexes are unmanaged, statistical composites, and their returns do not reflect payment of fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. The indexes include a different number of securities and have different risk characteristics. Performance for periods greater than one year are annualized unless specified otherwise. Selection of indices and time periods presented are chosen by advisor. Performance data shown represents past performance. Past performance, including performance of the indexes and benchmark, is no guarantee of future results and current performance may be higher or lower than the performance shown.

YCharts ©2023 YCharts, Inc. All rights reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided AS IS with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from the use of this information. Past performance is no guarantee of future results. YCharts, Inc. (YCharts) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through the application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

S&P 500 Index: Total returns in USD. Source: Standard and Poors Index Services Group for the period January 1990 – present. Source Ibbotson data courtesy of © Stocks, Bonds, Bills and Inflation YearbookTM, Ibbotson Associates, Chicago (annually updated works by Roger C. Ibbotson and Rex A. Sinquefield for the period January 1926 to December 1989. Copyright 2023 Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.