Inflation is Back: Any TIPS to Fight It?

October 26, 2021This Article was first published on RetirementInvestor.io.

We all know the years 2020 and 2021 have been a period for the record books. May you live in interesting times, as the saying goes.

Lockdowns of major economies around the world during 2020 due to COVID-19 led to the worst unemployment rates since the Great Depression1 and the worst short-term drop in GDP ever recorded2.

But misery and misfortune has turned into resiliency and recovery, and in record time. Consumers want to get out, travel, and spend once again in 2021, despite the prevalent Delta variant and stock markets are hitting new highs after a terrible correction in early 2020. Who knows what tomorrow will bring, but slowly but surely, it feels like we are trying to get back to some (emphasis on some) sense of normalcy in our lives.

While this is all welcome news, such quick changes come with unintended consequences. Pent-up consumer demand matched with inabilities of global supply chains to respond quickly has translated into a new threat to our livelihood and one that we have not seen in quite a while: inflation.

Should You Worry About Inflation? A History Lesson

Inflation, as Milton Friedman put it, is effectively taxation without legislation. Inflation refers to the broad increase in prices that consumers pay and producers receive across the economy.

Another way to think of inflation: The higher the inflation rate, the harder both your income and investments need to work to keep you from losing purchasing power over time.

Over time is the key phrase here. In shorter time periods inflation certainly can be more volatile due to temporary factors and are less consequential to consumer purchasing power over the longer term.

Is today one of those periods? We do not know for sure but let us first take a look at the long-term history of inflation, and then some of the data we see today.

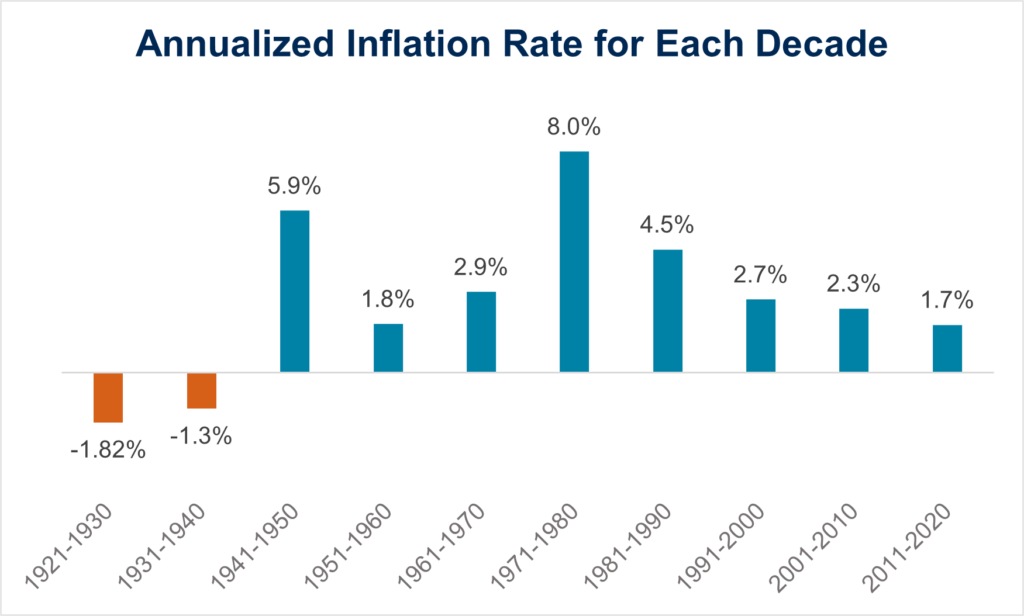

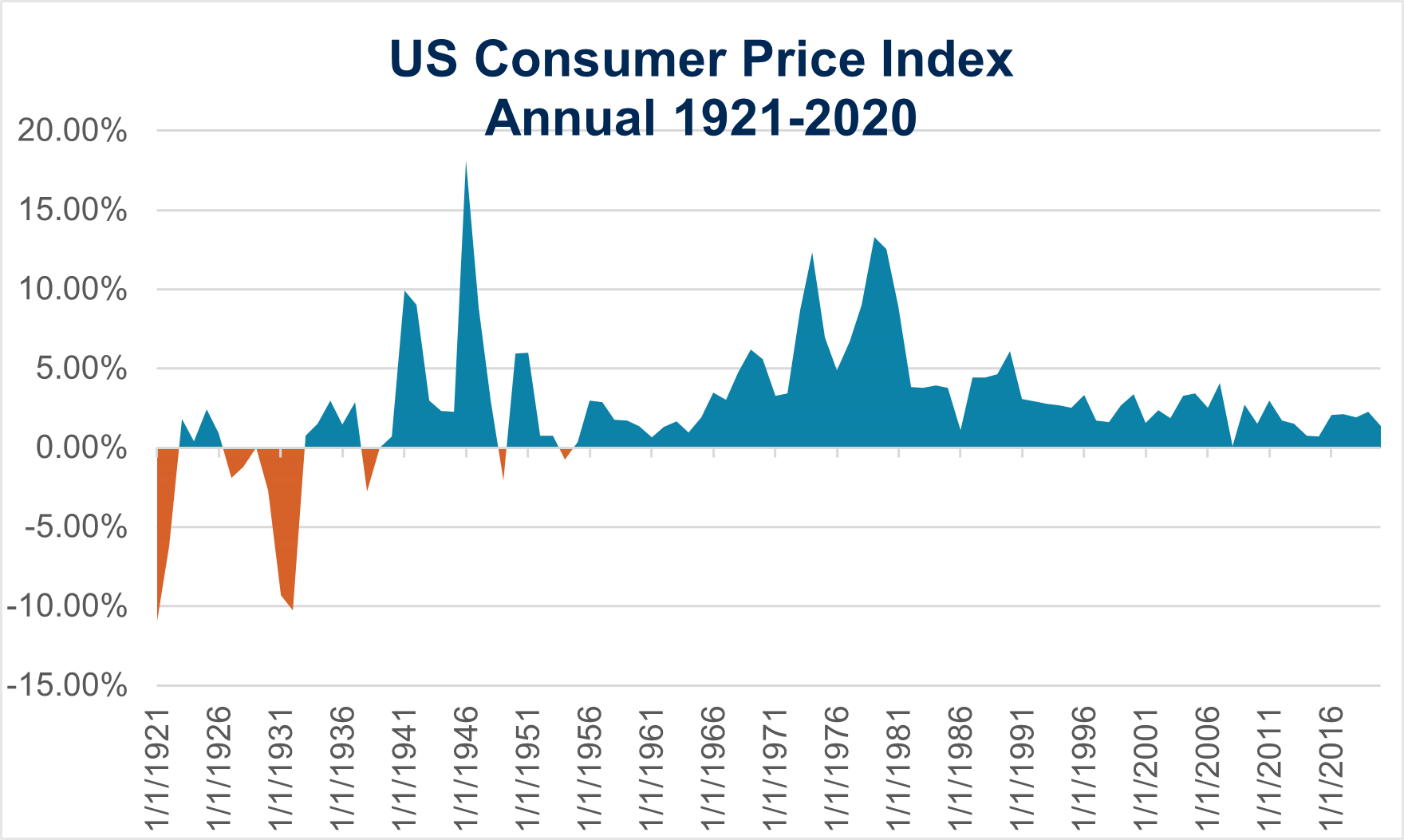

As was mentioned earlier, it has been a while since inflation has been a concern for the economy. When we look back at inflation over the last 100+ years (see charts below), we can see there were periods where inflation was significantly higher than we have experienced in the last couple of decades:

Source: 1921-1925, Consumer Price Index, Federal Reserve Bank of Minneapolis3. 1926-2020, Table 1. Consumer Price Index for All Urban Consumers: U. S. city average, by expenditure category, U.S. Bureau of Labor Statistics4

The Federal Reserve has done a great job at managing inflation ever since the double digits in the late 1970s and early 1980s. In recent decades, inflation has trended down to the point where even most investment professionals haven’t had to contend with high or increasing inflation during their careers. For perspective, not since 1991 have we seen an annual rate of inflation exceeding 4%. For most of the last two decades inflation has been below 3%.

However, in 2021, we have seen inflation rear its ugly head once again. The most used benchmark for inflation, namely the Consumer Price Index for All Urban Consumers, or CPI-U, jumped year-over-year by 5.4% in both June and July of 2021, and remained elevated in August at 5.3%.

Source: 1921-1925, Consumer Price Index, Federal Reserve Bank of Minneapolis5 1926-2020, Consumer Price Index for All Urban Consumers: U. S. city average, by expenditure category, U.S. Bureau of Labor Statistics6

Large factors in these gains are accelerated consumer and business spending in 2021 after a near dead-stop global economy in early 2020. People are driving and getting on airplanes again, both for business and pleasure. Rising fuel costs are a big contributor to recent inflation gains. But rapidly increased consumer demand in the economy also has led to supply chain constraints in areas such as food and technology, which are also contributing to consumer price increases more than at any time in the recent past.

So yes, it is possible that these inflationary factors will take somewhat longer to resolve themselves than we have become accustomed to over the last couple of decades.

What Can You Do to Fight Inflation?

By definition, the best way to combat rising inflation is to grow your income and investment returns at a faster pace than the inflation rate.

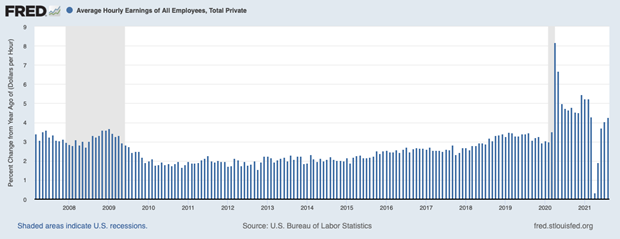

Looking at the income side, the average hourly earnings of all employees in the U.S. (a measure of wage inflation shown in the chart below) has been relatively consistent with the rate of inflation in recent decades. Of course, different segments and demographics of the population will vary from this average, but this data implies that wages alone for many people are barely keeping up with the cost of living.

It is therefore important to construct a long-term investment strategy that can also beat inflation over time to retain your future purchasing power.

Source: U.S. Bureau of Labor Statistics, Average Hourly Earnings of All Employees, Total Private , retrieved from FRED, Federal Reserve Bank of St. Louis7

Are Treasury Inflation-Protected Securities (TIPS) a Good Inflation Hedge?

Treasury Inflation-Protected Securities (also known as “TIPS”) are a special class of U.S. Treasury bonds that are designed specifically to protect investors from inflation by automatically increasing in value as inflation rises (as determined by the CPI). TIPS also pay interest over the term of the bond, which can range from five to 30 years.

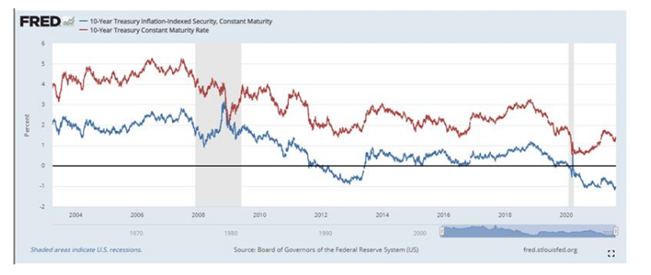

Sounds perfect, right? Historically, TIPS have done their job because in most time periods, interest rates were much higher than they are today. Currently, the yields for U.S. Treasuries are still below 2% across any maturity you can buy, while annualized inflation is trending well above these yields.

Why is this important? For TIPS to properly compensate investors for rising inflation, these bonds rise in value but like any other bond their yields drop as a result.

As we know, government-issued bonds do not pay much of a yield today. As we can see from the red line in the graph below, the 10-year Treasury yield (which we also refer to as the “nominal yield” of the bond) has continued to fall over time. The blue line is the yield on TIPS, which has recently turned negative because nominal Treasury yields (the red line) are so low and inflation is rising (the yield on a TIPS bond is equal to the nominal Treasury yield minus the inflation rate):

Source: Board of Governors of the Federal Reserve System (US), 10-Year Treasury Inflation-Indexed Security, Constant Maturity , retrieved from FRED, Federal Reserve Bank of St. Louis8

What does this all mean? Buying TIPs today with their negative yields only makes sense if you believe inflation will stay elevated and you can therefore benefit from capital appreciation of the TIPS prior to the bond’s maturity. Unfortunately, buying and holding TIPs to maturity when their yields are negative will guarantee you a negative real (I.e., after inflation) return on your investment (remember, there is no capital appreciation in any bond investment when it is held to maturity).

Our conclusion: TIPS do offer return of capital, but with their negative yields today TIPS offer questionable return on capital, at best.

Equities Have Been One of the Best Inflation Hedges

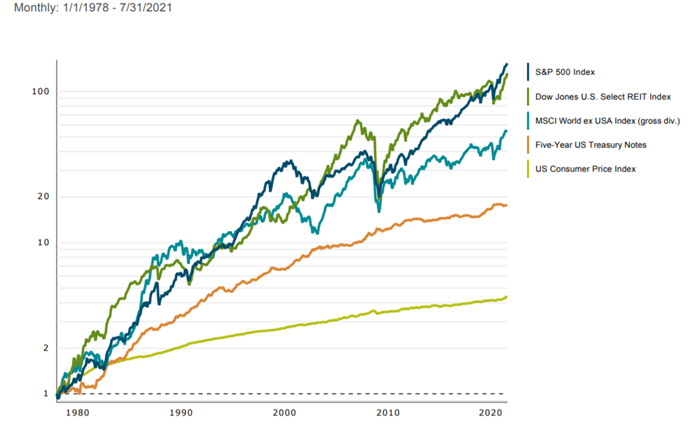

Can you do better than inflation or TIPS over the longer term? When it comes to protecting yourself from inflation, it turns out there are several alternatives to investing in TIPs based on history. Some asset classes, such as equities and real estate, have outpaced inflation, as shown in this chart below:

Source: Dimensional Fund Advisors

Let’s look at equities. As of mid-September 2021, investing in an S&P 500 fund provided an annualized dividend yield of 1.2%9, almost exactly in line with the 10-year Treasury Bond yield10, while the yield on a 10-year TIPS was negative, as we stated earlier. Equities also have produced much better total returns (income plus capital appreciation) versus bonds over time, which makes them a potentially attractive alternative to fighting inflation.

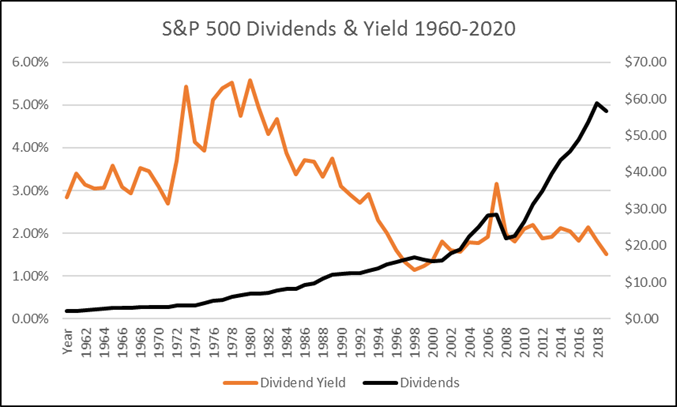

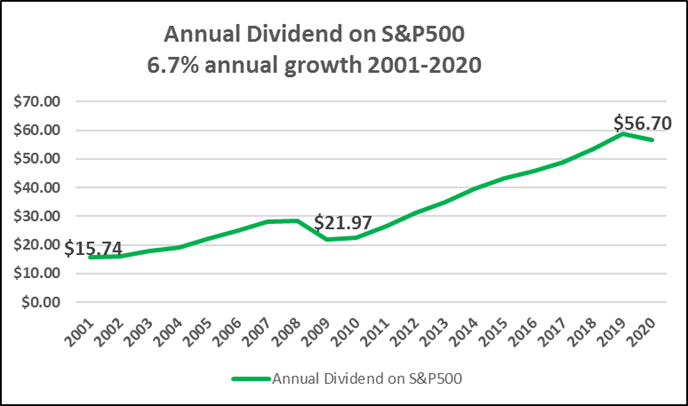

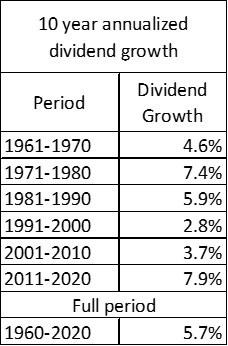

Even without capital appreciation, stock dividends alone have kept up with inflation over time. In fact, over the past 150 years, dividends paid by U.S. companies have grown 3.7% per year compared with 2% per year for inflation11. The charts below identify dividend growth in other periods over the 60 years from 1960-2020, including the last twenty years in which dividends grew at an annualized 6.7% rate.

Dividend Charts Source: Useful Data Sets, Damodaran online12

Whatever the Inflation Rate, Always Consider Your Financial Plan

Inflation may be more real than it has been in a long time but remember that your investment strategy should not be solely based on hedging against inflation in isolation of other considerations that are important to your overall financial plan.

A diversified investment portfolio is important to not only protect your purchasing power over time, but also to provide a greater level of risk protection should one asset underperform over a period.

1https://www.washingtonpost.com/business/2020/05/08/april-2020-jobs-report/

2https://www.npr.org/sections/coronavirus-live-updates/2020/07/30/896714437/3-months-of-hell-u-s-economys-worst-quarter-ever

3https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913-

4https://www.bls.gov/news.release/cpi.t01.htm

5https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913-

6https://www.bls.gov/news.release/cpi.t01.htm

7https://fred.stlouisfed.org/series/CES0500000003

8https://fred.stlouisfed.org/series/DFII10

9https://www.ssga.com/us/en/intermediary/etfs/funds/spdr-sp-500-etf-trust-spy

10https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

11https://www.ishares.com/us/insights/dividend-growth-and-inflation

12https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html#returns

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.