How To Prioritize Lifestyle Medicine To Increase Your Healthspan

March 8, 2023“Your health isn’t everything, but without your health, everything is nothing.” Asheville-based cardiologist Dr. Brian Asbill isn’t sure who initially said this quote, but he adamantly believes in it.

Dr. Asbill is an American College of Cardiology Fellow and American Board of Lifestyle Medicine Diplomate and has spent many years treating patients with lifestyle-related chronic illnesses that have led to cardiovascular disease.

After years of serving countless patients who were ill due to their lifestyle choices, he’s convinced that he can serve in a more impactful way by focusing more on lifestyle medicine than on cardiology.

Today, Dr. Asbill urges his patients to “die younger, as late as possible.”

“It’s not just about the accumulation of wealth,” Dr. Asbill told attendees at a longevity forum, “Wealth is a tool and certainly can be used to improve our own lives and, I would argue more importantly, to improve the lives of those around us. But what really matters is how well we live. We want to live longer, but how do we live more?”

Treating the Symptoms, Not the Problem

According to Dr. Asbill, most Americans spend 20% of their life dealing with chronic disease. Moreover, 80% of all deaths are attributed to lifestyle choices. And 80% of healthcare costs are used to treat chronic diseases.

He noted that doctors are extremely good at fixing symptoms, but he believes that doctors fail in treating chronic disease, which is what he says is increasing the level of healthcare spending in this country.

“Our current treatment paradigm sets us up for failure because we don’t recognize that poor lifestyle choices are at the root of this problem,” he said.

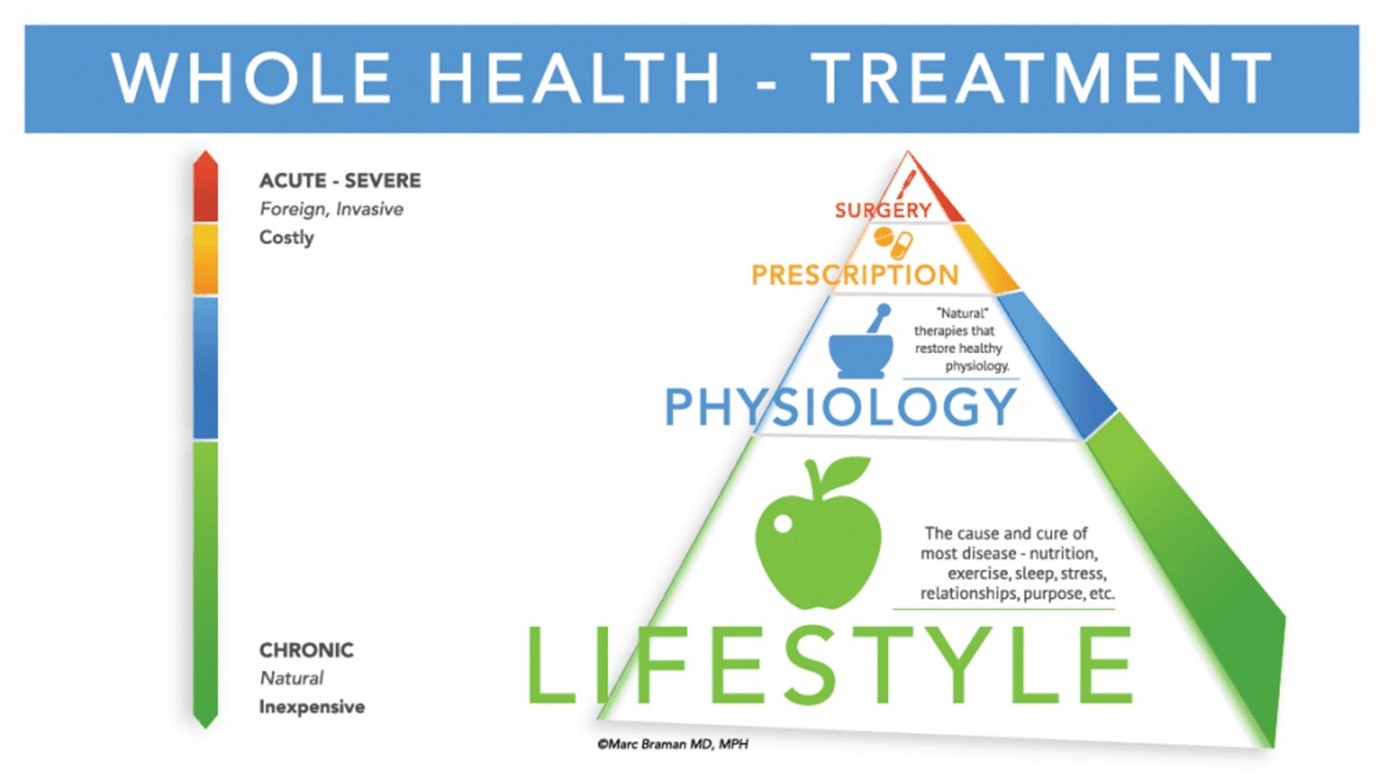

Source Marc Braman, MD

Lifestyle Medicine Focuses on Six Areas to Improve Health

The six lifestyle interventions are:

- Healthful eating of whole, plant-based food

- Increase physical activity

- Develop strategies to manage stress

- Form and maintain relationships

- Improve your sleep

- Cessation of tobacco

Dr. Asbill noted that the best nutritional advice he has ever received is from Michael Pollan who said, “eat food, not too much, mostly plants.”

Dr. Asbill gave attendees a number of other healthy dieting tips, such as no longer eating processed red meat like salami, observing time-restricted eating and occasional fasting.

Learning from the Blue Zones of Those Who Live the Longest

Based on lessons from the five zones around the world whose residents live the longest, there are nine commonalities:

- Move naturally – prioritize movement daily

- 80% rule – eat until you are 80% full

- Plant slant – prioritize plant-based foods

- Wine at 5 – but moderate drinking to healthy norms

- Know your purpose – this will add seven years to your life according to blue zone data

- Down shift – engage in hobbies to shed stress

- Belong – feel a sense of community

- Family first – prioritize your family and ancestors

- Right tribe – find a confidant group that you can depend on

As Dr. Asbill urged the crowd, “The only thing that will matter at the end of your days is who you love and who loves you. Health change is hard but do something today when you leave that will improve your quality of life so that you can add life to your years and years to your life.”

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.