Checking on your Retirement Savings Plans: Are you Maxing Out Your Contributions?

June 11, 2024

Many of us are given the opportunity to contribute to our retirement savings through our employers’ 401(k), 403(b) or other plans. Hopefully, you are taking full advantage of this benefit.

If you are, why not take the time to check in on your retirement plan contributions and make certain you are on track with your savings goals before the end of the year?

Are you maxing out your contributions?

In 2023, the contribution limit for anyone under 50 was $22,500. The 2024 employee contribution limit is $23,000. As a bonus, if you are at least 50 years of age, you can contribute an extra $7,500 on top of this as part of an annual “catch-up contribution.” Your paystub should tell you your year-to-date contributions so you can evaluate if you will have maxed out your contributions by the end of the year. If you have not already, consider increasing your contributions to account for this year’s $500 increase in the maximum allowed contribution before the last quarter.

Why max out contributions?

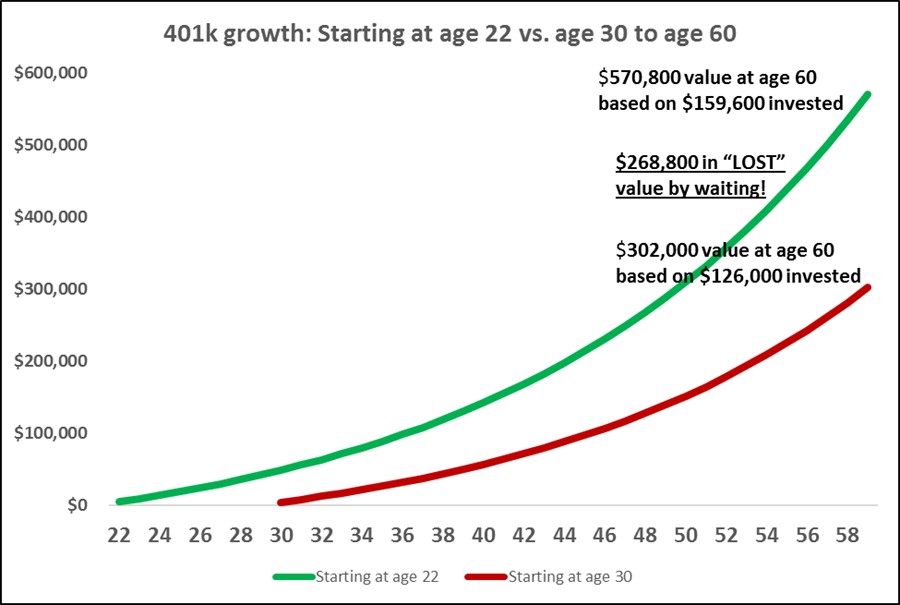

Saving for retirement is so important. If you do not have the ability within your cash flow to max out your contributions, consider adjusting your budget elsewhere to allow you to increase your contributions. Any increase to your savings will have an impact, especially with the power of compounding interest. The earlier you can start saving the better. See the chart below for an illustrative example on the power of compounding interest and the benefits of saving as early as you can.

Projections are based on assumptions provided by the advisor and are not guaranteed. Actual results will vary, perhaps to a significant degree. The projections are hypothetical in nature and for illustrative purposes only and do not account for fee deductions, commissions and other expenses associated with investing.

Tips to max out contributions:

Some 401(k) plans allow you to deposit a bonus directly into your account. This is a great way to boost your retirement savings without cutting deeper into your regular paycheck.

There is also a more immediate benefit to stashing more cash into your 401(k) plan before the end of the year. If you are contributing on a pre-tax basis in 2024, you are also lowering your 2024 taxable income. That means a smaller tax bill when you file your income tax return. Of course, if you are saving on a pre-tax basis, you will pay taxes when you withdraw money from the account in retirement. If you want to avoid the tax in retirement and pay it now, you can contribute to a Roth 401(k) if your employer offers that option.

Ok, I have maxed out my 401(k), now what?

If you have additional money, you may be able to save towards retirement with these other mechanisms:

- Roth IRA

- Traditional IRA

- HSA

If you have any questions at all regarding your investments and elections, please do not hesitate to reach out to Modera. We are happy to help.

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.